Insider Sell Alert: EVP, CFO Francis Pelzer Sells 2,500 Shares of F5 Inc (FFIV)

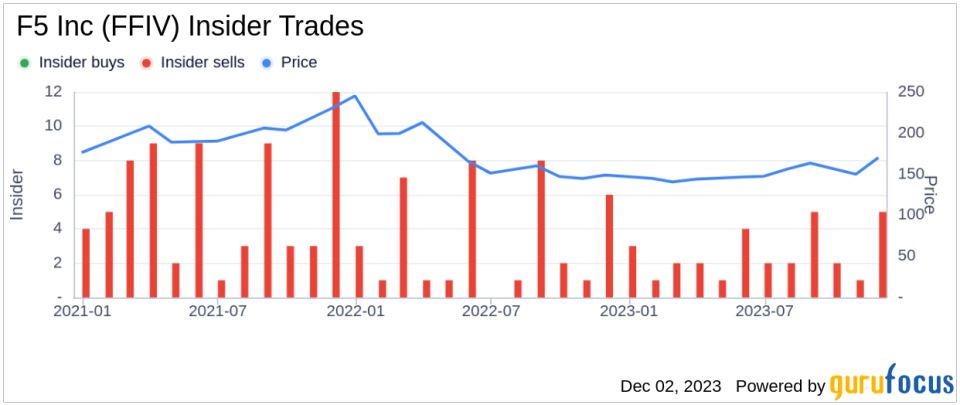

In the realm of stock market movements, insider trading activity is often a significant indicator that investors keep a close eye on. Recently, an insider sell event has caught the attention of the market. Francis Pelzer, the Executive Vice President and Chief Financial Officer of F5 Inc (NASDAQ:FFIV), sold 2,500 shares of the company on November 29, 2023. This transaction has prompted a closer look into the implications of such insider activities and their potential impact on the stock's performance.Who is Francis Pelzer of F5 Inc?Francis Pelzer is a key executive at F5 Inc, serving as the company's Executive Vice President and Chief Financial Officer. With a critical role in the financial planning and risk management of the company, Pelzer's actions and decisions are closely monitored by investors and analysts alike. His insider trading activities, in particular, are of great interest as they may reflect his confidence in the company's financial health and future prospects.F5 Inc's Business DescriptionF5 Inc is a multinational company specializing in application services and application delivery networking (ADN). The company's offerings include cloud and security solutions, which help ensure the availability, performance, and security of servers, data storage devices, and other network resources. F5's products are integral to managing traffic and user interactions in data centers, enabling businesses to optimize their operations in today's digital landscape.Analysis of Insider Buy/Sell and the Relationship with the Stock PriceThe recent sale by Francis Pelzer of 2,500 shares is part of a broader trend observed over the past year. During this period, Pelzer has sold a total of 2,500 shares and has not made any purchases. This one-sided activity raises questions about the insider's perspective on the stock's valuation and future growth potential.When examining the insider transaction history for F5 Inc, it is notable that there have been zero insider buys and 30 insider sells over the past year. This pattern of insider selling could be interpreted as a lack of confidence among insiders about the company's future stock price appreciation.

On the day of Pelzer's recent sale, shares of F5 Inc were trading at $170, giving the company a market cap of $10.305 billion. The price-earnings ratio stood at 26.27, slightly lower than the industry median of 26.85 but higher than the company's historical median price-earnings ratio. This suggests that the stock was trading at a reasonable valuation compared to its peers and its own historical standards.Considering the GF Value, with a price of $170 and a GuruFocus Value of $184.13, F5 Inc has a price-to-GF-Value ratio of 0.92, indicating that the stock is Fairly Valued based on its GF Value. The GF Value is a proprietary intrinsic value estimate developed by GuruFocus, taking into account historical trading multiples, a GuruFocus adjustment factor, and future business performance estimates from analysts.

The GF Value calculation includes:- Historical multiples such as price-earnings ratio, price-sales ratio, price-book ratio, and price-to-free cash flow.- A GuruFocus adjustment factor based on the companys past returns and growth.- Future estimates of business performance from Morningstar analysts.ConclusionThe insider sell activity by Francis Pelzer at F5 Inc, particularly in the absence of any insider buys over the past year, may suggest a cautious or bearish outlook from the insider's perspective. However, the stock's current valuation metrics and its GF Value indicate that it is fairly valued in the market.Investors should consider the broader context of the company's performance, industry trends, and overall market conditions when interpreting insider trading activities. While insider sells can provide valuable insights, they are just one piece of the puzzle in the complex decision-making process of stock market investing. It is essential to conduct thorough research and consider a multitude of factors before making investment decisions.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.