Insider Sell Alert: EVP and CLO Jay Rosenblum Sells 2,000 Shares of Assurant Inc (AIZ)

Assurant Inc (NYSE:AIZ), a leading global provider of lifestyle and housing solutions that support, protect, and connect major consumer purchases, has recently witnessed an insider sell that may catch the attention of investors. On November 20, 2023, Executive Vice President and Chief Legal Officer Jay Rosenblum sold 2,000 shares of the company. This transaction has prompted a closer look into the insider's trading behavior and its potential implications for the stock.

Who is Jay Rosenblum of Assurant Inc?

Jay Rosenblum serves as the Executive Vice President and Chief Legal Officer at Assurant Inc. In his role, Rosenblum is responsible for overseeing the company's legal, regulatory, and compliance functions. His position places him in the upper echelons of the company's decision-making hierarchy, making his trading activities particularly noteworthy to investors and market analysts.

Assurant Inc's Business Description

Assurant Inc is a Fortune 500 company that operates in the provision of risk management products and services. The company's offerings include extended service contracts, vehicle protection services, pre-funded funeral insurance, renters insurance, lender-placed homeowners insurance, and other specialty products. Assurant has a strong presence in North America, Latin America, Europe, and Asia Pacific, catering to a diverse client base and ensuring a stable revenue stream across various economic cycles.

Analysis of Insider Buy/Sell and the Relationship with the Stock Price

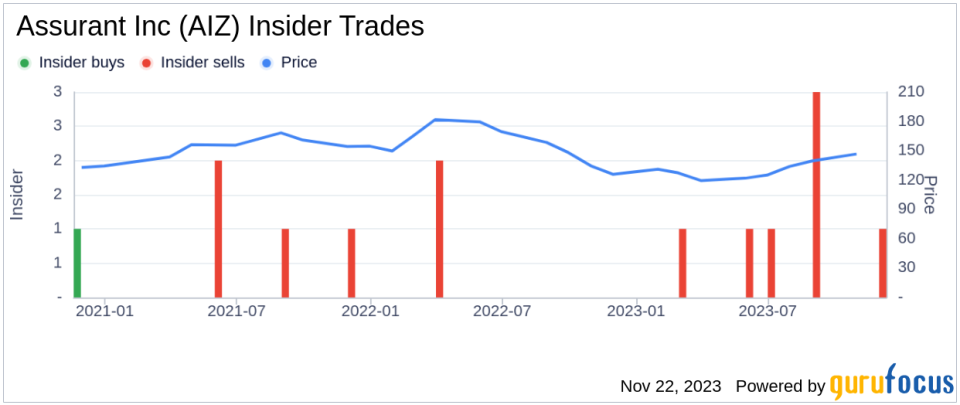

Insider trading activities, such as buys and sells, can provide valuable insights into a company's internal perspective on its financial health and future prospects. In the case of Assurant Inc, the insider transaction history over the past year shows a lack of insider buys and a total of 8 insider sells, which could signal a cautious stance from those with intimate knowledge of the company.

On the day of the insider's recent sell, shares of Assurant Inc were trading at $162.16, giving the company a market cap of $8.666 billion. This price point is significant as it reflects investor sentiment and market valuation at the time of the transaction.

The price-earnings ratio of 16.76 is higher than the industry median of 10.74 and also exceeds the company's historical median price-earnings ratio. This could indicate that the stock is priced at a premium compared to its peers and its own historical standards, potentially justifying the insider's decision to sell.

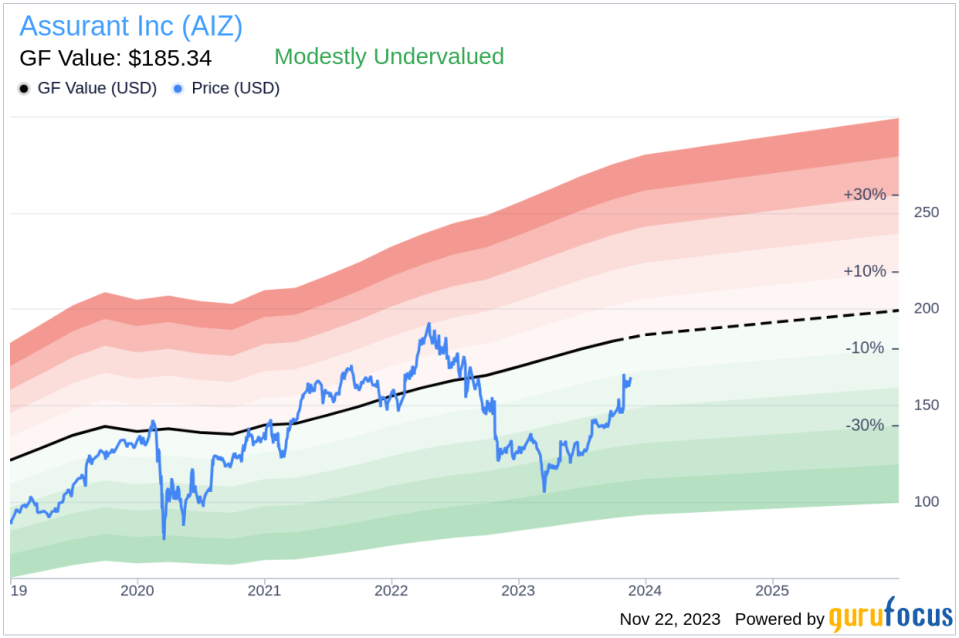

However, with a price of $162.16 and a GuruFocus Value of $185.34, Assurant Inc has a price-to-GF-Value ratio of 0.87, suggesting that the stock is modestly undervalued based on its GF Value. The GF Value is an intrinsic value estimate that considers historical trading multiples, a GuruFocus adjustment factor, and future business performance estimates.

The insider trend image above illustrates the recent sell transactions and the absence of buys, which could be interpreted as a lack of confidence in the stock's near-term appreciation potential by insiders.

The GF Value image provides a visual representation of the stock's valuation relative to its intrinsic value. The current price-to-GF-Value ratio under 1 indicates that the stock may be undervalued, offering a potential opportunity for investors who believe in the company's long-term prospects.

Conclusion

The recent insider sell by EVP and CLO Jay Rosenblum may raise questions among investors regarding the future performance of Assurant Inc. While the price-earnings ratio suggests a premium valuation, the GF Value indicates that the stock might be undervalued. Investors should consider the insider trading trends, the company's valuation metrics, and their own research when making investment decisions. As always, insider transactions are just one piece of the puzzle, and a comprehensive analysis should include a review of the company's financials, industry trends, and broader market conditions.

It's important to note that insider sells can be motivated by various factors, including personal financial planning, diversification of assets, or other non-company-specific reasons. Therefore, while insider trading activity is a valuable data point, it should not be the sole basis for investment decisions.

Assurant Inc's position in the market, with its diversified product offerings and global reach, continues to make it a company worth watching. As the market digests the insider's recent sell, investors will be keenly observing the company's performance in the coming quarters to gauge the potential impact on the stock's price and overall valuation.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.