Insider Sell Alert: EVP & GENERAL COUNSEL Paul Mahon Sells 6,000 Shares of United ...

United Therapeutics Corp (NASDAQ:UTHR) has recently witnessed a significant insider sell that has caught the attention of investors and market analysts. Paul Mahon, the company's EVP & General Counsel, sold 6,000 shares of the company on November 16, 2023. This transaction has prompted a closer look into the insider's trading behavior, the company's business operations, and the potential implications for the stock's valuation and performance.

Who is Paul Mahon?

Paul Mahon serves as the Executive Vice President and General Counsel for United Therapeutics Corp, a biotechnology company focused on the development and commercialization of unique products to address the unmet medical needs of patients with chronic and life-threatening conditions. Mahon's role within the company involves overseeing legal affairs, ensuring compliance with regulatory requirements, and providing strategic counsel to the executive team. His actions, particularly in the realm of stock transactions, are closely monitored by investors as they can provide insights into the company's internal perspective on its financial health and future prospects.

United Therapeutics Corp's Business Description

United Therapeutics Corp is a biotechnology firm that specializes in the development of innovative therapies for pulmonary arterial hypertension (PAH) and other orphan diseases. The company's portfolio includes several FDA-approved medications that have significantly improved the quality of life for patients suffering from these severe conditions. United Therapeutics is also known for its commitment to sustainability and its efforts to minimize the environmental impact of its operations and products.

Analysis of Insider Buy/Sell and Relationship with Stock Price

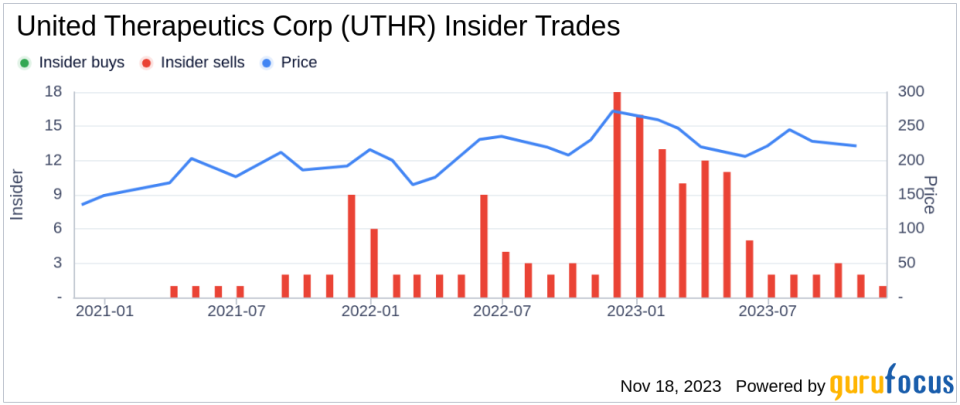

Insider trading activities, such as buys and sells, can provide valuable clues about a company's internal outlook. In the case of United Therapeutics Corp, the insider transaction history over the past year shows a notable absence of insider buys, with a total of 84 insider sells during the same period. This trend could suggest that insiders, including Paul Mahon, may perceive the stock's current price as favorable for liquidation, or it could reflect personal financial management decisions unrelated to the company's performance.

On the day of the insider's recent sell, shares of United Therapeutics Corp were trading at $226.6, giving the company a market cap of $10.758 billion. This price point is particularly interesting when considering the company's valuation metrics.

The price-earnings ratio of 12.61 is significantly lower than the industry median of 30.4 and also below the company's historical median price-earnings ratio. This could indicate that the stock is undervalued compared to its peers and its own historical standards, potentially offering an attractive entry point for value investors.

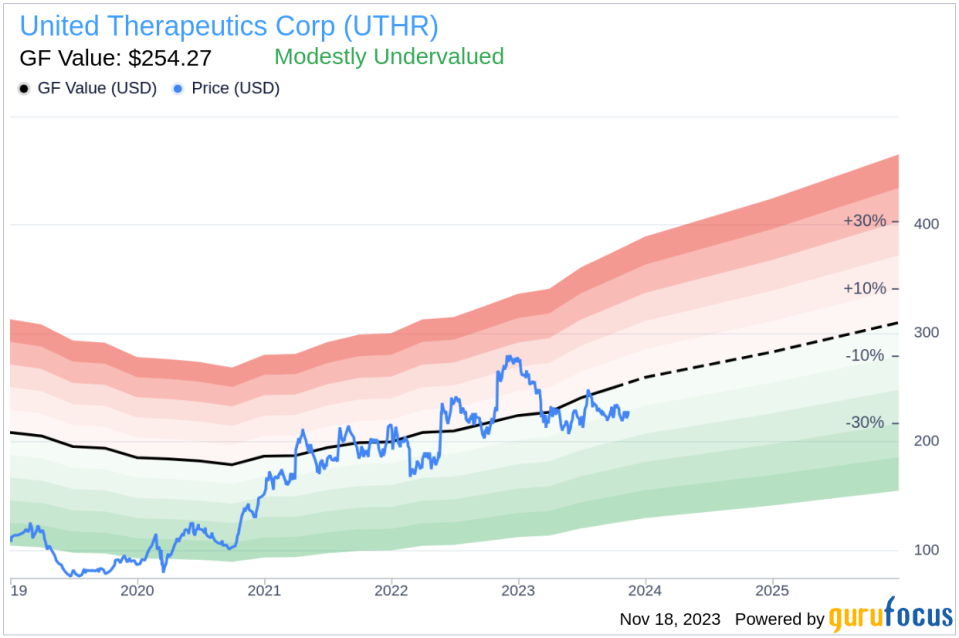

Moreover, with a price of $226.6 and a GuruFocus Value of $254.27, United Therapeutics Corp has a price-to-GF-Value ratio of 0.89. This suggests that the stock is modestly undervalued based on its GF Value, which takes into account historical trading multiples, a GuruFocus adjustment factor, and future business performance estimates from analysts.

However, the insider's decision to sell shares might raise questions among investors about whether there are underlying concerns that are not reflected in these valuation metrics. It is important to note that insider sells can be motivated by a variety of factors, including personal financial planning, diversification of assets, or other non-company related reasons.

The insider trend image above provides a visual representation of the selling pattern, which could be interpreted in different ways. A consistent pattern of insider selling, as seen in the case of United Therapeutics Corp, might be a signal for investors to scrutinize the company's financial health and future growth prospects more closely.

The GF Value image further illustrates the stock's current valuation in relation to its intrinsic value estimate. The modest undervaluation of United Therapeutics Corp, as indicated by the price-to-GF-Value ratio below 1, could be an opportunity for investors who believe in the company's long-term potential and are willing to look beyond the insider selling activity.

Conclusion

The recent insider sell by EVP & General Counsel Paul Mahon has brought United Therapeutics Corp into the spotlight. While the insider's trading activity may raise questions, the company's strong valuation metrics and its position as a leader in the biotechnology space cannot be overlooked. Investors should consider both the insider trading trends and the company's fundamental valuation when making investment decisions. As always, it is recommended to conduct thorough research and consider a diversified investment approach to mitigate risks associated with individual stock movements.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.