Insider Sell Alert: Director William Sandbrook Offloads Shares of Comfort Systems USA Inc (FIX)

Comfort Systems USA Inc (NYSE:FIX), a leader in the provision of commercial, industrial, and institutional heating, ventilation, air conditioning, and electrical contracting services, has witnessed a notable insider sell event. Director William Sandbrook parted with 5,000 shares of the company on November 9, 2023. This transaction has caught the attention of investors and market analysts, as insider activities often provide valuable clues about a company's prospects.

Who is William Sandbrook?

William Sandbrook is a seasoned executive with extensive experience in the building materials and construction industry. His tenure at Comfort Systems USA Inc has provided him with deep insights into the company's operations and strategic direction. Sandbrook's role as a director involves guiding the company's corporate governance and strategic initiatives, making his trading activities in the company's stock particularly noteworthy.

Comfort Systems USA Inc's Business Description

Comfort Systems USA Inc is a premier provider of comprehensive HVAC and electrical installation, maintenance, repair, and replacement services. The company operates primarily in the commercial, industrial, and institutional sectors, offering its expertise across a wide range of projects, from new construction to retrofitting and energy solutions. With a focus on quality, safety, and sustainability, Comfort Systems USA Inc has established a strong reputation for delivering reliable and efficient services to its clients.

Analysis of Insider Buy/Sell and Relationship with Stock Price

Insider trading activities, such as those of William Sandbrook, can provide investors with valuable insights into a company's internal perspective. Over the past year, Sandbrook has sold a total of 12,500 shares and has not made any purchases. This pattern of selling could suggest that the insider may perceive the stock's current price as being on the higher end of its value range, or it could be part of a personal financial planning strategy.

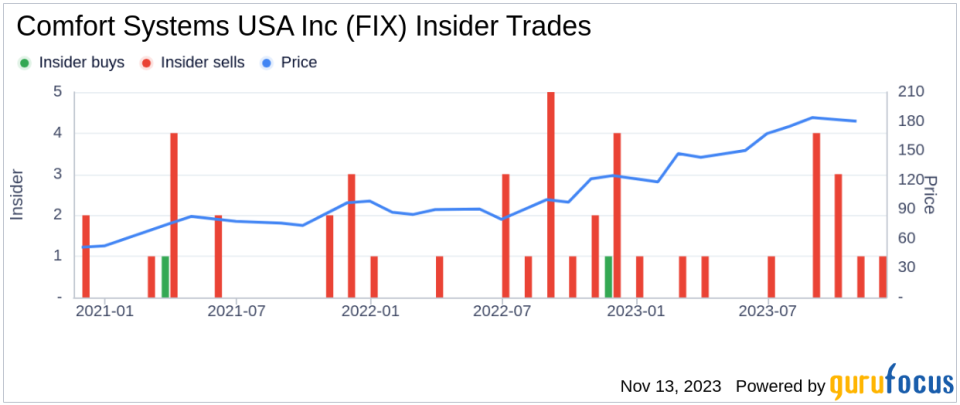

The broader insider transaction history for Comfort Systems USA Inc shows a predominance of selling over buying, with 13 insider sells and only 1 insider buy over the past year. This trend could indicate that insiders, on balance, are choosing to decrease their holdings, potentially signaling a cautious outlook on the stock's future performance.

On the day of Sandbrook's recent sell, shares of Comfort Systems USA Inc were trading at $185.19, giving the company a market cap of $6.757 billion. This price reflects a price-earnings ratio of 23.68, which is higher than both the industry median of 14.33 and the company's historical median price-earnings ratio. Such a premium valuation suggests that the market has high expectations for the company's earnings growth relative to its peers.

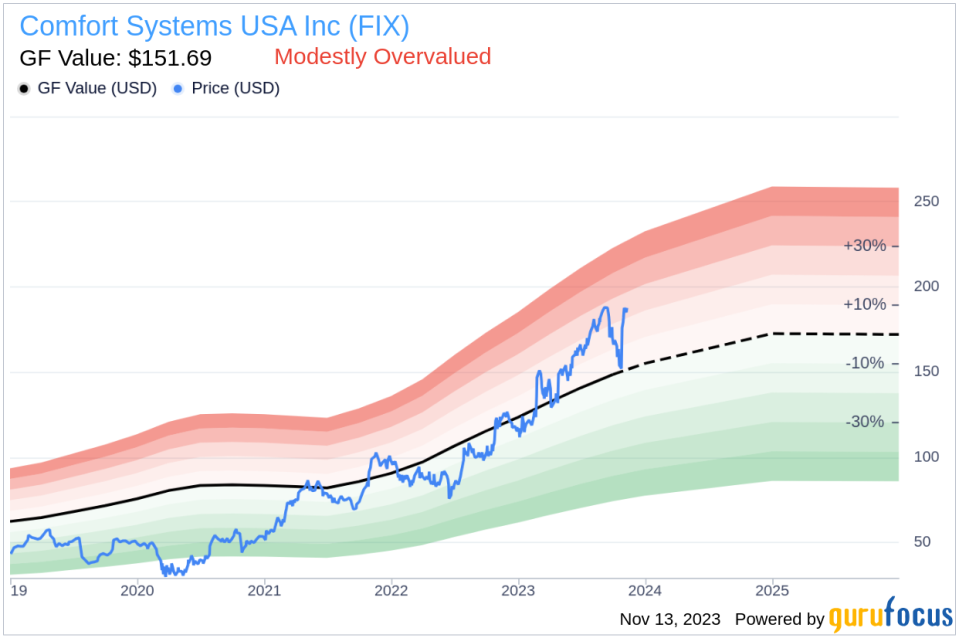

Moreover, with a price-to-GF-Value ratio of 1.22, the stock is considered modestly overvalued based on its GF Value of $151.69. The GF Value is a proprietary intrinsic value estimate from GuruFocus, factoring in historical trading multiples, a GuruFocus adjustment factor, and future business performance estimates from analysts.

The insider trend image above illustrates the recent selling pattern among insiders, which could be interpreted as a lack of confidence in the stock's ability to provide significant returns in the near term. However, it is essential to consider that insider sells can be motivated by various factors, including diversification of personal portfolios, tax planning, or liquidity needs, and may not always reflect a bearish view on the company's prospects.

The GF Value image provides a visual representation of the stock's valuation relative to its intrinsic value estimate. The current modest overvaluation suggests that investors may want to exercise caution and conduct further analysis before making investment decisions based on the stock's current price level.

Conclusion

Director William Sandbrook's recent sale of 5,000 shares of Comfort Systems USA Inc is a significant event that warrants attention from the investment community. While the insider's sell activities over the past year, coupled with the broader trend of more insider sells than buys, could be seen as a cautious signal, it is crucial to consider the broader context of the company's valuation and market position. Comfort Systems USA Inc's premium valuation and modest overvaluation based on the GF Value suggest that the stock may be priced with optimistic growth expectations. Investors should weigh these factors alongside their own research and investment goals when considering Comfort Systems USA Inc as a potential addition to their portfolios.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.