Insider Sell Alert: Director Vance Tang Sells Shares of American Woodmark Corp (AMWD)

Recent insider trading activity has caught the attention of market analysts as Vance Tang, a Director at American Woodmark Corp, has sold a significant number of shares in the company. On December 7, 2023, Vance Tang parted with 3,000 shares of American Woodmark Corp (NASDAQ:AMWD), a notable transaction that prompts a closer look into the insider's actions and the potential implications for the stock.

Who is Vance Tang?

Vance Tang has been a key figure at American Woodmark Corp, serving as a Director. His role in the company provides him with a deep understanding of the company's operations, strategic direction, and financial health. Insider transactions, such as those executed by Tang, are closely monitored as they can provide insights into the insider's belief in the company's future prospects.

American Woodmark Corp's Business Description

American Woodmark Corp is a leading manufacturer and distributor of kitchen cabinets and vanities for the remodeling and new home construction markets. With a rich history and a strong reputation for quality and service, the company has established itself as a significant player in the cabinetry industry. American Woodmark's products are sold through a network of independent dealers and distributors, as well as directly to major builders and home centers.

Analysis of Insider Buy/Sell and Relationship with Stock Price

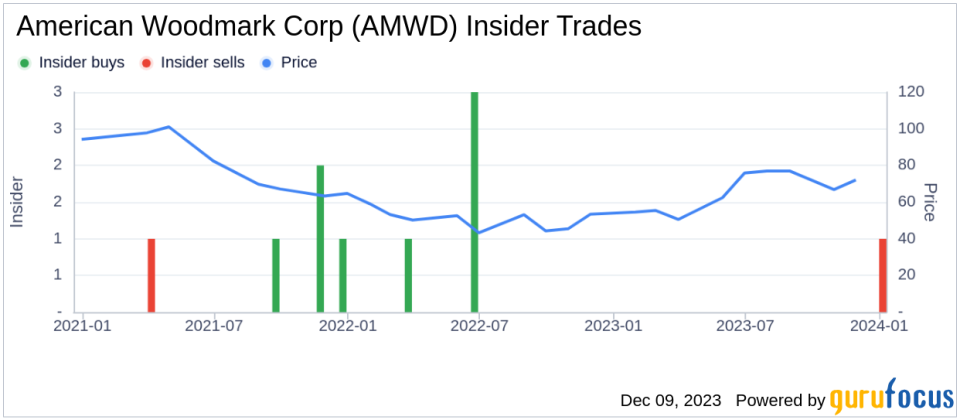

Insider transactions can be a valuable indicator of a company's health and future performance. Over the past year, Vance Tang has sold a total of 3,000 shares and has not made any purchases, which could signal a lack of confidence in the company's short-term growth potential or simply a personal financial decision. It is important to consider the context and reasons behind an insider's decision to sell, as it may not always reflect a negative outlook.

The insider transaction history for American Woodmark Corp shows a lack of insider buying over the past year, with 0 total insider buys. However, there has been 1 insider sell during the same timeframe, which could suggest that insiders are cautious about the company's current valuation or future prospects.

On the day of the insider's recent sell, shares of American Woodmark Corp were trading at $85.2, giving the company a market cap of $1.413 billion. The price-earnings ratio stood at 12.95, which is lower than the industry median of 18.52 and also below the company's historical median price-earnings ratio. This could indicate that the stock is undervalued based on earnings potential.

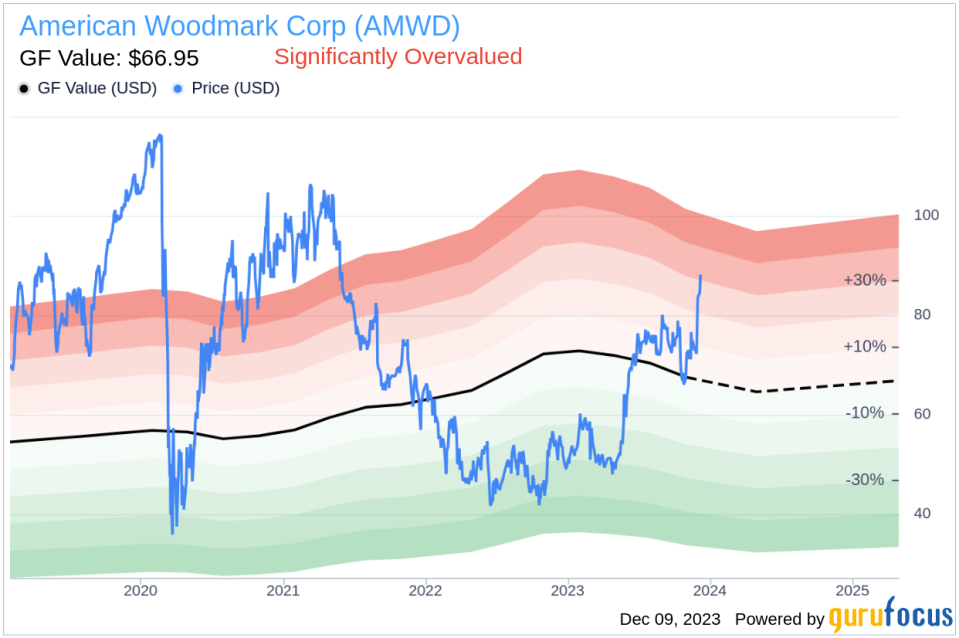

However, with a price of $85.2 and a GuruFocus Value of $66.95, American Woodmark Corp has a price-to-GF-Value ratio of 1.27, suggesting that the stock is Significantly Overvalued based on its GF Value.

The GF Value is an intrinsic value estimate that takes into account historical trading multiples, a GuruFocus adjustment factor based on past returns and growth, and future business performance estimates from Morningstar analysts.

The insider trend image above provides a visual representation of the recent insider sell, which stands out against the backdrop of no insider buys over the past year. This could be interpreted as a bearish signal by some investors.

The GF Value image further illustrates the discrepancy between the current stock price and the estimated intrinsic value, reinforcing the notion that the stock may be overvalued at its current price level.

Conclusion

The recent insider sell by Director Vance Tang at American Woodmark Corp raises questions about the insider's perspective on the stock's valuation and future performance. While the low price-earnings ratio could suggest an undervalued stock based on earnings, the price-to-GF-Value ratio indicates that the stock is significantly overvalued. Investors should consider these mixed signals and conduct further research to understand the potential impact of insider transactions on their investment decisions.

It is also crucial to consider broader market conditions, the company's financial performance, and industry trends when evaluating the significance of insider sells. As always, insider transactions are just one piece of the puzzle, and a comprehensive analysis should be undertaken before making any investment decisions.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.