Insider Sell Alert: EVP and COO John Molloy Sells 76,819 Shares of Motorola Solutions Inc (MSI)

Motorola Solutions Inc (NYSE:MSI), a renowned player in the field of communication solutions and services, has recently witnessed a significant insider sell that has caught the attention of investors and market analysts alike. On December 14, 2023, John Molloy, the Executive Vice President and Chief Operating Officer of Motorola Solutions Inc, sold a substantial number of shares, amounting to 76,819. This transaction has raised questions about the insider's confidence in the company's future prospects and the potential impact on the stock's performance.

Who is John Molloy of Motorola Solutions Inc?

John Molloy is a seasoned executive with a wealth of experience in the technology and communications industry. As the EVP and COO of Motorola Solutions Inc, Molloy has been instrumental in driving the company's operational efficiency and strategic initiatives. His role involves overseeing the company's day-to-day operations, ensuring that Motorola Solutions continues to deliver innovative products and services to its global customer base.

Motorola Solutions Inc's Business Description

Motorola Solutions Inc is a global leader in mission-critical communications and analytics. With a history that spans over 90 years, the company provides a comprehensive suite of services and products, including two-way radios, software and video security solutions, and command center software. Motorola Solutions serves a diverse set of markets, including public safety, government, and enterprise customers, helping them to increase their safety and operational efficiency.

Analysis of Insider Buy/Sell and the Relationship with the Stock Price

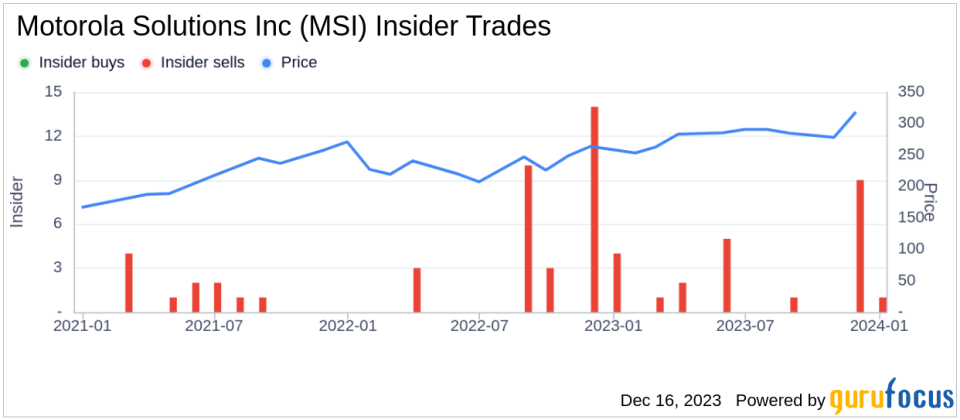

Insider transactions are often scrutinized by investors as they can provide insights into the company's internal perspective on its financial health and future growth potential. In the case of Motorola Solutions Inc, the insider transaction history over the past year shows a trend that leans heavily towards selling, with 20 insider sells and no insider buys. This could suggest that insiders, including John Molloy, may perceive the stock's current valuation as being on the higher side, prompting them to realize gains.

On the day of the insider's recent sell, shares of Motorola Solutions Inc were trading at $323.21, giving the company a market cap of $51.53 billion. The price-earnings ratio stands at 31.40, which is above both the industry median of 22.87 and the company's historical median. This elevated P/E ratio could be a contributing factor to the insider's decision to sell shares, as it may indicate that the stock is priced optimistically relative to its earnings.

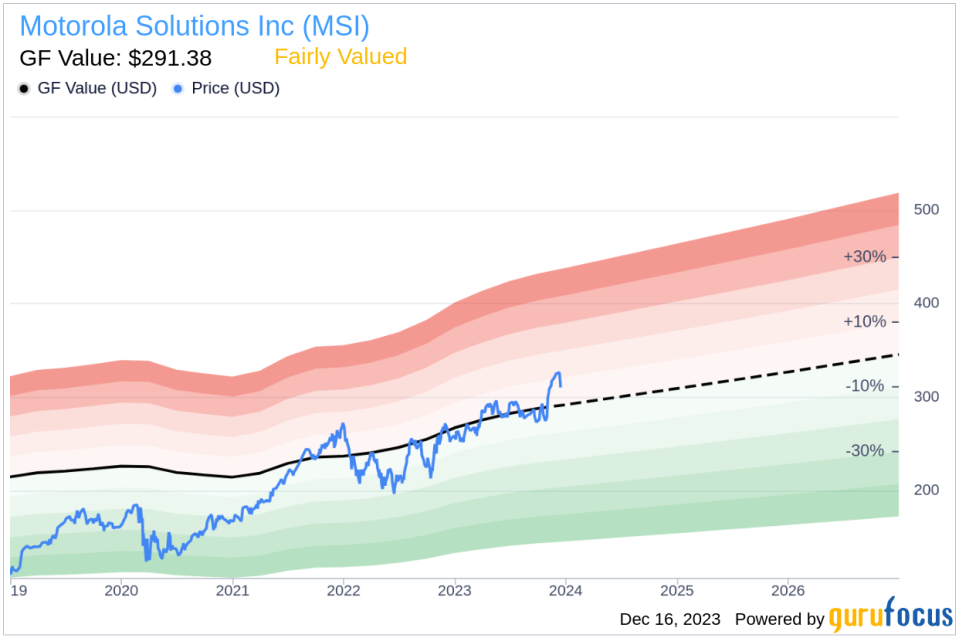

When considering the price-to-GF-Value ratio of 1.11, Motorola Solutions Inc is deemed to be Fairly Valued based on its GF Value. The GF Value, an intrinsic value estimate, takes into account historical trading multiples, a GuruFocus adjustment factor, and future business performance estimates. Although the stock is not considered overvalued, the insider's sell-off could be interpreted as a lack of confidence in the stock's ability to offer substantial returns in the near term.

The insider trend image above illustrates the recent selling pattern among Motorola Solutions Inc's insiders. This pattern can influence investor sentiment and potentially lead to increased volatility in the stock's price. It is important for investors to monitor such trends as they may precede shifts in the stock's performance.

The GF Value image provides a visual representation of the stock's valuation relative to its intrinsic value. While the current price-to-GF-Value ratio suggests that the stock is fairly valued, the insider's sell action might still raise concerns among investors about the stock's future trajectory.

Conclusion

John Molloy's recent sell of 76,819 shares of Motorola Solutions Inc is a significant event that warrants attention from the investment community. While the company's stock is considered fairly valued based on the GF Value, the high P/E ratio and the pattern of insider selling over the past year could be indicative of a cautious outlook from those with intimate knowledge of the company's operations. Investors should consider these factors, along with the company's business fundamentals and market position, when making investment decisions regarding Motorola Solutions Inc.

As always, insider transactions are just one piece of the puzzle when it comes to evaluating a stock's potential. It is essential for investors to conduct thorough research and consider a wide range of financial and market indicators before making any investment decisions.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.