Insider Sell Alert: EVP, CFO Noemie Heuland Sells 3,000 Shares of Ceridian HCM Holding Inc (CDAY)

Recent filings with the SEC have revealed that Noemie Heuland, the Executive Vice President and Chief Financial Officer of Ceridian HCM Holding Inc (NYSE:CDAY), has sold 3,000 shares of the company's stock. The transaction took place on November 10, 2023, marking a significant move by a key insider within the organization.

Who is Noemie Heuland of Ceridian HCM Holding Inc?

Noemie Heuland serves as the EVP and CFO of Ceridian HCM Holding Inc, a position that places her at the helm of the company's financial strategies and operations. Her role includes overseeing financial planning, risk management, record-keeping, and financial reporting. Heuland's insights into the company's financial health and her access to internal metrics make her trading activities particularly noteworthy to investors and market analysts.

About Ceridian HCM Holding Inc

Ceridian HCM Holding Inc is a global software company specializing in human capital management (HCM) solutions. The company provides a range of services, including payroll processing, human resources management, talent management, and workforce management, to businesses of various sizes across multiple industries. Ceridian's flagship platform, Dayforce, is a cloud-based platform that integrates HCM functions into a single application, streamlining processes and enhancing the user experience for both employers and employees.

Analysis of Insider Buy/Sell and Relationship with Stock Price

Insider trading activities, such as the recent sale by Noemie Heuland, can provide valuable clues about a company's future prospects. Over the past year, Heuland has sold a total of 6,211 shares and has not made any purchases. This one-sided activity could signal a lack of confidence in the company's future growth or simply a personal financial decision by the insider.

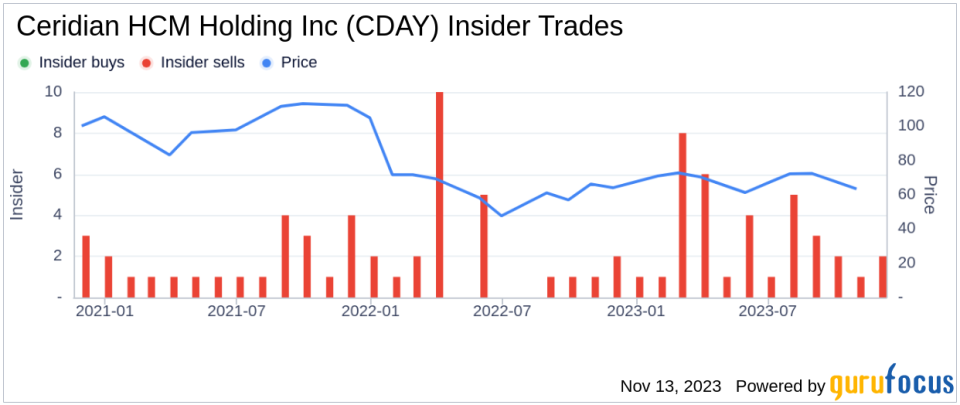

When examining the broader insider transaction history for Ceridian HCM Holding Inc, there have been no insider buys and 36 insider sells over the past year. This trend of insider selling could be interpreted as a bearish signal, suggesting that those with the most intimate knowledge of the company may believe the stock is fully valued or overvalued at current levels.

On the day of Heuland's recent sale, shares of Ceridian HCM Holding Inc were trading at $65.18, giving the company a market cap of $10.113 billion. The stock's price-earnings ratio stands at a staggering 2,161.33, significantly higher than the industry median of 26.88 and the company's historical median. Such a high P/E ratio could indicate that the stock is overvalued compared to its earnings, which may justify the insider's decision to sell.

However, it's important to consider the price relative to the GuruFocus Value (GF Value). With a stock price of $65.18 and a GF Value of $102.28, Ceridian HCM Holding Inc has a price-to-GF-Value ratio of 0.64. This suggests that the stock might be a possible value trap, and investors should think twice before taking a position based on its GF Value.

The GF Value is calculated considering historical trading multiples, a GuruFocus adjustment factor based on past returns and growth, and future business performance estimates from analysts. Despite the current price-to-GF-Value ratio, the high P/E ratio and insider selling trend could be red flags for potential investors.

The insider trend image above illustrates the recent selling pattern, which could be a cause for concern among shareholders and potential investors. It's crucial to monitor such trends as they can often precede changes in the stock's performance.

The GF Value image provides a visual representation of the stock's valuation relative to its intrinsic value estimate. The current market price below the GF Value might typically indicate an undervalued stock, but given the high P/E ratio and insider selling, the situation may not be as straightforward.

Conclusion

The recent insider sell by Noemie Heuland, EVP and CFO of Ceridian HCM Holding Inc, is a significant event that warrants attention. While the sale could be interpreted in various ways, the high P/E ratio, the trend of insider selling, and the price-to-GF-Value ratio collectively suggest that investors should approach the stock with caution. As always, it's recommended that investors conduct their own due diligence and consider the broader market context when evaluating insider trading activities and their potential impact on stock prices.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.