Insider Sell Alert: EVP & Chief Development Officer Michael Murdock Sells 10,115 Shares of ...

In a notable insider transaction, EVP & Chief Development Officer Michael Murdock has parted with 10,115 shares of RadNet Inc (NASDAQ:RDNT), a leading provider of diagnostic imaging services. This sale, executed on December 5, 2023, has caught the attention of investors and market analysts, prompting a closer look at the implications of such insider activity.

Who is Michael Murdock of RadNet Inc?

Michael Murdock serves as the Executive Vice President and Chief Development Officer of RadNet Inc. In his role, Murdock is responsible for overseeing the company's growth initiatives, including strategic acquisitions and partnerships. His insider position grants him a unique perspective on the company's operations and future prospects, making his trading activities particularly noteworthy to investors.

RadNet Inc's Business Description

RadNet Inc is a national leader in providing high-quality, cost-effective diagnostic imaging services through a network of fully-owned and operated outpatient imaging centers. The company's core services include MRI, CT, and PET scans, as well as X-rays, ultrasound, mammography, and other interventional procedures. RadNet's focus on technology and patient care has positioned it as a key player in the healthcare sector, with a reputation for innovation and efficiency.

Analysis of Insider Buy/Sell and the Relationship with the Stock Price

The insider transaction history for RadNet Inc reveals a pattern of insider selling over the past year. With Michael Murdock's recent sale of 10,115 shares and no recorded purchases, the trend appears to lean towards insiders cashing in on their holdings. This activity can sometimes signal insiders' beliefs that the stock may be fully valued or overvalued, prompting them to lock in profits.

The relationship between insider selling and stock price can be complex. While some investors interpret insider selling as a lack of confidence in the company's future growth, it is essential to consider that insiders may have various reasons for selling, including personal financial planning or diversifying their investment portfolio. Therefore, while insider sales can provide valuable context, they should not be the sole factor in investment decisions.

Valuation and Market Cap

On the day of the insider's recent sale, RadNet Inc's shares were trading at $35.02, giving the company a market cap of $2.448 billion. This valuation places RadNet Inc in the mid-cap category, which often encompasses companies with substantial growth potential.

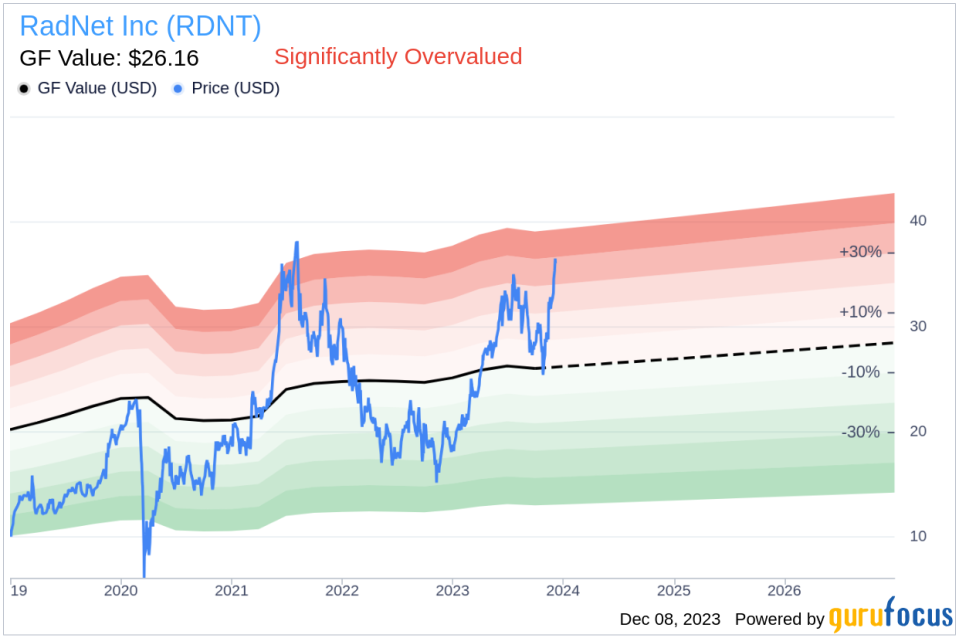

With a price of $35.02 and a GuruFocus Value of $26.16, RadNet Inc has a price-to-GF-Value ratio of 1.34. This indicates that the stock is Significantly Overvalued based on its GF Value.

The GF Value is a proprietary metric developed by GuruFocus, designed to estimate the intrinsic value of a stock. The calculation incorporates historical trading multiples, an adjustment factor based on the company's past performance, and future business projections provided by analysts. When a stock trades above its GF Value, it suggests that the market may be assigning an optimistic premium to the company's shares.

Conclusion

The sale of 10,115 shares by EVP & Chief Development Officer Michael Murdock is a significant event that warrants attention from RadNet Inc's investors. While the insider's actions may raise questions about the stock's current valuation, it is crucial to consider the broader context, including the company's market position and growth prospects. As RadNet Inc continues to navigate the dynamic healthcare landscape, investors should weigh insider trends alongside other fundamental and technical analyses to make informed investment decisions.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.