Insider Sell Alert: EVP Anthony Grande Sells 10,000 Shares of CoreCivic Inc (CXW)

CoreCivic Inc (NYSE:CXW), a diversified government solutions company, has recently witnessed a significant insider sell by one of its top executives. Anthony Grande, the company's Executive Vice President and Chief Development Officer, sold 10,000 shares of CoreCivic stock on November 13, 2023. This transaction has caught the attention of investors and market analysts, as insider activity can often provide valuable insights into a company's financial health and future prospects.

Who is Anthony Grande of CoreCivic Inc?

Anthony Grande is a seasoned executive with extensive experience in the corrections and detention industry. As EVP and Chief Development Officer at CoreCivic Inc, Grande is responsible for overseeing the company's growth strategies, including the development and acquisition of new facilities and services. His role is pivotal in expanding CoreCivic's reach and ensuring the company's offerings align with the evolving needs of government partners.

CoreCivic Inc's Business Description

CoreCivic Inc is a company that specializes in providing solutions to governments facing complex challenges. The company operates a range of facilities, including prisons, detention centers, and residential reentry centers, and offers a suite of services such as inmate transportation, community corrections, and real estate solutions. CoreCivic's business model is built on a public-private partnership framework, where it works closely with government agencies to deliver cost-effective and innovative solutions for public safety and rehabilitation.

Analysis of Insider Buy/Sell and Relationship with Stock Price

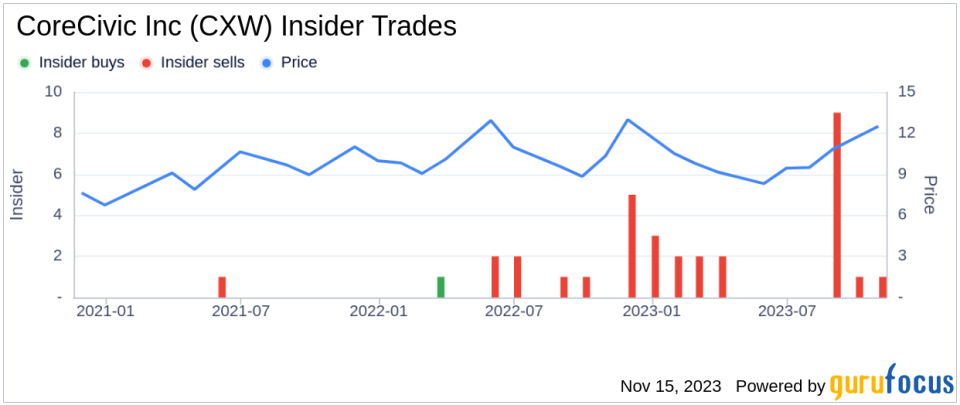

Insider transactions are closely monitored by investors as they can provide clues about a company's internal perspective on its stock's value. In the case of CoreCivic Inc, the insider transaction history over the past year shows a lack of insider buys and a prevalence of insider sells, with 25 insider sells and no insider buys. This trend could suggest that insiders, including Anthony Grande, may believe the stock is fully valued or potentially overvalued at current levels.

On the day of the insider's recent sell, CoreCivic Inc's shares were trading at $13.39, giving the company a market cap of $1.580 billion. This price level reflects a price-earnings ratio of 24.40, which is higher than both the industry median of 16.52 and the company's historical median price-earnings ratio. Such a high price-earnings ratio could indicate that the stock is priced at a premium compared to its peers and its own historical valuation.

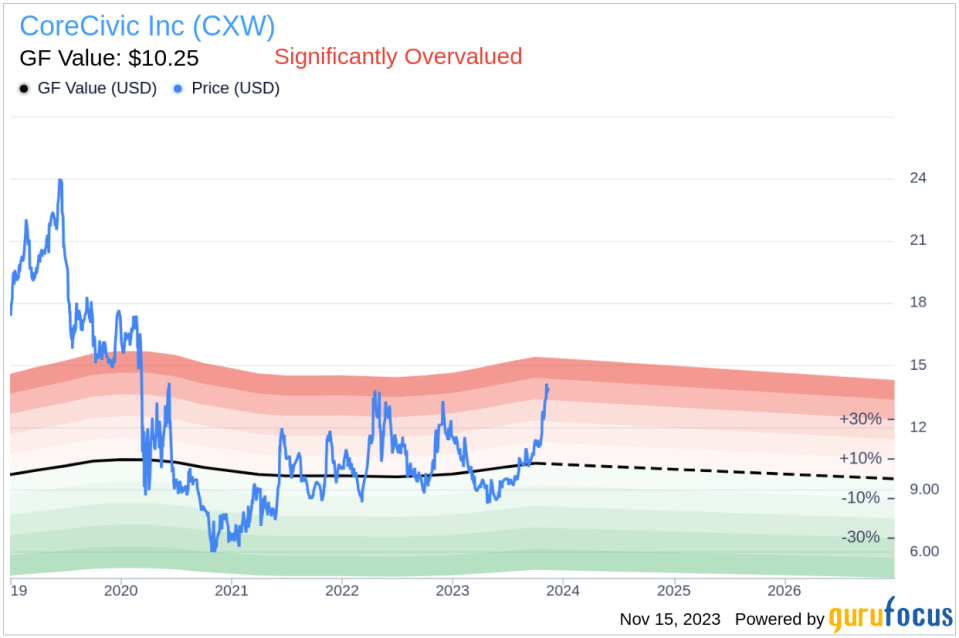

Adding to the valuation analysis, CoreCivic Inc's price-to-GF-Value ratio stands at 1.31, with the stock being significantly overvalued based on its GF Value of $10.25. The GF Value is a proprietary intrinsic value estimate from GuruFocus, which takes into account historical trading multiples, a GuruFocus adjustment factor, and future business performance estimates. The current price-to-GF-Value ratio suggests that the stock may not have much upside potential from its current level, aligning with the insider selling activity.

The insider trend image above illustrates the recent selling pattern among CoreCivic's insiders, which could be interpreted as a bearish signal by the market. However, it is important to note that insider sells can be motivated by various factors, including personal financial planning, diversification of assets, or other non-company related reasons. Therefore, while insider sells can be a piece of the puzzle, they should not be the sole basis for investment decisions.

The GF Value image provides a visual representation of the stock's valuation relative to its intrinsic value estimate. The current position above the GF Value line indicates that the stock is trading at a premium to what GuruFocus considers its fair value.

Conclusion

Anthony Grande's recent sale of 10,000 shares of CoreCivic Inc is a notable insider transaction that warrants attention. While the company's business model is robust, focusing on government solutions, the insider selling trend and the stock's valuation metrics suggest that the stock may be overvalued at current levels. Investors should consider these factors, along with broader market conditions and individual investment goals, when evaluating CoreCivic Inc as a potential investment. As always, insider transactions are just one of many tools that can be used to assess a stock's potential, and a comprehensive analysis should include a review of financials, industry trends, and other pertinent data.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.