Insider Sell Alert: EVP Brendan Teehan Sells Shares of ACADIA Pharmaceuticals Inc

ACADIA Pharmaceuticals Inc (NASDAQ:ACAD), a biopharmaceutical company specializing in the development and commercialization of medicines to address unmet medical needs in central nervous system disorders, has recently witnessed a significant insider sell transaction. Brendan Teehan, the company's Executive Vice President, Chief Operating Officer, and Head of Commercial, sold 4,960 shares of the company's stock on November 20, 2023.

Brendan Teehan is a seasoned executive with a wealth of experience in the pharmaceutical industry. At ACADIA Pharmaceuticals Inc, Teehan has been instrumental in driving the commercial strategy and operational excellence. His role encompasses overseeing the company's commercial operations, ensuring that ACADIA's products effectively reach patients and healthcare providers.

ACADIA Pharmaceuticals Inc is known for its pioneering work in neuroscience, with a focus on delivering innovative treatments for patients suffering from Parkinson's disease psychosis, schizophrenia, and other central nervous system disorders. The company's commitment to advancing the field of neuropsychiatry is reflected in its robust pipeline of potential therapies.

According to the data provided, Brendan Teehan has been actively managing his holdings in the company over the past year, selling a total of 23,121 shares and not purchasing any additional shares. This latest transaction is part of a series of sales by the insider, which could be interpreted in various ways by investors and market analysts.

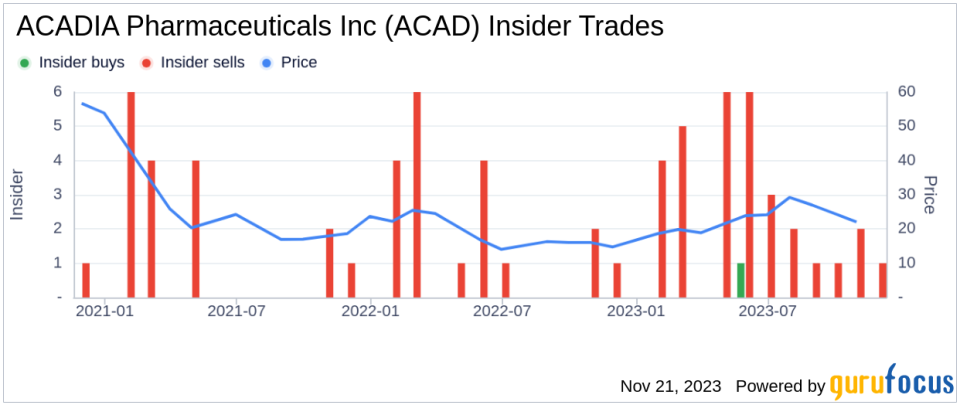

The insider transaction history for ACADIA Pharmaceuticals Inc shows a trend that leans heavily towards selling, with 33 insider sells and only 1 insider buy over the past year. This pattern of insider activity can sometimes raise questions about the insiders' confidence in the company's future prospects.

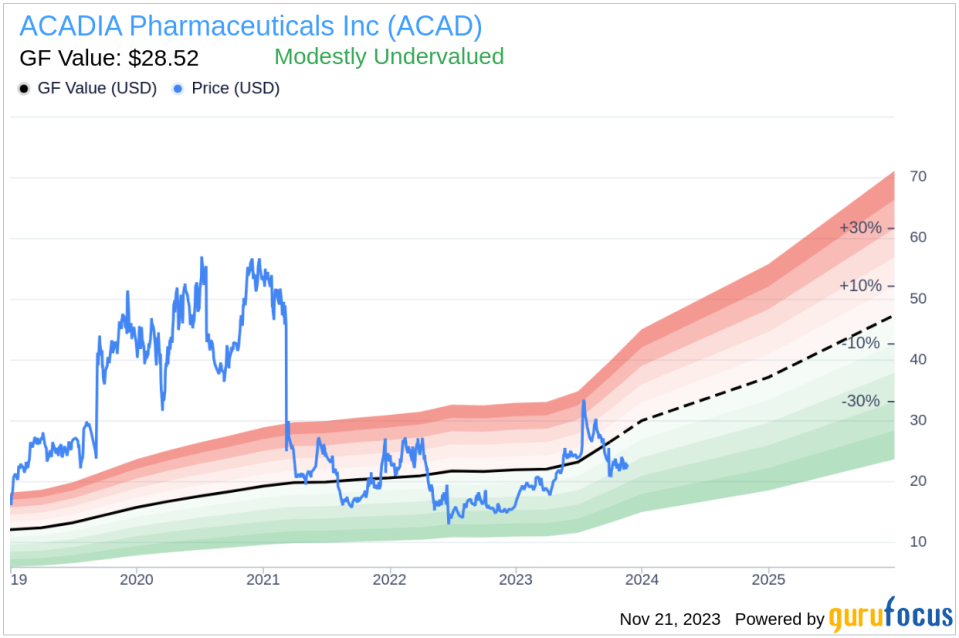

On the valuation front, shares of ACADIA Pharmaceuticals Inc were trading at $22.64 on the day of Teehan's recent sell, giving the company a market cap of $3.682 billion. This valuation places the stock below the GuruFocus Value (GF Value) of $28.52, suggesting that the stock is modestly undervalued with a price-to-GF-Value ratio of 0.79.

The GF Value is a proprietary metric developed by GuruFocus, which takes into account historical trading multiples, an adjustment factor based on the company's past performance, and future business performance estimates provided by Morningstar analysts. When a stock trades below its GF Value, it is often considered an opportunity for value investors, assuming the company's fundamentals remain strong.

However, the insider selling trend, particularly the recent sell by Brendan Teehan, may lead some investors to question whether the current undervaluation represents a true buying opportunity or if it reflects potential headwinds for the company. It is important for investors to consider the context of these insider transactions and not to rely solely on valuation metrics when making investment decisions.

Here is the insider trend image reflecting the recent activities:

And here is the GF Value image for ACADIA Pharmaceuticals Inc:

In conclusion, while the insider selling activity, particularly by EVP Brendan Teehan, may raise some concerns, the stock's current valuation relative to the GF Value indicates that ACADIA Pharmaceuticals Inc could be undervalued. Investors should conduct thorough due diligence, considering both the insider activity and the company's fundamental outlook, before making any investment decisions. As always, insider transactions are just one piece of the puzzle when it comes to evaluating a stock's potential.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.