Insider Sell Alert: EVP, CFO Michael Lucareli Sells 60,000 Shares of Modine Manufacturing Co (MOD)

Modine Manufacturing Co (NYSE:MOD), a global leader in thermal management technology and solutions, has recently witnessed a significant insider sell that has caught the attention of investors and market analysts. Michael Lucareli, the Executive Vice President and Chief Financial Officer of Modine Manufacturing Co, sold 60,000 shares of the company on November 20, 2023. This transaction has raised questions about the insider's confidence in the company's future prospects and its current valuation.

Who is Michael Lucareli of Modine Manufacturing Co?

Michael Lucareli is a seasoned financial executive with extensive experience in corporate finance, accounting, and strategic planning. As the EVP and CFO of Modine Manufacturing Co, Lucareli plays a crucial role in overseeing the company's financial operations, including financial reporting, treasury, tax, and investor relations. His insights into the company's financial health and strategic direction are invaluable, making his trading activities particularly noteworthy to investors.

Modine Manufacturing Co's Business Description

Modine Manufacturing Co specializes in thermal management systems and components, providing innovative solutions for various markets, including automotive, industrial, and commercial HVAC (heating, ventilation, and air conditioning). The company's products are essential for cooling and heating in a wide range of applications, making it a key player in the thermal management industry. With a commitment to sustainability and efficiency, Modine continues to invest in research and development to maintain its competitive edge.

Analysis of Insider Buy/Sell and Relationship with Stock Price

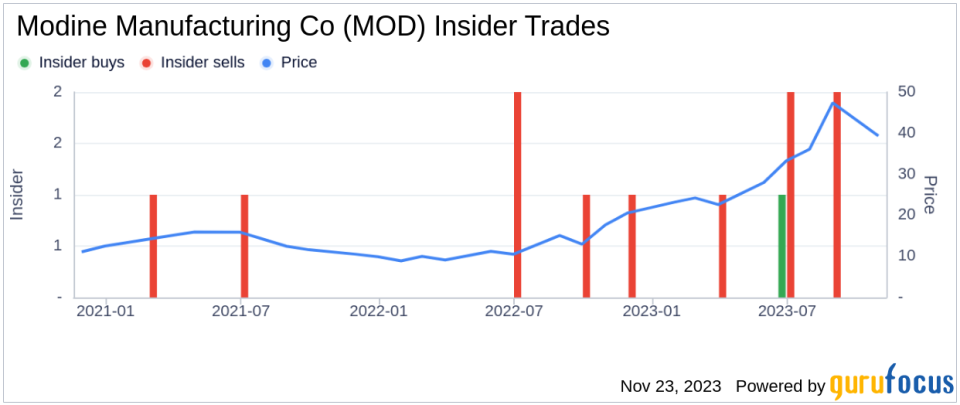

Insider trading activities, particularly sells, can provide valuable clues about a company's internal perspective on its stock's valuation and future performance. In the case of Modine Manufacturing Co, the insider transaction history reveals a pattern of more sells than buys over the past year, with 6 insider sells and only 1 insider buy. This could indicate that insiders, including Michael Lucareli, may perceive the stock as being fully valued or potentially overvalued at current prices.

On the day of Lucareli's recent sell, shares of Modine Manufacturing Co were trading at $50.29, giving the company a market cap of $2.695 billion. This price reflects a price-earnings ratio of 13.33, which is lower than both the industry median of 16.85 and the company's historical median price-earnings ratio. While this might suggest an undervaluation based on earnings, other factors must be considered.

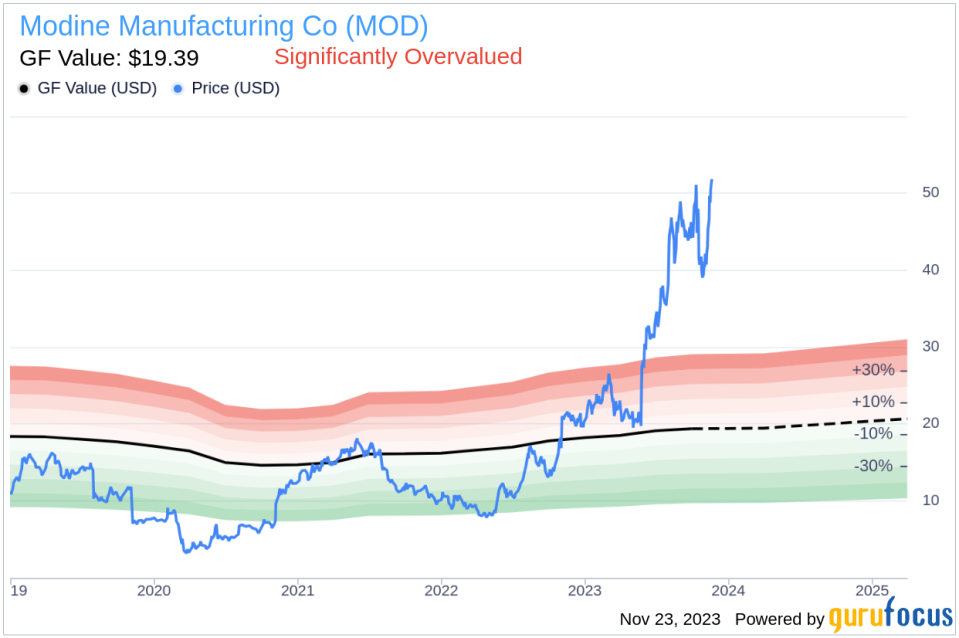

When comparing the stock's price to the GuruFocus Value (GF Value) of $19.39, we find that Modine Manufacturing Co has a price-to-GF-Value ratio of 2.59, indicating that the stock is significantly overvalued based on its GF Value. The GF Value is a comprehensive measure that takes into account historical trading multiples, a GuruFocus adjustment factor, and future business performance estimates. This disparity between the stock's trading price and its GF Value could be a driving factor behind the insider's decision to sell.

The insider trend image above illustrates the recent insider trading activities, providing a visual representation of the sells and buys over the past year. The predominance of sells over buys could be interpreted as a lack of confidence among insiders in the stock's ability to provide substantial returns in the near future.

The GF Value image further supports the notion that Modine Manufacturing Co's stock may be overvalued at its current trading price. Investors should consider this valuation discrepancy when making investment decisions, as it may signal a potential reversion to the mean in the future.

Conclusion

Michael Lucareli's recent sell of 60,000 shares of Modine Manufacturing Co is a significant event that warrants investor attention. While the company's lower price-earnings ratio compared to the industry might suggest an attractive valuation, the high price-to-GF-Value ratio indicates that the stock may be overvalued. The insider trading trend, characterized by more sells than buys, could suggest that insiders like Lucareli believe the stock's current price does not fully reflect potential risks or headwinds. As always, investors should conduct their own due diligence and consider insider trading patterns as one of many factors in their investment decision-making process.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.