Insider Sell Alert: EVP, GC, and CDO Robert Smith Sells Shares of Pinnacle West Capital Corp (PNW)

In a recent transaction on December 8, 2023, Robert Smith, the Executive Vice President, General Counsel, and Chief Development Officer of Pinnacle West Capital Corp (NYSE:PNW), sold 1,610 shares of the company. This move by a key insider has caught the attention of investors and market analysts, prompting a closer look at the implications of such insider activity.

Who is Robert Smith of Pinnacle West Capital Corp?

Robert Smith holds a significant position within Pinnacle West Capital Corp, serving as the Executive Vice President, General Counsel, and Chief Development Officer. His role encompasses overseeing legal affairs, regulatory compliance, and guiding the company's development strategies. Smith's insider status provides him with a deep understanding of the company's operations and future prospects, making his trading activities particularly noteworthy to investors.

Pinnacle West Capital Corp's Business Description

Pinnacle West Capital Corp is a holding company that, through its subsidiary, Arizona Public Service, provides retail and wholesale electric services to much of the state of Arizona. The company generates, transmits, and distributes electricity using coal, nuclear, gas, oil, and solar resources. With a commitment to sustainability and innovation, Pinnacle West Capital Corp plays a crucial role in the energy sector, particularly in the Southwestern United States.

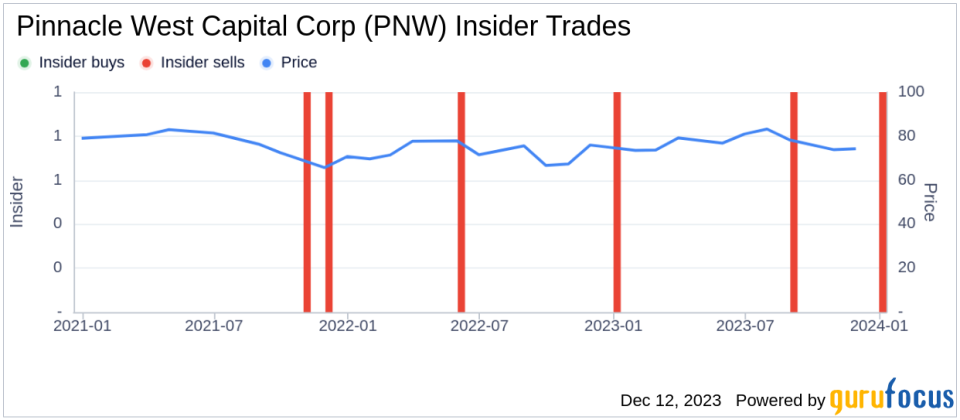

Analysis of Insider Buy/Sell and the Relationship with the Stock Price

The insider transaction history for Pinnacle West Capital Corp reveals a pattern of insider sells over the past year, with Robert Smith's recent sale of 1,610 shares being part of this trend. Over the same period, there have been no insider buys recorded, which could signal a lack of confidence among insiders about the company's short-term growth prospects or simply a rebalancing of personal investment portfolios.

When analyzing the relationship between insider trading activity and stock price, it's important to consider the context of each transaction. Insider sells can sometimes indicate that those with the most intimate knowledge of the company believe the stock may be overvalued or that there may be challenges ahead. However, insiders might also sell shares for personal reasons that have no bearing on their outlook for the company, such as diversifying assets or financing large purchases.

Valuation and Market Reaction

On the day of the insider's recent sale, shares of Pinnacle West Capital Corp were trading at $75.95, giving the company a market cap of $8.451 billion. The price-earnings ratio of 17.75 is higher than the industry median of 14.52, suggesting that the stock may be trading at a premium compared to its peers.However, with a price of $75.95 and a GuruFocus Value of $88.55, Pinnacle West Capital Corp has a price-to-GF-Value ratio of 0.86, indicating that the stock is modestly undervalued based on its GF Value.

The GF Value is a proprietary metric developed by GuruFocus, taking into account historical trading multiples, a GuruFocus adjustment factor based on past returns and growth, and future business performance estimates from analysts. This valuation suggests that despite the insider's decision to sell, the stock may still have room for price appreciation based on its intrinsic value.

Conclusion

The recent insider sell by Robert Smith of Pinnacle West Capital Corp warrants attention from investors and market analysts. While the insider's actions may raise questions about the stock's future performance, the company's current valuation indicates that it may still be an attractive investment opportunity. As always, investors should conduct their own due diligence and consider insider trading as one of many factors in their investment decision-making process.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.