Insider Sell Alert: EVP & CFO Craig Safian Offloads Shares of Gartner Inc

In a notable insider transaction, Craig Safian, the Executive Vice President and Chief Financial Officer of Gartner Inc (NYSE:IT), sold 4,387 shares of the company on December 13, 2023. This move has caught the attention of investors and analysts, as insider sales can provide valuable insights into a company's financial health and future prospects.

Who is Craig Safian of Gartner Inc?

Craig Safian has been serving as the EVP & CFO of Gartner Inc, a leading research and advisory company. In his role, Safian oversees the financial strategies and operations of the company, contributing to its growth and financial stability. His actions, especially in terms of stock transactions, are closely watched as they may reflect his confidence in the company's future performance.

Gartner Inc's Business Description

Gartner Inc is a global research and advisory firm that provides insights, advice, and tools for leaders in IT, finance, HR, customer service and support, legal and compliance, marketing, sales, and supply chain functions. With a deep understanding of various industries and markets, Gartner equips executives with indispensable insights, advice, and tools to achieve their mission-critical priorities and build the successful organizations of tomorrow.

Analysis of Insider Buy/Sell and Relationship with Stock Price

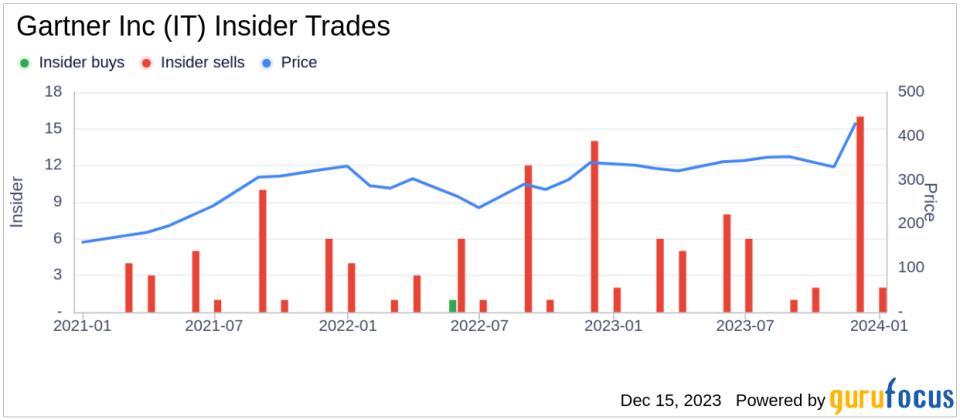

Insider transactions, particularly those involving high-ranking executives, can be a strong indicator of a company's internal perspective on its stock's value. In the case of Gartner Inc, the insider transaction history over the past year shows a significant imbalance between sells and buys, with 46 insider sells and no insider buys. This could suggest that insiders, including Safian, may believe that the stock is currently valued high enough to warrant taking profits.

On the day of Safian's recent sale, Gartner Inc's shares were trading at $467.37, giving the company a substantial market cap of $34.641 billion. This price point is particularly interesting when considering the company's price-earnings ratio of 38.21, which is higher than the industry median of 26.73. Although this suggests a premium valuation, it is lower than the company's historical median price-earnings ratio, indicating that the stock may not be as overvalued as it has been in the past.

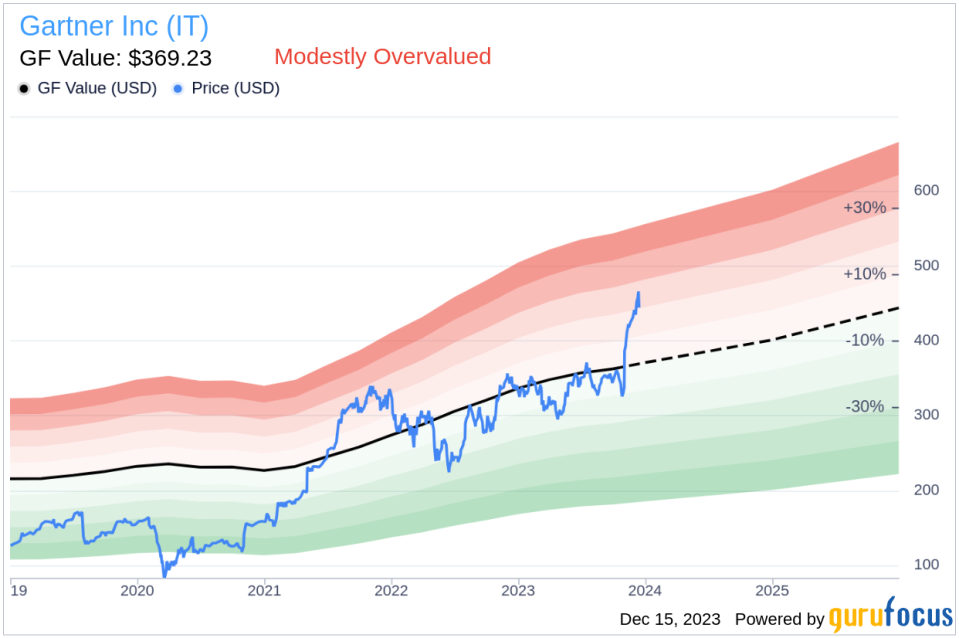

However, when we look at the price-to-GF-Value ratio of 1.27, we see that Gartner Inc is considered modestly overvalued based on its GF Value of $369.23. The GF Value is a proprietary intrinsic value estimate from GuruFocus, which takes into account historical trading multiples, a GuruFocus adjustment factor, and future business performance estimates from analysts.

The insider trend image above provides a visual representation of the selling pattern over the past year. The consistent selling could be interpreted as a lack of confidence in the stock's ability to provide significant returns in the near future, or simply as a part of the insiders' portfolio management strategies.

The GF Value image further illustrates the stock's valuation status. With the current price above the GF Value, investors may want to consider the possibility that the stock's growth potential is already reflected in its price, and thus, the upside may be limited.

Conclusion

Craig Safian's recent sale of 4,387 shares of Gartner Inc is a transaction that warrants attention. While insider selling does not always imply a negative outlook, the lack of insider buys over the past year, combined with the stock's modest overvaluation according to the GF Value, suggests that potential investors should approach the stock with caution. As always, it is important to consider insider transactions as one piece of a larger investment puzzle, alongside thorough analysis of the company's fundamentals, industry trends, and broader market conditions.

Investors should continue to monitor insider activity and look for any significant changes in the pattern that could signal a shift in internal sentiment towards the company's valuation and future prospects. For now, the recent insider sell by the EVP & CFO of Gartner Inc adds an interesting dimension to the ongoing evaluation of the company's stock.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.