Insider Sell Alert: EVP, CFO Michael Lucareli Sells 20,000 Shares of Modine Manufacturing Co

Michael Lucareli, the Executive Vice President and Chief Financial Officer of Modine Manufacturing Co (NYSE:MOD), has recently sold 20,000 shares of the company's stock. The transaction took place on December 14, 2023, and has caught the attention of investors and analysts alike. This sale is part of a series of transactions by Lucareli over the past year, during which he has sold a total of 133,001 shares and made no purchases.

Who is Michael Lucareli of Modine Manufacturing Co?

Michael Lucareli plays a crucial role at Modine Manufacturing Co as the Executive Vice President and Chief Financial Officer. His responsibilities include overseeing the financial operations and strategies of the company. Lucareli's insights into the company's financial health and his actions in the stock market are closely monitored by investors, as they can provide valuable signals about the company's prospects and insider confidence.

Modine Manufacturing Co's Business Description

Modine Manufacturing Co is a global leader in thermal management technology and solutions. The company designs, manufactures, and tests heat transfer products for a wide range of applications and markets, including automotive, industrial, and commercial. With a commitment to innovation and quality, Modine Manufacturing Co continues to advance its technologies to meet the evolving needs of its customers and the industries it serves.

Analysis of Insider Buy/Sell and the Relationship with the Stock Price

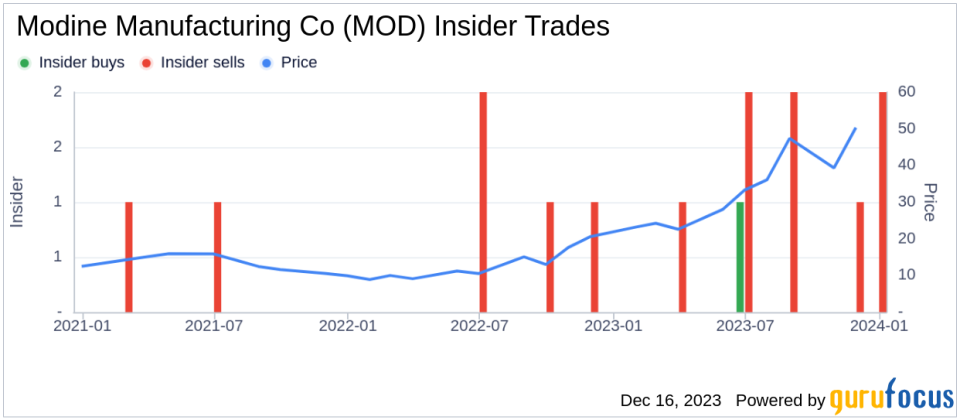

Insider transactions can provide valuable insights into a company's health and the sentiment of its executives. Over the past year, Modine Manufacturing Co has seen a total of 1 insider buy and 8 insider sells. This pattern of more frequent selling than buying among insiders may raise questions about the long-term value of the company's stock.

On the day of Lucareli's recent sale, shares of Modine Manufacturing Co were trading at $55, giving the company a market cap of $2.964 billion. The price-earnings ratio of 14.66 is lower than both the industry median of 17.1 and the company's historical median, suggesting that the stock may be undervalued based on earnings.

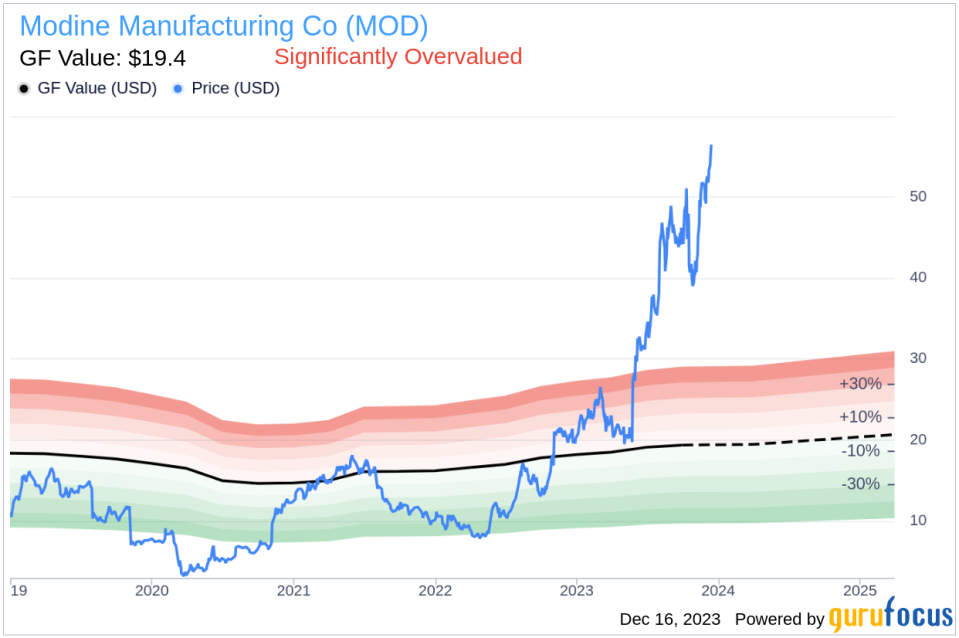

However, with a price-to-GF-Value ratio of 2.84, the stock appears to be Significantly Overvalued according to GuruFocus's proprietary GF Value metric. This discrepancy between traditional valuation metrics and the GF Value could indicate that the market is pricing in future growth expectations or other factors not captured by historical multiples.

The GF Value is determined by considering historical trading multiples, a GuruFocus adjustment factor based on past returns and growth, and future business performance estimates from Morningstar analysts. The current GF Value for Modine Manufacturing Co is $19.40, significantly lower than the current trading price, suggesting that the stock may be overpriced.

The insider trend image above shows the recent insider transactions at Modine Manufacturing Co. The visual representation of buys and sells can help investors discern patterns or shifts in insider behavior, which could be indicative of the company's future performance.

The GF Value image provides a visual comparison of the stock's current price against its intrinsic value estimate. When the stock price is significantly above the GF Value line, as it is in the case of Modine Manufacturing Co, it suggests that the stock may be overvalued relative to the intrinsic value calculated by GuruFocus.

Conclusion

Michael Lucareli's recent sale of 20,000 shares of Modine Manufacturing Co is part of a broader pattern of insider selling at the company. While the stock's low price-earnings ratio might suggest an undervaluation, the high price-to-GF-Value ratio indicates that the stock is significantly overvalued. Investors should consider these mixed signals and conduct further research to understand the potential reasons behind the insider's decision to sell. Factors such as personal financial planning or diversification could also play a role in the insider's transactions, apart from their outlook on the company's future performance.

As always, insider transactions are just one piece of the puzzle when evaluating a stock's potential. It's important to look at the broader financial picture, including earnings reports, industry trends, and macroeconomic factors, before making investment decisions. Modine Manufacturing Co's future performance will ultimately be determined by its ability to innovate and grow in a competitive market, and investors should keep a close eye on these developments.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.