Insider Sell Alert: Director William Griffiths Sells 30,892 Shares of Quanex Building Products ...

In the realm of stock market movements, insider trading activity is often a significant indicator that investors keep a close eye on. Recently, an insider sell event has caught the attention of the market. William Griffiths, a director at Quanex Building Products Corp (NYSE:NX), sold a substantial number of shares, prompting a closer look at the implications of this transaction.

Who is William Griffiths?

William Griffiths is a seasoned executive with a history of leadership roles in various companies. At Quanex Building Products Corp, Griffiths serves on the board of directors, bringing his extensive experience to the table in guiding the company's strategic direction. His insights and decisions are critical to the company's success, making his trading activities particularly noteworthy to shareholders and potential investors.

About Quanex Building Products Corp

Quanex Building Products Corp is a company that specializes in components for the fenestration industry. They design and produce energy-efficient window and door products, including window and door profiles, insulating glass spacers, screens & other fenestration components. Their commitment to innovation and sustainability has positioned them as a key player in the building products sector, catering to a market that values energy efficiency and quality construction materials.

Analysis of Insider Buy/Sell and Stock Price Relationship

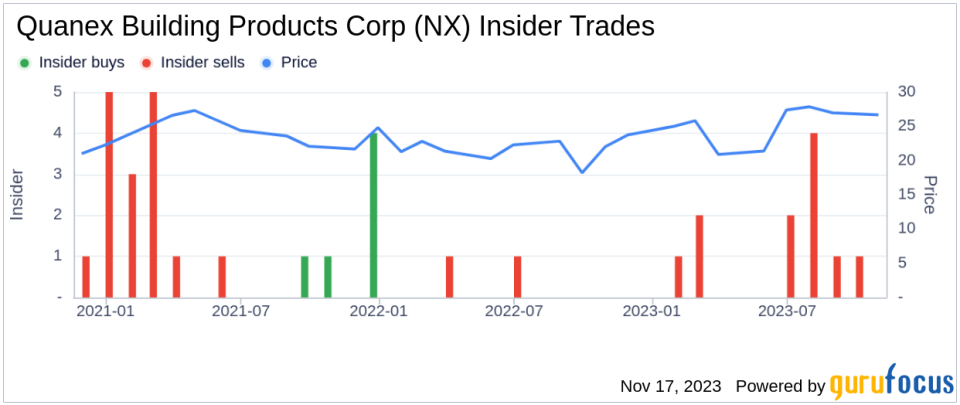

The recent insider sell by William Griffiths involved 30,892 shares of Quanex Building Products Corp, which took place on November 15, 2023. This transaction is part of a larger pattern observed over the past year, where Griffiths has sold a total of 147,596 shares and has not made any purchases. This one-sided activity could signal a variety of things, from personal financial planning to a lack of confidence in the company's short-term growth prospects.

The insider trend for Quanex Building Products Corp shows a clear preference for selling over buying among insiders. With 12 insider sells and no insider buys over the past year, there appears to be a consensus among those with intimate knowledge of the company that now may be an opportune time to realize gains.

Stock Valuation and Market Reaction

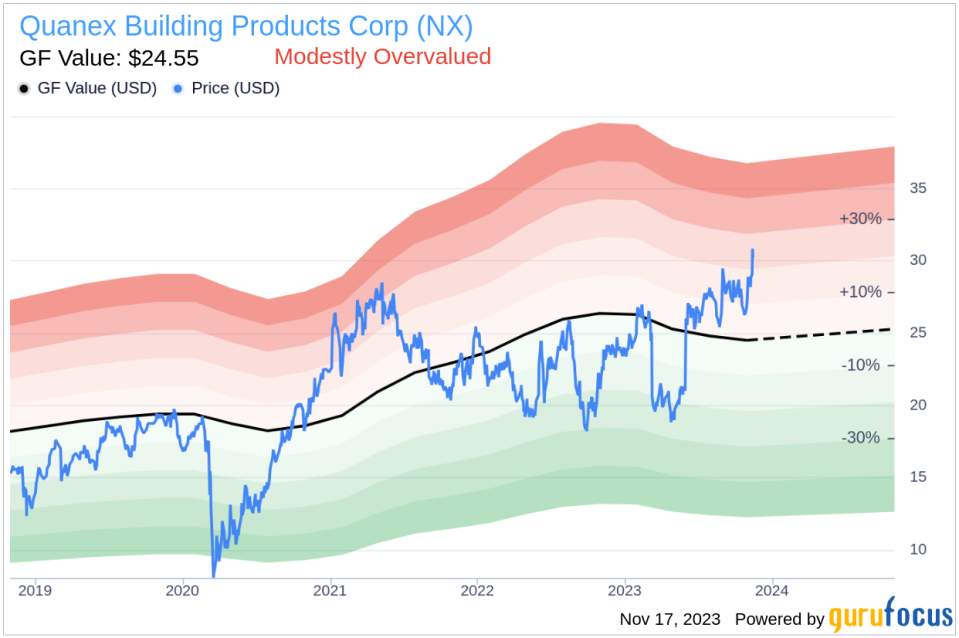

On the day of the insider's recent sell, shares of Quanex Building Products Corp were trading at $30.38, giving the company a market cap of $996.187 million. The price-earnings ratio stands at 12.48, which is lower than both the industry median of 14.3 and the company's historical median price-earnings ratio. This could suggest that the stock is undervalued based on earnings potential.However, when considering the GuruFocus Value, which is set at $24.55, Quanex Building Products Corp has a price-to-GF-Value ratio of 1.24, indicating that the stock is modestly overvalued.

The GF Value is a proprietary metric developed by GuruFocus, taking into account historical trading multiples, a GuruFocus adjustment factor based on past returns and growth, and future business performance estimates from analysts. The current price-to-GF-Value ratio suggests that the market has potentially overestimated the stock's value relative to its intrinsic worth.

Conclusion

The insider sell activity by William Griffiths at Quanex Building Products Corp, particularly in the context of broader insider selling trends, raises questions about the stock's future trajectory. While the company's fundamentals, as indicated by a lower-than-average price-earnings ratio, may seem strong, the GF Value suggests that the stock's current price may not be sustainable.Investors should consider the implications of insider selling patterns, valuation metrics, and the company's position within its industry when making investment decisions. While insider sells do not always predict a downturn, they are a piece of the puzzle that can provide valuable insights into the sentiment of those who know the company best.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.