Insider Sell Alert: Dropbox Inc's Chief Legal Officer Bart Volkmer Sells 7,088 Shares

Dropbox Inc (NASDAQ:DBX), the renowned cloud storage and collaboration platform, has recently witnessed a significant insider sell from its Chief Legal Officer, Bart Volkmer. On November 16, 2023, Bart Volkmer sold 7,088 shares of the company, a move that has caught the attention of investors and market analysts alike. This transaction is part of a series of insider activities that provide insights into the company's financial health and future prospects.

Bart Volkmer has been an integral part of Dropbox Inc, serving as the Chief Legal Officer. His role involves overseeing the company's legal affairs, ensuring compliance with regulatory requirements, and providing strategic legal guidance to the executive team. His actions, especially in the stock market, are closely monitored as they may reflect his confidence in the company's future performance.

Dropbox Inc has established itself as a key player in the technology sector, offering a suite of services that facilitate collaboration and file sharing for individuals and businesses. The company's platform allows users to create, access, and share content across various devices, fostering a more connected and efficient work environment. Dropbox's business model is subscription-based, generating a steady stream of revenue from its user base, which includes millions of active users worldwide.

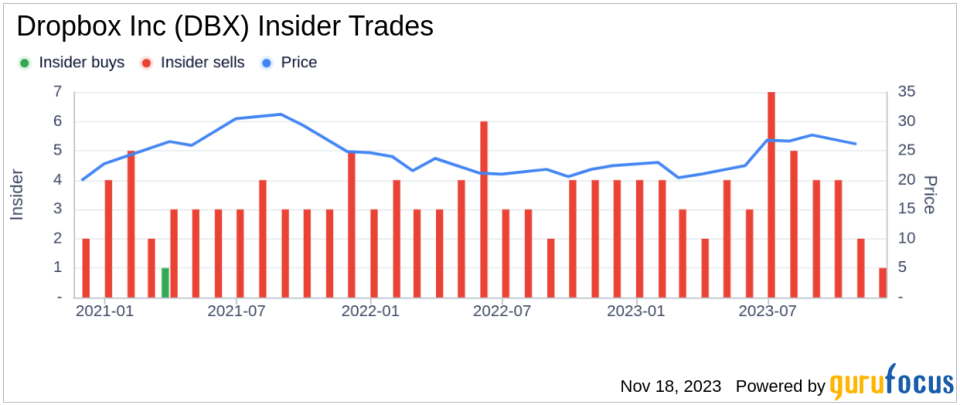

Analysis of Insider Buy/Sell and Relationship with Stock Price

Over the past year, Bart Volkmer has sold a total of 109,903 shares and has not made any purchases. This pattern of selling without corresponding buys could be interpreted in various ways. While some may view it as a lack of confidence in the company's future growth, it is also possible that the insider is diversifying their portfolio or addressing personal financial planning needs.

The insider transaction history for Dropbox Inc shows a trend of more insider sells than buys over the past year, with 47 insider sells and no insider buys. This trend can influence investor sentiment, as consistent selling by insiders may lead to concerns about the company's valuation or future prospects.

On the day of Volkmer's recent sell, shares of Dropbox Inc were trading at $26.55, giving the company a market cap of $9.159 billion. The price-earnings ratio stood at 17.07, which is lower than the industry median of 26.8 and also below the company's historical median price-earnings ratio. This lower price-earnings ratio could suggest that the stock is undervalued compared to its peers, or it may reflect market skepticism about the company's growth potential.

Regarding the stock's valuation, with a share price of $26.55 and a GuruFocus Value of $28.95, Dropbox Inc has a price-to-GF-Value ratio of 0.92. This indicates that the stock is Fairly Valued based on its GF Value. The GF Value is a proprietary intrinsic value estimate from GuruFocus, which takes into account historical trading multiples, a GuruFocus adjustment factor, and future business performance estimates from analysts.

It is important to consider that insider sells do not always signal negative prospects for a company. Insiders may sell shares for personal reasons that are unrelated to their outlook on the company's future. However, when analyzing insider transactions, it is crucial to look for patterns and the context of the broader market.

The above insider trend image provides a visual representation of the selling and buying activities of Dropbox Inc insiders. The absence of insider buys over the past year, coupled with a consistent pattern of sells, could be a point of analysis for investors considering the stock's potential.

The GF Value image above offers a snapshot of Dropbox Inc's valuation relative to its intrinsic value. The Fairly Valued status suggests that the stock is trading close to what GuruFocus considers its true value, based on historical and projected performance metrics.

Conclusion

The recent insider sell by Dropbox Inc's Chief Legal Officer, Bart Volkmer, is a significant event that warrants attention from investors. While the company's lower price-earnings ratio and Fairly Valued status based on GF Value may suggest an attractive entry point for some investors, the consistent pattern of insider sells over the past year could raise questions about the stock's future trajectory. As with any investment decision, it is essential to consider a comprehensive analysis of the company's financials, industry trends, and broader market conditions before drawing conclusions from insider trading activities.

Investors are encouraged to monitor further insider transactions and company announcements to stay informed about Dropbox Inc's performance and strategic direction. As always, insider trading is just one piece of the puzzle when evaluating investment opportunities, and a holistic approach to stock analysis is recommended.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.