Insider Sell Alert: Director Walter Woltosz Sells 60,000 Shares of Simulations Plus Inc (SLP)

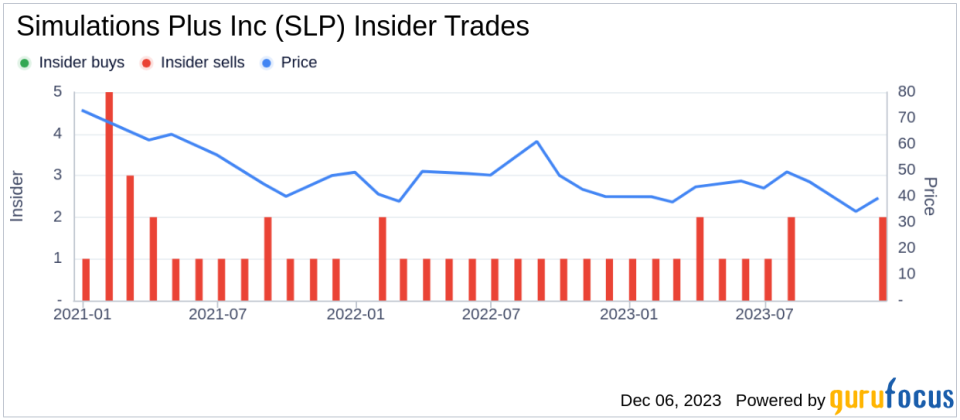

In a notable insider transaction, Walter Woltosz, a Director and 10% Owner of Simulations Plus Inc (NASDAQ:SLP), sold 60,000 shares of the company on December 5, 2023. This move has caught the attention of investors and analysts, as insider transactions can provide valuable insights into a company's prospects and the confidence level of its senior executives.Who is Walter Woltosz?Walter Woltosz is a significant figure in the history of Simulations Plus Inc. As a co-founder of the company, Woltosz has been instrumental in its growth and development. His expertise in simulation and modeling software for pharmaceutical research has been a cornerstone of the company's success. Woltosz's role has evolved over the years, but his influence as a Director and major shareholder remains substantial.About Simulations Plus IncSimulations Plus Inc is a leading provider of simulation and modeling software for pharmaceutical discovery and development. The company's software is used by major pharmaceutical, biotechnology, chemicals, and consumer goods companies worldwide to accelerate the research and development of new drugs. Simulations Plus Inc's tools are designed to improve the efficiency of drug discovery and the regulatory approval process, which can be both time-consuming and costly.Analysis of Insider Buy/Sell and Relationship with Stock PriceThe insider transaction history for Simulations Plus Inc reveals a pattern of more insider selling than buying over the past year. Specifically, Walter Woltosz has sold a total of 260,000 shares and has not made any purchases. This could be interpreted in several ways. On one hand, it might suggest that insiders see the current stock price as favorable for taking profits. On the other hand, it could also raise questions about the insiders' long-term confidence in the company's growth prospects.

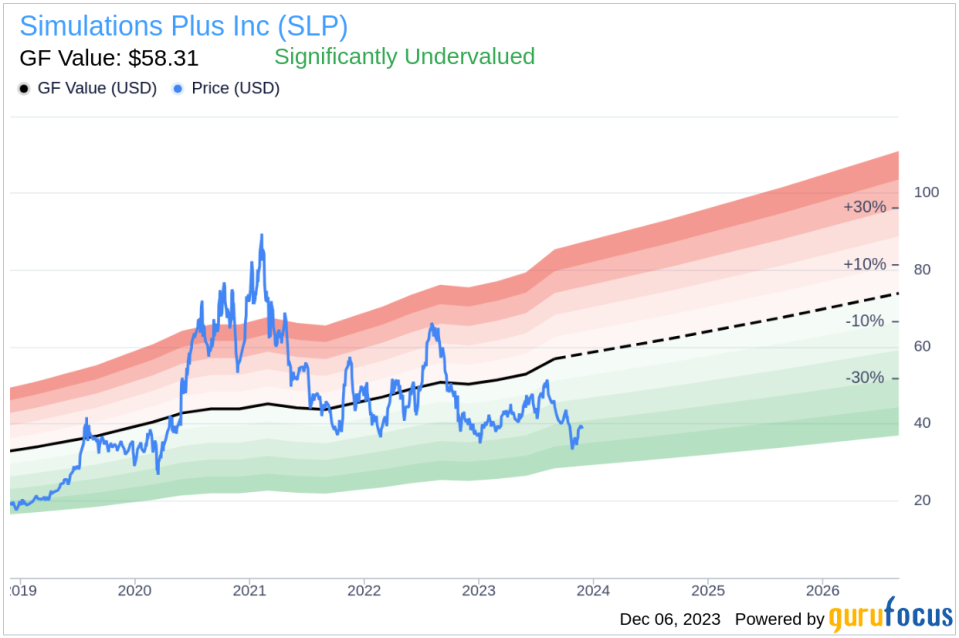

When analyzing insider transactions, it's important to consider the context and potential motivations behind the trades. Insider selling can occur for various reasons that may not necessarily relate to the company's performance, such as personal financial planning or diversifying investments.Valuation and Market ResponseOn the day of the insider's recent sale, shares of Simulations Plus Inc were trading at $38.72, giving the company a market cap of $776.401 million. The price-earnings ratio of 79.43 is higher than both the industry median of 26.36 and the company's historical median, suggesting a premium valuation compared to its peers.Despite the high price-earnings ratio, the stock appears to be significantly undervalued based on the GuruFocus Value (GF Value) of $58.31. With a price-to-GF-Value ratio of 0.66, the market may not be fully recognizing the company's intrinsic value.

The GF Value is a proprietary metric that takes into account historical trading multiples, a GuruFocus adjustment factor based on past returns and growth, and future business performance estimates from analysts. The significant undervaluation based on this metric could indicate an attractive entry point for investors, despite the recent insider selling.ConclusionThe sale of 60,000 shares by Walter Woltosz is a significant event that warrants attention from Simulations Plus Inc's investors. While the insider's actions may raise some concerns, the company's strong fundamentals and the apparent undervaluation based on the GF Value suggest that the stock could still be an attractive investment opportunity. As always, investors should conduct their own due diligence and consider the broader context of insider transactions when making investment decisions.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.