Insider Sell Alert: EVP Bryson Koehler Unloads Shares of Equifax Inc (EFX)

Equifax Inc (NYSE:EFX), a global data, analytics, and technology company, has recently witnessed an insider sell that has caught the attention of market watchers. Bryson Koehler, the company's Executive Vice President, Chief Technology Officer, Product & Data & Analytics Officer, has sold 1,000 shares of the company's stock. This transaction took place on November 15, 2023, and has prompted discussions regarding insider trading patterns and their potential implications for investors.

Who is Bryson Koehler?

Bryson Koehler is a key executive at Equifax Inc, serving as the Executive Vice President, Chief Technology Officer, Product & Data & Analytics Officer. With a background rich in technology and innovation, Koehler has been instrumental in driving the company's strategic initiatives, particularly in the realms of product development, data management, and advanced analytics. His role at Equifax involves overseeing the technological advancements that maintain the company's competitive edge in the market.

Equifax Inc's Business Description

Equifax Inc is a company that specializes in providing information solutions and human resources business process outsourcing services for businesses, governments, and consumers. The company's offerings include credit reporting, credit monitoring, and fraud prevention services, among others. Equifax leverages advanced analytics and proprietary technology to deliver insights that help its clients make more informed decisions. With a global footprint, Equifax is a key player in the information services industry, enabling financial inclusion and helping to foster a more secure financial ecosystem.

Analysis of Insider Buy/Sell and the Relationship with the Stock Price

Insider trading activities, such as the recent sale by Bryson Koehler, can provide valuable insights into a company's internal perspective on its stock's valuation. Over the past year, Koehler has sold a total of 11,000 shares and has not made any purchases. This pattern of consistent selling could be interpreted in various ways by investors. Some may view it as a lack of confidence in the company's future prospects, while others may consider it a normal part of personal financial management for executives.

It is important to note that insider sells can be motivated by a variety of factors that are not necessarily related to the company's performance. These can include personal financial planning, diversification of assets, or meeting personal expenses. Therefore, while insider transactions are worth noting, they should not be the sole basis for investment decisions.

On the day of Koehler's recent sell, Equifax Inc's shares were trading at $201, giving the company a market cap of $25.285 billion. This valuation reflects the market's assessment of the company's worth, taking into account its current and future potential earnings.

The price-earnings ratio of Equifax Inc stands at 48.63, which is significantly higher than the industry median of 16.44 and also above the company's historical median price-earnings ratio. This elevated P/E ratio could suggest that the stock is priced on the higher end, potentially factoring in expectations of strong future earnings growth or a premium for the company's market position and stability.

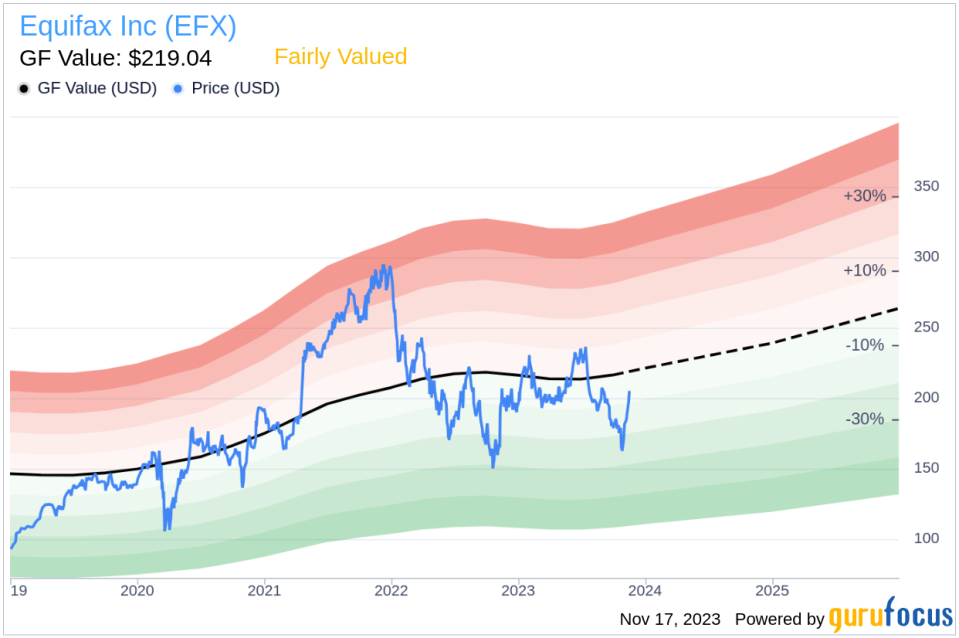

When considering the price-to-GF-Value ratio of 0.92, based on a trading price of $201 and a GuruFocus Value of $219.04, Equifax Inc appears to be Fairly Valued. The GF Value is a proprietary metric developed by GuruFocus, which takes into account historical trading multiples, a GuruFocus adjustment factor, and future business performance estimates provided by Morningstar analysts. This valuation suggests that the stock is trading close to its intrinsic value, as estimated by GuruFocus.

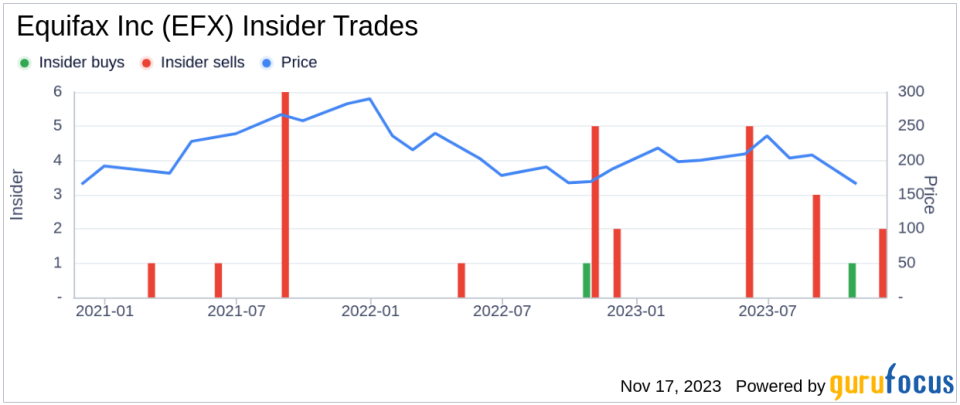

The insider trend image above provides a visual representation of the buying and selling activities of insiders over the past year. With 11 insider sells and only 1 insider buy, there is a clear trend of insiders divesting their holdings in the company. While this could raise questions about insiders' confidence in the stock, it is also essential to consider the broader context of the market and the individual circumstances of each insider.

The GF Value image further illustrates the stock's valuation in relation to its intrinsic value. The proximity of the current price to the GF Value indicates that the market's perception of the stock's worth is aligned with GuruFocus's intrinsic value estimate.

Conclusion

The recent insider sell by Bryson Koehler at Equifax Inc is a development that investors may want to consider as part of their overall analysis of the company. While the insider's selling activity over the past year suggests a pattern, it is crucial to contextualize this information within the broader scope of the company's financial health, market position, and future prospects. Equifax Inc's current valuation metrics and GF Value indicate that the stock is fairly valued, which may provide some reassurance to investors concerned about the implications of insider selling activities.

As always, investors are encouraged to conduct their own due diligence and consider a multitude of factors, including insider trading patterns, when making investment decisions. The actions of insiders can provide valuable clues, but they are just one piece of the complex puzzle that is the stock market.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.