Insider Sell Alert: EVP Cole Carter Unloads Shares of CoreCivic Inc (CXW)

Recent filings with the SEC have revealed that Cole Carter, the Executive Vice President, General Counsel, and Secretary of CoreCivic Inc (NYSE:CXW), has sold a significant number of shares in the company. On November 21, 2023, the insider executed a sale of 39,345 shares of CoreCivic Inc, a notable transaction that has caught the attention of investors and market analysts alike.

Who is Cole Carter of CoreCivic Inc?

Cole Carter serves as the Executive Vice President, General Counsel, and Secretary of CoreCivic Inc. In his role, Carter is responsible for overseeing all legal matters, including litigation, compliance, and corporate governance. His position places him in the upper echelons of the company's executive team, providing him with a comprehensive view of CoreCivic's operations and strategic direction.

CoreCivic Inc's Business Description

CoreCivic Inc is a diversified government solutions company providing quality corrections and detention management, community reentry services, and real estate solutions to the government. The company owns and manages private prisons and detention centers and provides community reentry programs to assist with the successful reintegration of inmates into society. CoreCivic's real estate solutions include the design and construction of new facilities, as well as the management of government-owned properties.

Analysis of Insider Buy/Sell and Relationship with Stock Price

Insider transactions can provide valuable insights into a company's health and the sentiment of its executives. Over the past year, Cole Carter has sold a total of 74,345 shares and has not made any purchases. This one-sided activity could be interpreted in several ways. On one hand, insiders might sell shares for personal financial reasons that do not necessarily reflect their outlook on the company's future. On the other hand, a lack of insider purchases might suggest that insiders do not view the stock as undervalued or do not expect significant appreciation in the near term.

The relationship between insider selling and stock price is not always straightforward. However, consistent selling by insiders, particularly without any offsetting insider buying, can sometimes lead to negative market sentiment. Investors often look for a balance between insider buying and selling to gauge insider confidence in the company's prospects.

On the day of Carter's recent sale, CoreCivic Inc's shares were trading at $13.53, giving the company a market cap of $1.618 billion. The price-earnings ratio of 25.00 is higher than the industry median of 17.02 and also exceeds CoreCivic's historical median price-earnings ratio. This suggests that the stock may be trading at a premium compared to its peers and its own historical valuation.

When examining the insider trend image, we can see that there have been no insider buys over the past year, while there have been 22 insider sells in the same timeframe. This trend could indicate that insiders are taking advantage of the current stock price to realize gains or redistribute their investment portfolios.

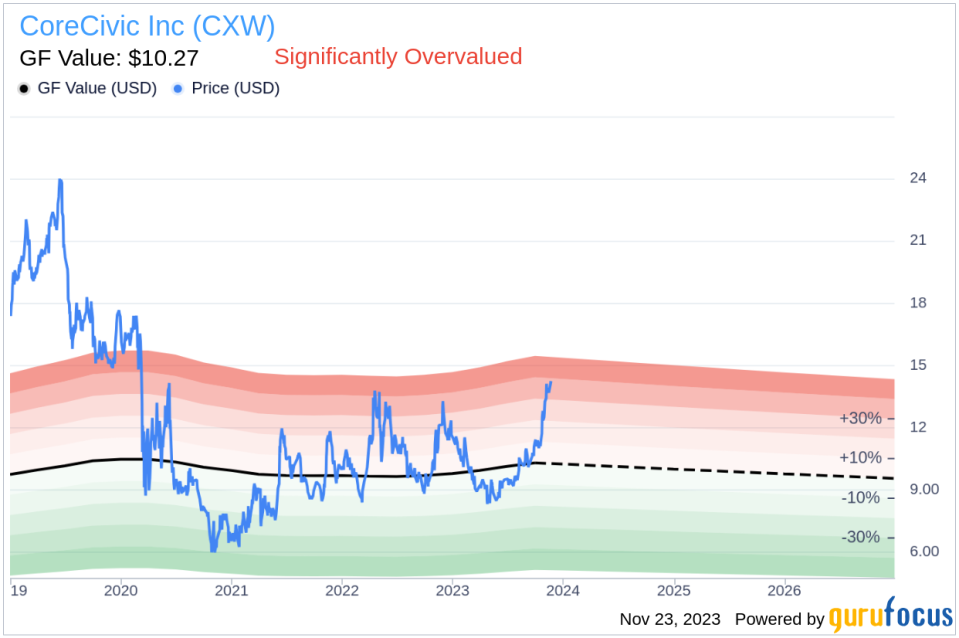

Looking at the GF Value image, CoreCivic Inc has a price-to-GF-Value ratio of 1.32, with a GF Value of $10.27. This indicates that the stock is significantly overvalued based on its GF Value. The GF Value is calculated considering historical trading multiples, a GuruFocus adjustment factor based on past returns and growth, and future business performance estimates from Morningstar analysts.

Conclusion

The recent insider sell by EVP Cole Carter may raise questions among CoreCivic Inc's investors. While the reasons behind Carter's decision to sell are not publicly known, the transaction occurs at a time when the stock is considered significantly overvalued based on GuruFocus's proprietary GF Value. Investors should consider insider trends, valuation metrics, and the company's overall performance when making investment decisions. As always, insider transactions are just one piece of the puzzle, and a comprehensive analysis should include a variety of factors.

It is important to note that insider selling does not always predict future stock performance, and investors should not base their decisions solely on such events. However, staying informed about insider activities can provide valuable context for understanding market dynamics and potential shifts in company strategy or outlook.

For those interested in CoreCivic Inc's stock, it would be prudent to keep an eye on further insider transactions and to look for any signs of insider buying, which could signal growing confidence among the company's executives about its future prospects.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.