Insider Sell Alert: EVP, Gen Counsel & Secretary Thomas Indelicarto Sells Shares of ...

In the realm of stock market movements, insider trading activity is often a significant indicator that investors keep a close eye on. Recently, Thomas Indelicarto, the Executive Vice President, General Counsel, and Secretary of VeriSign Inc (NASDAQ:VRSN), sold 613 shares of the company on December 5, 2023. This transaction has caught the attention of market watchers and raises questions about the potential implications for VeriSign's stock performance.

Who is Thomas Indelicarto of VeriSign Inc?

Thomas Indelicarto serves as the Executive Vice President, General Counsel, and Secretary of VeriSign Inc. In his role, Indelicarto is responsible for overseeing the legal aspects of the company's operations, including compliance with regulatory requirements and the management of legal risks. His position places him in the upper echelons of the company's executive team, giving him a comprehensive view of VeriSign's strategic direction and operational performance.

VeriSign Inc's Business Description

VeriSign Inc is a global provider of domain name registry services and internet infrastructure, ensuring the security, stability, and resiliency of key internet functions. The company operates a diverse array of network infrastructure, including two of the world's 13 Internet root servers, and is the authoritative registry for the .com, .net, and other top-level domains. VeriSign's services are critical for the operation of the internet, enabling billions of people and devices to connect online with reliability and confidence.

Analysis of Insider Buy/Sell and the Relationship with the Stock Price

The recent sale by Thomas Indelicarto is part of a broader pattern of insider selling at VeriSign Inc. Over the past year, Indelicarto has sold a total of 11,048 shares and has not made any purchases. This trend is consistent with the overall insider transaction history for the company, which shows 0 insider buys and 62 insider sells over the same timeframe.

The relationship between insider selling and stock price can be complex. While insider sales can sometimes signal a lack of confidence in the company's future prospects, they can also be motivated by personal financial planning or diversification needs. In the case of VeriSign, the insider selling has not necessarily been a bearish signal for the stock price. It's important to consider the context of these transactions and the company's overall financial health.

Valuation and Market Cap

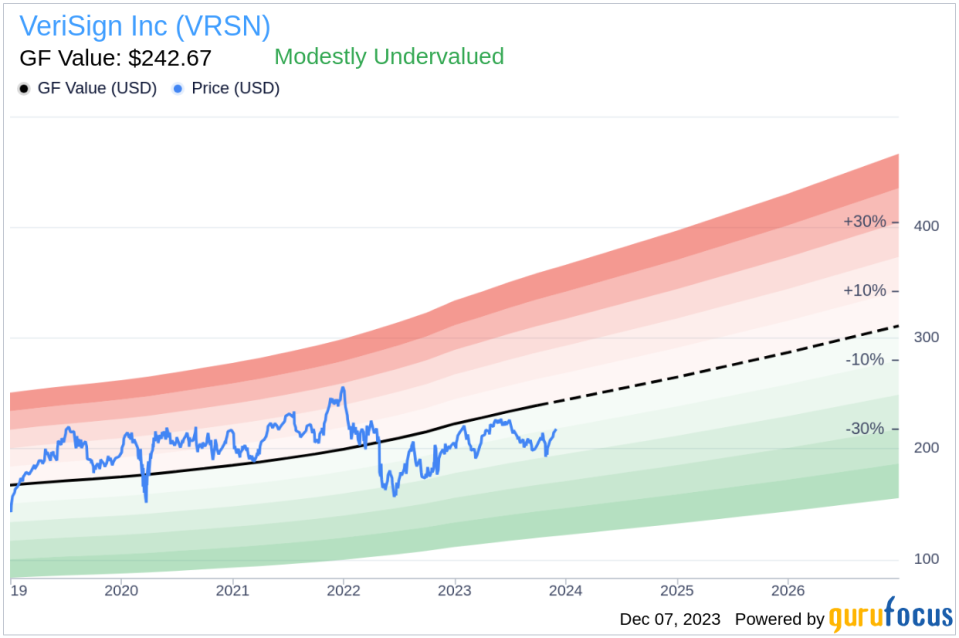

On the day of Indelicarto's recent sale, shares of VeriSign Inc were trading at $218.54, giving the company a market cap of $22.05 billion. The price-earnings ratio of 30.77 is higher than both the industry median of 26.84 and VeriSign's historical median, suggesting a premium valuation compared to its peers and its own past trading multiples.However, when considering the GuruFocus Value (GF Value) of $242.67, VeriSign Inc appears to be modestly undervalued with a price-to-GF-Value ratio of 0.9.

The GF Value is calculated based on historical trading multiples, a GuruFocus adjustment factor, and future business performance estimates. This intrinsic value estimate indicates that, despite the insider selling activity, the stock may still hold value for potential investors.

Conclusion

The insider selling by Thomas Indelicarto at VeriSign Inc is a noteworthy event for investors and analysts. While the pattern of insider sales over the past year could be interpreted in various ways, the current valuation metrics suggest that the stock may still be an attractive investment opportunity. As always, investors should conduct their own due diligence and consider the broader market context when evaluating the implications of insider trading activity.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.