Insider Sell Alert: EVP, CTO Iqbal Arshad Sells 11,818 Shares of Cerence Inc (CRNC)

Cerence Inc (NASDAQ:CRNC), a leader in creating unique, moving experiences for the automotive world, has recently witnessed a significant insider sell from one of its top executives. Iqbal Arshad, the company's Executive Vice President and Chief Technology Officer, sold 11,818 shares of the company's stock on November 22, 2023. This transaction has caught the attention of investors and market analysts, as insider activity can often provide valuable insights into a company's prospects.

Who is Iqbal Arshad of Cerence Inc?

Iqbal Arshad is a seasoned executive with a wealth of experience in the technology sector. As the EVP and CTO of Cerence Inc, Arshad plays a pivotal role in steering the company's technological advancements and product development. His expertise in innovation and strategic planning is crucial for Cerence as it navigates the competitive landscape of automotive AI. Arshad's recent sell-off of company shares may be interpreted in various ways, but it certainly puts the spotlight on Cerence's current market position and future outlook.

Cerence Inc's Business Description

Cerence Inc is at the forefront of the automotive industry's transformation, focusing on developing intuitive AI-driven interfaces that enhance the user experience in vehicles. The company's cutting-edge technology powers voice recognition, natural language understanding, and personalized digital assistants that enable drivers to interact seamlessly with their cars. Cerence's solutions are designed to create a safer, more enjoyable, and more productive driving experience, and are trusted by many of the world's leading automotive manufacturers.

Analysis of Insider Buy/Sell and the Relationship with the Stock Price

The recent sale by Iqbal Arshad of 11,818 shares is part of a broader pattern of insider activity at Cerence Inc. Over the past year, Arshad has sold a total of 17,859 shares and has not made any purchases. This one-sided transaction history could suggest that insiders, including Arshad, may believe the stock is currently overvalued or that they are taking profits after a period of stock appreciation.

Insider sells can sometimes lead to negative market sentiment, as investors may perceive them as a lack of confidence in the company's future growth. However, it is essential to consider the context of these transactions. Insiders might sell shares for various reasons unrelated to their outlook on the company, such as diversifying their personal portfolio, tax planning, or other personal financial considerations.

The insider transaction history for Cerence Inc shows a trend of more insider sells than buys over the past year, with 7 sells and only 1 buy. This trend could be a signal to investors to proceed with caution, especially when considering the company's stock price in relation to its intrinsic value.

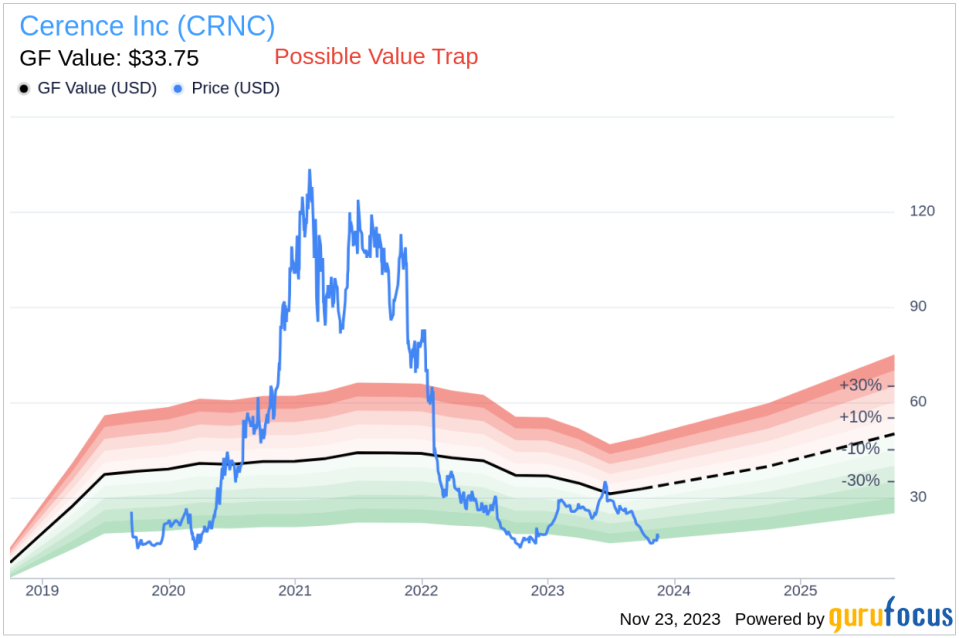

On the day of Arshad's recent sell, Cerence Inc's shares were trading at $17.82, giving the company a market cap of $683.245 million. This price point is significantly below the GuruFocus Value (GF Value) of $33.75, suggesting that the stock might be undervalued.

The GF Value is a proprietary intrinsic value estimate from GuruFocus, which takes into account historical trading multiples, an adjustment factor based on the company's past performance, and future business performance estimates. With a price-to-GF-Value ratio of 0.53, Cerence Inc is currently categorized as a "Possible Value Trap, Think Twice" according to GuruFocus's valuation model.

This valuation discrepancy raises questions about the stock's potential and whether the insider sell activity is a red flag for underlying issues not reflected in the company's financials. Investors should consider whether the low price-to-GF-Value ratio is an opportunity to buy a quality stock at a discount or a warning sign of potential pitfalls ahead.

Conclusion

The sale of 11,818 shares by EVP, CTO Iqbal Arshad is a notable event for Cerence Inc and its investors. While the insider's actions may not necessarily predict the future movement of the stock, they do warrant attention and further analysis. Given the company's current valuation and the insider trend of more sells than buys, investors should conduct thorough due diligence and consider the broader market context before making investment decisions. As always, insider transactions are just one piece of the puzzle when evaluating a company's investment potential.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.