Insider Sell Alert: EVP Christopher Tessitore Sells 38,056 Shares of NNN REIT Inc

In a notable insider transaction, Executive Vice President Christopher Tessitore of NNN REIT Inc (NYSE:NNN) has sold 38,056 shares of the company on December 13, 2023. This move has caught the attention of investors and analysts who closely monitor insider activities as an indicator of a company's financial health and future performance.

Who is Christopher Tessitore?

Christopher Tessitore serves as an Executive Vice President at NNN REIT Inc, a position that places him in the upper echelons of the company's management. His role likely involves significant responsibilities in the company's operations, strategy, and possibly its financial planning. As an insider with such a high-ranking position, Tessitore's trading activities are closely watched for insights into the company's internal perspective on its stock's value and future prospects.

About NNN REIT Inc

NNN REIT Inc is a real estate investment trust that specializes in acquiring, owning, and managing single-tenant retail properties in the United States. The company's portfolio consists of various properties leased to tenants in different industries, including retail, restaurants, automotive, and more. These properties are typically operated under long-term net leases, which require the tenant to pay most, if not all, of the property expenses, including taxes, insurance, and maintenance. This business model provides NNN REIT Inc with a stable and predictable income stream, making it an attractive option for investors seeking regular dividends and long-term capital appreciation.

Insider Buy/Sell Analysis and Stock Price Relationship

Insider transactions can provide valuable clues about a company's future. When insiders buy shares, it is often interpreted as a sign of confidence in the company's prospects. Conversely, when insiders sell, it can raise questions about their outlook on the stock's potential. However, it is essential to consider that insiders might sell shares for various reasons unrelated to their view of the company's future, such as personal financial planning or diversifying their investment portfolio.

Over the past year, Christopher Tessitore has sold a total of 38,056 shares and has not made any purchases. This one-sided activity could suggest that the insider sees the current stock price as a good opportunity to realize gains. However, without additional context, it is difficult to draw definitive conclusions from these transactions alone.

The insider transaction history for NNN REIT Inc shows a lack of insider buying over the past year, with zero total buys. Meanwhile, there have been three insider sells in the same timeframe. This trend might indicate a cautious or neutral stance from insiders regarding the company's stock price performance.

Valuation and Market Reaction

On the day of Tessitore's recent sale, shares of NNN REIT Inc were trading at $41.68, giving the company a market cap of $7.645 billion. The price-earnings ratio stands at 19.67, slightly higher than the industry median of 17.38 but lower than the company's historical median. This discrepancy suggests that while the stock may be trading at a premium compared to its peers, it is still below its own historical valuation levels.

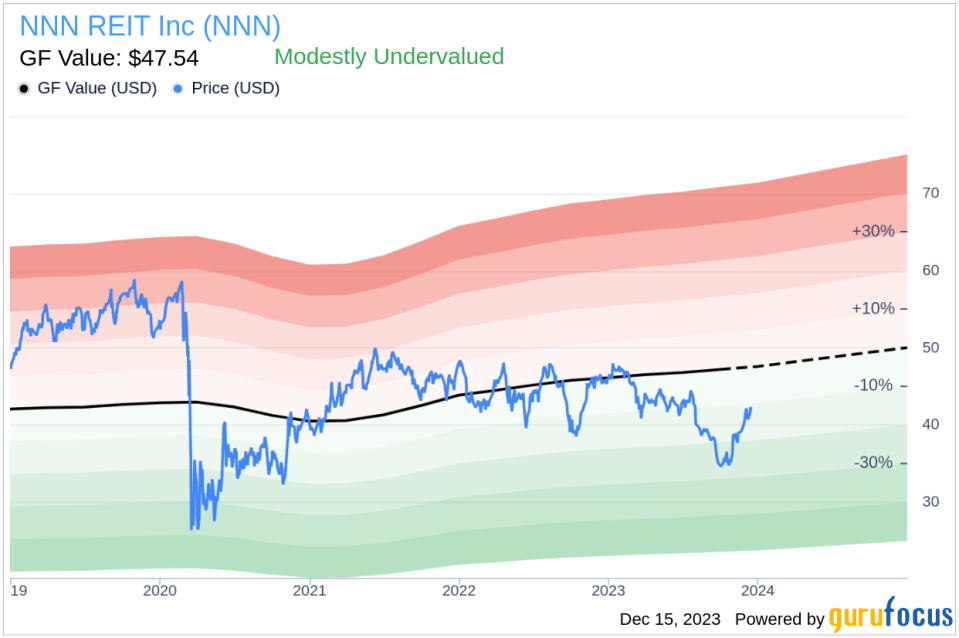

With the current price and a GuruFocus Value of $47.54, NNN REIT Inc has a price-to-GF-Value ratio of 0.88, indicating that the stock is modestly undervalued based on its GF Value. This assessment suggests that the stock might have room for appreciation, which could be a factor in the insider's decision to sell at this time.

The GF Value is a proprietary intrinsic value estimate developed by GuruFocus. It takes into account historical trading multiples, a GuruFocus adjustment factor based on past returns and growth, and future business performance estimates from analysts. The current GF Value for NNN REIT Inc implies that the stock might be an attractive buy for value investors seeking underpriced securities.

Conclusion

The recent insider sell by EVP Christopher Tessitore of NNN REIT Inc has provided the market with information to consider in evaluating the stock's future direction. While the insider's sell-off could be interpreted in various ways, the overall valuation metrics suggest that NNN REIT Inc may still be undervalued. Investors should weigh this insider activity alongside other financial analyses and market trends before making investment decisions. As always, insider transactions are just one piece of the puzzle when it comes to assessing a stock's potential.

It is important for investors to conduct their due diligence and consider the broader economic environment, the company's fundamentals, and their investment strategy. Keeping an eye on insider trends and valuations can be a helpful tool in building a well-informed investment portfolio.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.