Insider Sell Alert: EVP, Chief Technology Officer Elimelech Rosner Sells Shares of HealthEquity ...

In the realm of stock market movements, insider trading activity is often a significant indicator for investors. Recently, Elimelech Rosner, the Executive Vice President and Chief Technology Officer of HealthEquity Inc (NASDAQ:HQY), sold 2,017 shares of the company on December 11, 2023. This transaction has caught the attention of market analysts and investors alike, as insider sales can provide insights into a company's internal expectations and financial health.

Who is Elimelech Rosner of HealthEquity Inc?

Elimelech Rosner serves as the EVP and Chief Technology Officer of HealthEquity Inc, a company that specializes in providing health savings accounts and other health financial services. Rosner's role is pivotal in driving the technological advancements and maintaining the digital infrastructure that supports the company's services. With a background in technology and a deep understanding of the healthcare industry, Rosner's actions and decisions are closely watched by investors for clues about the company's direction and performance.

HealthEquity Inc's Business Description

HealthEquity Inc is a leader in health savings accounts and other health-related financial services. The company provides a platform for managing health savings accounts (HSAs), health reimbursement arrangements (HRAs), flexible spending accounts (FSAs), and other health financial services. HealthEquity's mission is to empower individuals to make informed decisions about their healthcare spending and saving, leveraging technology to simplify the process and enhance user experience.

Analysis of Insider Buy/Sell and the Relationship with the Stock Price

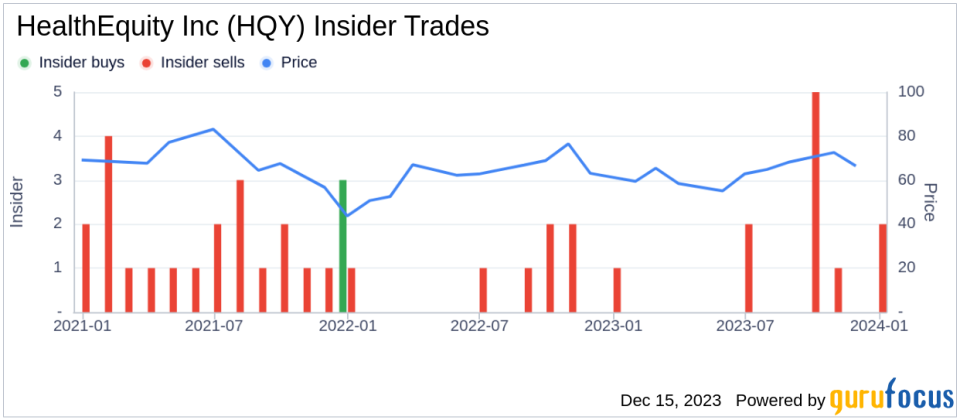

Over the past year, Elimelech Rosner has sold a total of 14,171 shares and has not made any purchases. This one-sided activity could suggest that the insider sees the current stock price as an opportune time to realize gains or reallocate assets. The absence of insider purchases may raise questions about the insider's confidence in the company's future growth prospects.

The insider transaction history for HealthEquity Inc shows a pattern of 0 insider buys and 10 insider sells over the past year. This trend could indicate that insiders, including Rosner, may believe that the stock is fully valued or that they are taking profits after a period of stock appreciation.

On the day of Rosner's recent sale, shares of HealthEquity Inc were trading at $70.09, giving the company a market cap of $5.495 billion. The price-earnings ratio of 189.47 is significantly higher than the industry median of 25.845 and above the company's historical median price-earnings ratio. This elevated P/E ratio could suggest that the stock is overvalued compared to its peers and historical performance, potentially justifying the insider's decision to sell.

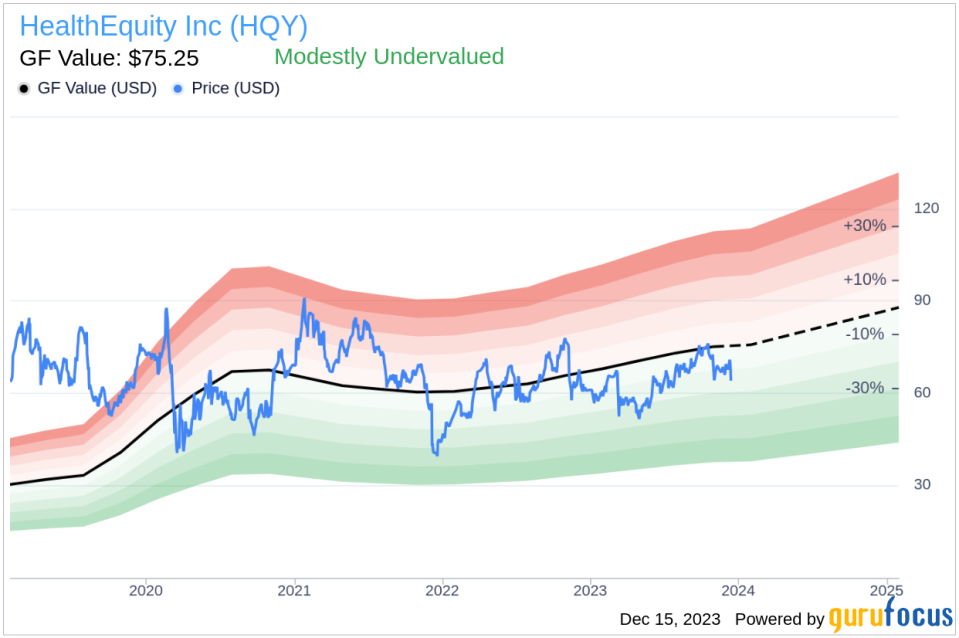

However, with a price of $70.09 and a GuruFocus Value of $75.25, HealthEquity Inc has a price-to-GF-Value ratio of 0.93, indicating that the stock is modestly undervalued based on its GF Value. The GF Value is an intrinsic value estimate that considers historical trading multiples, a GuruFocus adjustment factor, and future business performance estimates.

The insider trend image above reflects the recent selling activity and could be a signal for investors to scrutinize the company's valuation and growth prospects more closely.

The GF Value image provides a visual representation of the stock's valuation relative to its intrinsic value. Despite the insider selling, the modest undervaluation suggests that the stock may still have room for growth or that the market has not fully recognized the company's potential.

Conclusion

Elimelech Rosner's recent sale of HealthEquity Inc shares may raise questions among investors about the insider's confidence in the company's future performance. While the high price-earnings ratio could be a red flag for overvaluation, the GF Value indicates that the stock might still be undervalued. Investors should consider both the insider selling trend and the company's valuation metrics when making investment decisions. As always, insider trading is just one piece of the puzzle, and a comprehensive analysis should include a review of the company's fundamentals, competitive position, and market conditions.

It's important to note that insider selling does not always imply negative sentiment; insiders might sell shares for personal financial planning, diversification, or other non-company-related reasons. Therefore, while insider transactions are a valuable piece of information, they should be weighed alongside other data points and not be used in isolation to make investment decisions.

Investors interested in HealthEquity Inc should continue to monitor insider trading activity and look for any changes in the pattern that could signal a shift in insider sentiment. Additionally, staying informed about the company's performance, industry trends, and broader market movements will provide a more complete picture for making well-informed investment choices.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.