Insider Sell Alert: EVP Bert Frost Sells 5,000 Shares of CF Industries Holdings Inc

In a notable insider transaction, Bert Frost, Executive Vice President of Sales, Market Development, and Supply Chain at CF Industries Holdings Inc (NYSE:CF), sold 5,000 shares of the company on November 15, 2023. This move has caught the attention of investors and analysts, as insider sales can provide valuable insights into a company's prospects and the sentiment of its top executives.

Who is Bert Frost?

Bert Frost is a seasoned executive with extensive experience in the agricultural industry. At CF Industries Holdings Inc, he is responsible for overseeing the company's sales, market development, and supply chain operations. His role is critical in ensuring that the company's products meet market demand efficiently and effectively. Frost's decisions and strategic direction can significantly impact CF Industries' performance, making his insider transactions particularly noteworthy.

About CF Industries Holdings Inc

CF Industries Holdings Inc is a leading global manufacturer and distributor of nitrogen products for fertilizer, emissions abatement, and other industrial applications. The company's products play a crucial role in helping farmers increase crop yields and improve food production. With a strong presence in the agricultural sector, CF Industries is well-positioned to benefit from the growing demand for fertilizers as the global population continues to expand.

Analysis of Insider Buy/Sell and Relationship with Stock Price

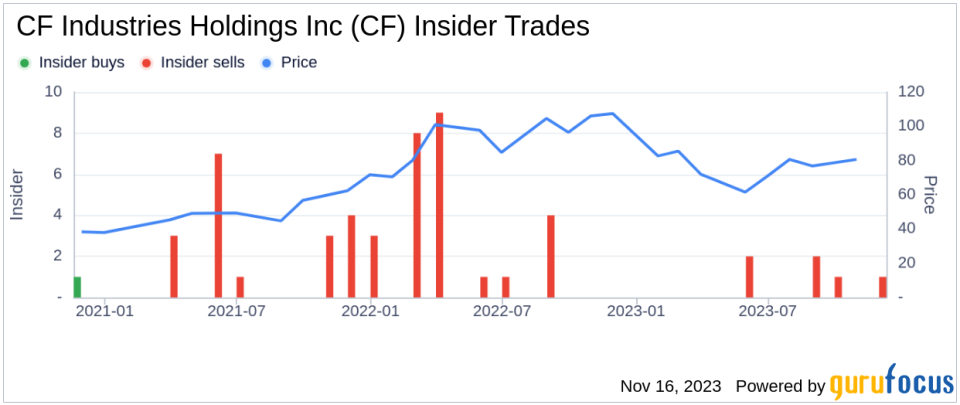

Bert Frost's recent sale of 5,000 shares is part of a larger pattern observed over the past year. The insider has sold a total of 25,000 shares and has not made any purchases during this period. This consistent selling could be interpreted in several ways. It might suggest that the insider believes the stock is currently valued appropriately or may be anticipating a plateau or decline in the stock's performance. However, without additional context, it is challenging to determine the exact motivation behind these sales.The insider transaction history for CF Industries Holdings Inc shows a lack of insider buying over the past year, with 6 insider sells recorded during the same timeframe. This trend could indicate that insiders are generally content with realizing gains or reallocating their investments rather than increasing their stakes in the company.

On the day of Bert Frost's recent sale, CF Industries Holdings Inc shares were trading at $80.1, giving the company a market cap of $15.31 billion. The price-earnings ratio of 7.45 is lower than both the industry median of 17.87 and the company's historical median, suggesting that the stock may be undervalued compared to its peers and its own past trading history.

Valuation and GF Value

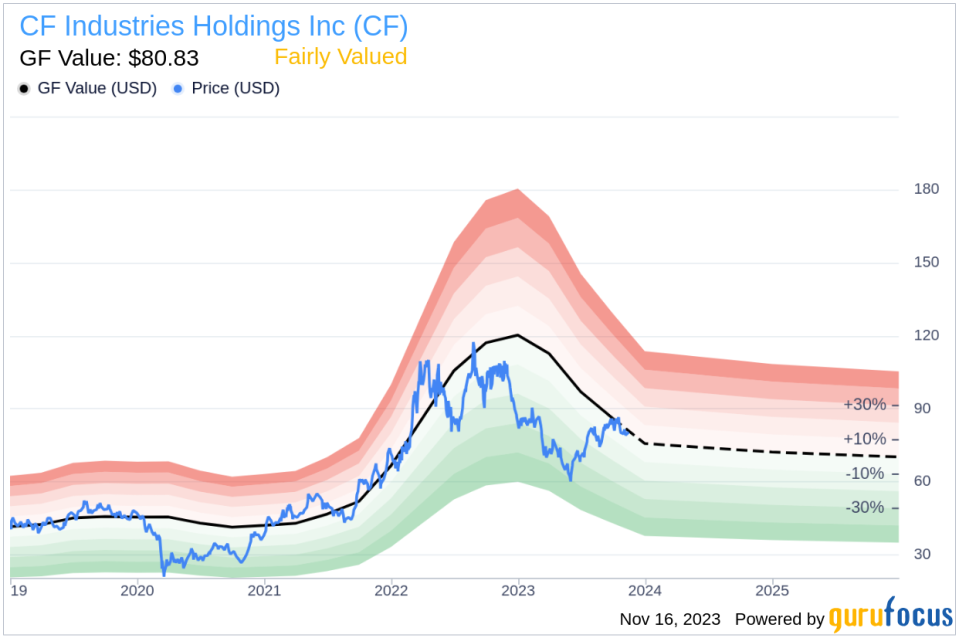

Considering the stock's price of $80.1 and a GuruFocus Value of $80.83, CF Industries Holdings Inc has a price-to-GF-Value ratio of 0.99, indicating that the stock is Fairly Valued based on its GF Value. The GF Value is a proprietary intrinsic value estimate from GuruFocus, which factors in historical trading multiples, a GuruFocus adjustment factor based on past returns and growth, and future business performance estimates from analysts.

The alignment of the stock's trading price with its GF Value suggests that the market has efficiently priced CF Industries Holdings Inc, taking into account its historical performance and future prospects. This fair valuation could be a contributing factor to the insider's decision to sell shares, as there may be limited upside potential in the near term if the stock is already trading at its intrinsic value.

Conclusion

The recent insider sale by Bert Frost at CF Industries Holdings Inc provides investors with an opportunity to scrutinize the company's valuation and future outlook. While insider selling alone is not a definitive indicator of a stock's direction, the consistent pattern of sales by Frost, coupled with the lack of insider buying, may warrant a closer examination of the company's fundamentals and market position.Investors should consider the fair valuation of the stock, its competitive standing in the nitrogen products industry, and the broader economic factors affecting agricultural demand. As always, insider transactions are just one piece of the puzzle, and a comprehensive analysis should include a review of the company's financial health, growth prospects, and external market conditions.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.