Insider Sell Alert: EVP David Marra Sells Shares of RenaissanceRe Holdings Ltd

In the realm of stock market movements, insider trading activity is often a significant indicator that investors keep an eye on. Recently, David Marra, the Executive Vice President and Chief Underwriting Officer of RenaissanceRe Holdings Ltd (RNR), sold 1,000 shares of the company's stock. This transaction, dated November 20, 2023, has caught the attention of market analysts and investors alike, as insider sales can provide insights into a company's future prospects.

David Marra is a seasoned executive with extensive experience in the insurance and reinsurance industry. As the Chief Underwriting Officer at RenaissanceRe, Marra is responsible for overseeing the underwriting strategies and ensuring that the company's risk management practices align with its overall business objectives. His role is pivotal in maintaining the company's reputation for underwriting excellence and innovation.

RenaissanceRe Holdings Ltd is a global provider of reinsurance and insurance solutions, specializing in property catastrophe and specialty reinsurance, as well as certain insurance coverages. The company is known for its expertise in matching well-structured risk with efficient capital and has a reputation for its strong analytical capabilities in the industry.

Let's delve into the details of the insider's recent sell activity and analyze the potential implications for RenaissanceRe Holdings Ltd's stock price.

Over the past year, David Marra has sold a total of 1,000 shares and has not made any purchases of the company's stock. This could be interpreted in various ways, but without additional context, it is challenging to draw definitive conclusions solely based on these transactions.

Insider Trends

The insider transaction history for RenaissanceRe Holdings Ltd reveals a pattern of more insider selling than buying over the past year. Specifically, there has been only 1 insider buy compared to 4 insider sells during this period. This trend could suggest that insiders, on balance, see the current stock price as favorable for taking profits or reallocating their investments.

Valuation

On the date of the insider's recent sale, shares of RenaissanceRe Holdings Ltd were trading at $207.73, giving the company a market capitalization of $11.336 billion. This valuation places the stock's price-earnings ratio at 6.95, which is lower than both the industry median of 10.74 and the company's historical median price-earnings ratio. This could indicate that the stock is undervalued compared to its peers and its own historical valuation.

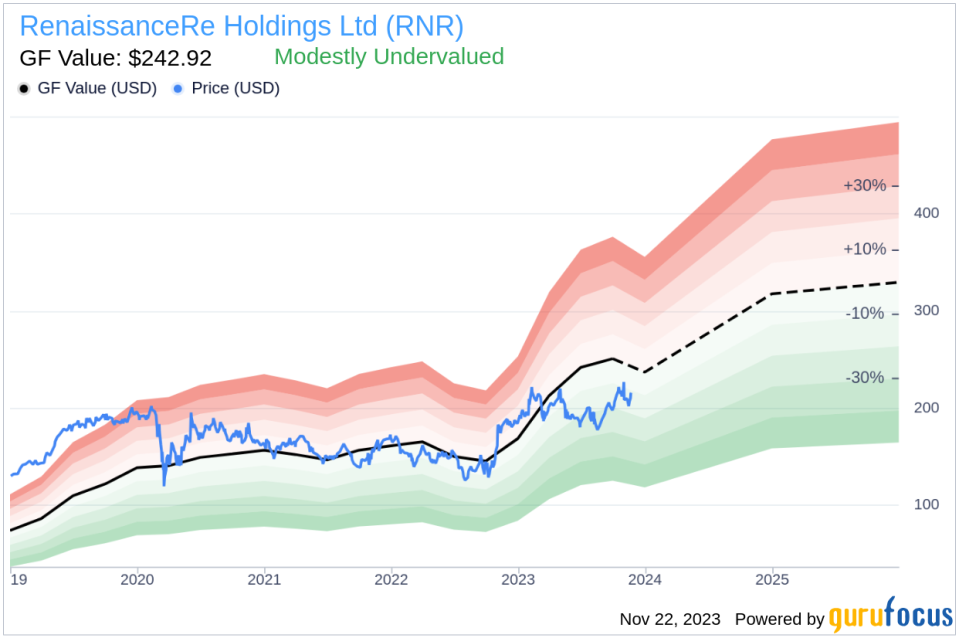

Moreover, with a price of $207.73 and a GuruFocus Value (GF Value) of $242.92, RenaissanceRe Holdings Ltd has a price-to-GF-Value ratio of 0.86. This suggests that the stock is modestly undervalued based on its GF Value.

The GF Value is a proprietary intrinsic value estimate developed by GuruFocus. It is calculated based on historical trading multiples, a GuruFocus adjustment factor reflecting past returns and growth, and future business performance estimates from Morningstar analysts. When a stock trades below its GF Value, it is considered to be undervalued, potentially offering an attractive entry point for investors.

However, it is important to consider that the insider's decision to sell shares does not necessarily reflect a negative outlook on the company's valuation. Insiders may sell shares for various reasons, including personal financial planning, diversification of assets, or other non-company-specific factors.

In the case of RenaissanceRe Holdings Ltd, the modestly undervalued status based on the GF Value, combined with a lower price-earnings ratio compared to the industry, could be seen as a positive sign for potential investors. However, the insider selling trend may raise questions about the insiders' confidence in the company's near-term growth prospects.

Investors should also consider the broader market conditions, the company's recent performance, and any industry-specific challenges when interpreting insider trading activity. It is essential to conduct thorough research and consider multiple factors before making investment decisions based on insider transactions.

In conclusion, the recent sale of shares by EVP David Marra is a noteworthy event for current and potential shareholders of RenaissanceRe Holdings Ltd. While the company appears to be undervalued based on traditional valuation metrics and the GF Value, the insider selling trend may warrant a closer examination of the company's future growth potential and risk factors. As always, investors are encouraged to look beyond insider trading activity and consider a comprehensive analysis of the company's fundamentals, industry trends, and broader economic indicators before making investment decisions.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.