Insider Sell Alert: EVP and COO Donald Kafka Sells 65,000 Shares of First BanCorp (FBP)

In a notable insider transaction, Executive Vice President and Chief Operating Officer Donald Kafka of First BanCorp (NYSE:FBP) has sold 65,000 shares of the company's stock. The sale, which took place on December 5, 2023, has caught the attention of investors and market analysts, prompting a closer look at the insider's trading history and the potential implications for First BanCorp's stock.

Who is Donald Kafka of First BanCorp?

Donald Kafka has been an integral part of First BanCorp, serving as the Executive Vice President and Chief Operating Officer. His role within the company involves overseeing the operational aspects of the bank, ensuring that it runs efficiently and effectively. With years of experience in the banking industry, Kafka's actions and decisions are closely watched by investors as they can provide insights into the company's internal dynamics and future prospects.

First BanCorp's Business Description

First BanCorp is a financial services holding company headquartered in San Juan, Puerto Rico. The company operates through its main subsidiary, FirstBank Puerto Rico, providing a range of financial products and services. These include commercial and consumer banking services, mortgage loans, and insurance products. With a strong presence in Puerto Rico, the Virgin Islands, and Florida, First BanCorp has established itself as a key player in the financial sector within these regions.

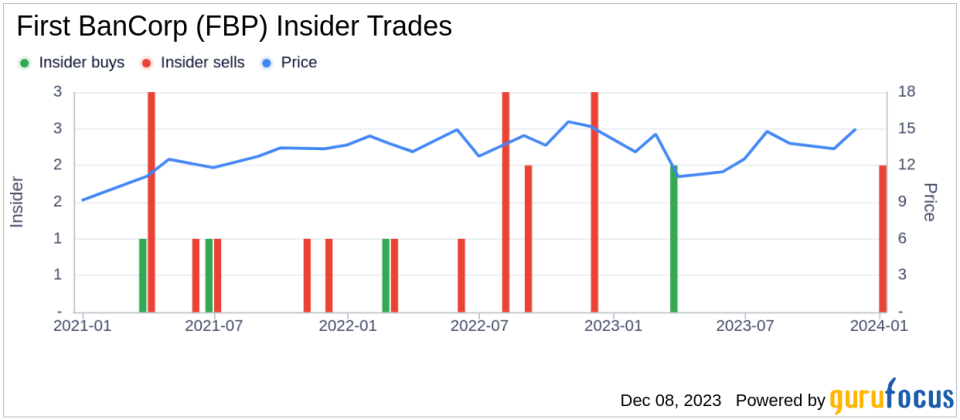

Analysis of Insider Buy/Sell and Relationship with Stock Price

The insider transaction history for First BanCorp reveals a balanced pattern of insider activity over the past year, with 2 insider buys and 2 insider sells recorded. This latest transaction by Donald Kafka represents a significant sell-off, as the insider has sold 65,000 shares without any reported purchases within the same period.

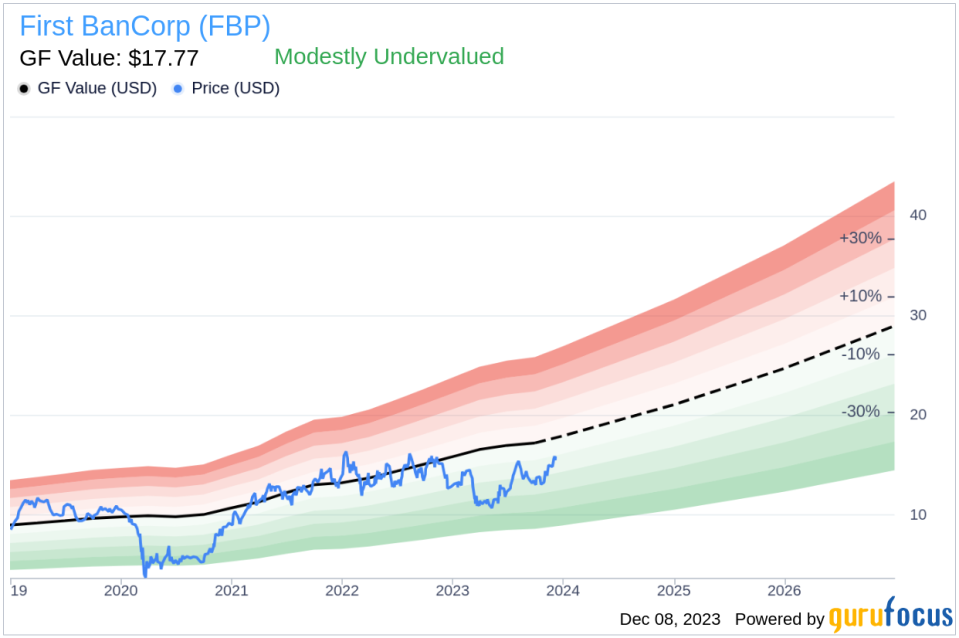

The relationship between insider transactions and stock price can be complex. While insider selling does not always indicate a lack of confidence in the company, it can sometimes lead investors to question the insider's view of the stock's future performance. In the case of First BanCorp, the stock was trading at $15.79 on the day of Kafka's sale, with a market cap of $2.769 billion.The price-earnings ratio of First BanCorp stands at 9.79, which is higher than the industry median of 8.73 but lower than the company's historical median price-earnings ratio. This suggests that while the stock is trading at a higher multiple compared to its industry peers, it may still be undervalued based on its own historical standards.

Moreover, with a price of $15.79 and a GuruFocus Value of $17.77, First BanCorp has a price-to-GF-Value ratio of 0.89, indicating that the stock is modestly undervalued based on its GF Value. The GF Value is an intrinsic value estimate that takes into account historical trading multiples, a GuruFocus adjustment factor, and future business performance estimates.

Insider Trends and Market Reaction

The market often reacts to insider transactions, as they can provide a glimpse into the insider's confidence in the company's future. In the case of First BanCorp, the balanced insider activity over the past year, coupled with the current valuation metrics, suggests that the market may not see Kafka's sell-off as a definitive bearish signal. Instead, investors might interpret this move as part of a normal portfolio management strategy by the insider.It is also important to consider the broader economic context and the banking industry's performance when analyzing insider transactions. Market conditions, regulatory changes, and competitive dynamics can all influence an insider's decision to buy or sell shares.

Conclusion

The sale of 65,000 shares by EVP and COO Donald Kafka is a significant transaction that warrants attention from First BanCorp investors. While insider selling can sometimes raise concerns, the current valuation and modestly undervalued status of First BanCorp's stock based on the GF Value suggest that the company may still have room for growth. Investors should continue to monitor insider activity and consider the broader market context when making investment decisions. As always, it is advisable to look at a comprehensive set of factors, including company performance, industry trends, and macroeconomic indicators, before drawing conclusions from insider transactions.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.