Insider Sell Alert: EVP Alaleh Nouri Divests 15,000 Shares of PROCEPT BioRobotics Corp

In a notable insider transaction, Alaleh Nouri, the Executive Vice President, Chief Legal Officer, and Corporate Secretary of PROCEPT BioRobotics Corp, sold 15,000 shares of the company on December 15, 2023. This move has caught the attention of investors and market analysts, prompting a closer look at the implications of such insider activity.

Who is Alaleh Nouri at PROCEPT BioRobotics Corp?

Alaleh Nouri is a seasoned executive with a significant role at PROCEPT BioRobotics Corp. As the EVP, Chief Legal Officer, and Corporate Secretary, Nouri is responsible for overseeing the company's legal affairs, ensuring compliance with regulatory requirements, and managing corporate governance. Her position at the company gives her an intimate understanding of its operations, strategy, and potential, making her trading activities particularly noteworthy to investors.

About PROCEPT BioRobotics Corp

PROCEPT BioRobotics Corp is a commercial-stage surgical robotics company focused on advancing patient care by developing transformative solutions in urology. The company's flagship product, the AquaBeam Robotic System, utilizes its proprietary Aquablation therapy, a minimally invasive, waterjet-based treatment for benign prostatic hyperplasia (BPH), commonly known as an enlarged prostate. This innovative approach combines real-time, multi-dimensional imaging, automated robotics, and heat-free waterjet ablation for targeted, precise, and rapid removal of prostate tissue. PROCEPT BioRobotics Corp is dedicated to improving the lives of men suffering from BPH, offering a treatment that aims to reduce the risks and limitations associated with traditional surgical methods.

Analysis of Insider Buy/Sell and Relationship with Stock Price

Insider trading activities, such as the recent sale by Alaleh Nouri, can provide valuable insights into a company's internal perspective. Over the past year, Nouri has sold a total of 72,063 shares and has not made any purchases. This pattern of selling without corresponding buys could signal a lack of confidence in the company's short-term growth prospects or simply a personal financial decision.

It is important to consider the context of these transactions. The absence of insider buys over the past year, coupled with 12 insider sells, may raise questions among investors. However, insiders might sell shares for various reasons unrelated to their outlook on the company, such as diversifying their portfolio, tax planning, or personal financial needs.

On the day of Nouri's recent sale, shares of PROCEPT BioRobotics Corp were trading at $42.96, valuing the company at a market cap of $2.189 billion. The stock price at the time of the transaction is crucial as it can influence the perceived value of the sale. If the stock was trading near all-time highs, the sale might be viewed as a top-ticking move. Conversely, if the stock was near lows, it could be seen as a lack of confidence in a recovery.

When analyzing insider transactions, it's also beneficial to look at the broader market and sector performance, as well as the company's financial health and growth outlook. This comprehensive approach helps investors discern whether insider trading activities align with general market trends or stand out as anomalies.

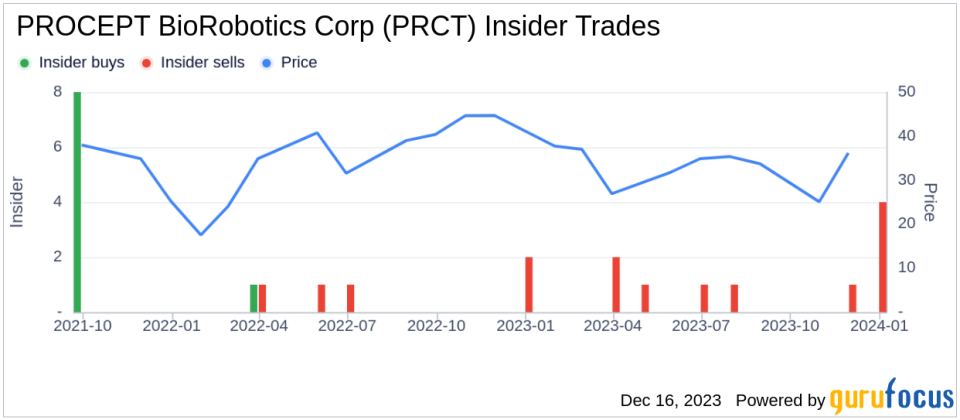

Insider Trend Image Analysis

The insider trend image above provides a visual representation of the buying and selling activities of insiders at PROCEPT BioRobotics Corp. The absence of insider buys and the presence of multiple sells over the past year could be interpreted in various ways. A consistent pattern of insider selling may suggest that those with the most intimate knowledge of the company see limited upside potential or expect headwinds that could affect the stock's performance.

However, it is essential to note that insider selling does not always correlate with negative performance. Insiders might have personal reasons for selling that are not indicative of their belief in the company's future. Therefore, while insider trends can be a piece of the puzzle, they should not be the sole basis for investment decisions.

Conclusion

The recent insider sell by Alaleh Nouri at PROCEPT BioRobotics Corp is a transaction that warrants attention. While the reasons behind Nouri's decision to sell shares are not publicly known, the pattern of insider selling over the past year could be a signal for investors to investigate further. It is crucial to consider this information in the context of the company's overall performance, industry trends, and broader market conditions. As always, investors are encouraged to conduct their due diligence and consider multiple factors before making investment decisions.

For those interested in following insider activities and understanding their potential impact on stock prices, staying informed through platforms like GuruFocus can provide valuable insights into the sentiment of those who know the company best.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.