Insider Sell Alert: Equitable Holdings Inc CEO Mark Pearson Sells 120,000 Shares

Mark Pearson, the President and CEO of Equitable Holdings Inc (NYSE:EQH), has recently made a significant change to his stake in the company. On December 1, 2023, the insider sold a total of 120,000 shares of Equitable Holdings Inc. This transaction has caught the attention of investors and market analysts, as insider activity, particularly from high-ranking executives, can provide valuable insights into a company's financial health and future prospects.

Who is Mark Pearson of Equitable Holdings Inc?

Mark Pearson is a seasoned executive with extensive experience in the financial services industry. As the President and CEO of Equitable Holdings Inc, Pearson has been at the helm of the company, steering it through various market conditions and strategic initiatives. His leadership has been instrumental in the company's growth and stability. Pearson's decisions, including those related to his own investments in the company, are closely watched by investors and analysts alike.

Equitable Holdings Inc's Business Description

Equitable Holdings Inc is a diversified financial services company that operates through various subsidiaries. The company provides a wide range of financial products and services, including life insurance, annuities, investment management, and retirement solutions. With a strong presence in the United States, Equitable Holdings Inc is committed to helping its clients secure their financial well-being and achieve their long-term financial goals.

Analysis of Insider Buy/Sell and the Relationship with the Stock Price

Insider transactions can be a valuable indicator of a company's internal perspective on its stock's value. Over the past year, Mark Pearson has sold 120,000 shares and has not made any purchases. This one-sided activity may raise questions about the insider's confidence in the company's future performance.

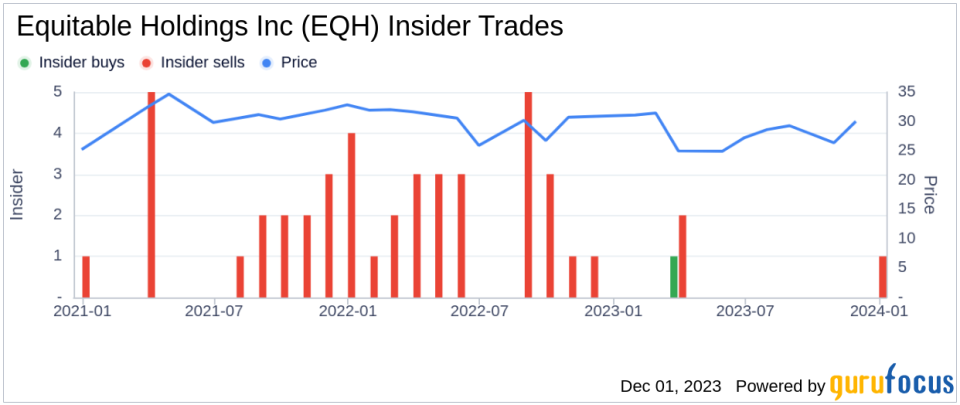

When examining the insider transaction history for Equitable Holdings Inc, we observe that there has been only 1 insider buy over the past year, compared to 3 insider sells during the same period. This trend suggests that insiders may perceive the stock's current price as favorable for selling rather than buying.

On the day of Pearson's recent sale, shares of Equitable Holdings Inc were trading at $30.38, giving the company a market cap of $10.581 billion. The price-earnings ratio stood at 5.55, which is lower than both the industry median of 10.75 and the company's historical median price-earnings ratio. This could indicate that the stock is undervalued compared to its peers and its own historical valuation.

Furthermore, with a price of $30.38 and a GuruFocus Value of $35.39, Equitable Holdings Inc has a price-to-GF-Value ratio of 0.86. This suggests that the stock is modestly undervalued based on its GF Value, which takes into account historical multiples, a GuruFocus adjustment factor, and future business performance estimates.

The insider trend image above provides a visual representation of the recent insider transactions, highlighting the disparity between buys and sells. This could be interpreted as a signal that insiders, including Pearson, may believe the stock has reached a price point that justifies taking profits.

The GF Value image further illustrates the stock's valuation status. The modest undervaluation of Equitable Holdings Inc, as indicated by the price-to-GF-Value ratio, may suggest that the stock has room for growth. However, the insider's decision to sell a substantial number of shares could be seen as a lack of alignment with this valuation model.

Conclusion

Mark Pearson's recent sale of 120,000 shares of Equitable Holdings Inc is a significant event that warrants attention from investors. While the company appears to be undervalued based on various financial metrics, the insider selling trend may suggest a different narrative. Investors should consider both the valuation indicators and insider activity when making investment decisions regarding Equitable Holdings Inc.

It is also important to note that insider transactions are not always indicative of a company's future performance. They can be influenced by a variety of factors, including personal financial planning, diversification of assets, or other non-company related reasons. As such, while insider activity is an important piece of the puzzle, it should be considered alongside a comprehensive analysis of the company's financial health, market position, and growth prospects.

Equitable Holdings Inc's future trajectory will depend on a multitude of factors, and while the insider sell-off by Mark Pearson may raise some eyebrows, it is just one of many elements that investors must weigh in their assessment of the company's stock.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.