Insider Sell Alert: EVP & General Counsel Jennifer Wuamett Sells Shares of NXP Semiconductors NV

In a notable insider transaction, EVP & General Counsel Jennifer Wuamett sold 2,000 shares of NXP Semiconductors NV (NASDAQ:NXPI) on December 1, 2023. This sale has caught the attention of investors and analysts who closely monitor insider activities as an indicator of a company's financial health and future performance. Insider transactions can provide valuable insights into the sentiment of those who know the company best.

Jennifer Wuamett is a key figure at NXP Semiconductors NV, serving as the company's Executive Vice President and General Counsel. Her role involves overseeing the legal aspects of the company's operations, including compliance, intellectual property, and corporate governance. Wuamett's position within the company grants her a deep understanding of NXP's business strategy and market positioning, making her trading activities particularly noteworthy to investors.

NXP Semiconductors NV is a leading global semiconductor company operating in over 30 countries. The company provides high-performance mixed-signal and standard product solutions that leverage its leading RF, analog, power management, interface, security, and digital processing expertise. These products are used in a wide range of automotive, industrial, IoT, mobile, and communication infrastructure applications. NXP's commitment to innovation and quality has positioned it as a key player in the semiconductor industry.

Over the past year, Jennifer Wuamett has sold a total of 28,394 shares and has not made any purchases. This pattern of selling without corresponding buys could be interpreted in various ways, but it is essential to consider the context of these transactions and the overall insider trading trends at NXP Semiconductors NV.

Insider Trends

The insider transaction history for NXP Semiconductors NV shows a pattern of more insider sells than buys over the past year, with 1 insider buy and 7 insider sells. This trend can suggest that insiders might believe the shares are fully valued or may be taking profits after a period of stock appreciation.

Valuation

On the day of the insider's recent sale, shares of NXP Semiconductors NV were trading at $204, giving the company a market cap of $53.174 billion. The price-earnings ratio of 19.12 is lower than the industry median of 26.46 and also below the company's historical median price-earnings ratio. This valuation suggests that the stock may be undervalued compared to its peers and its own historical standards.

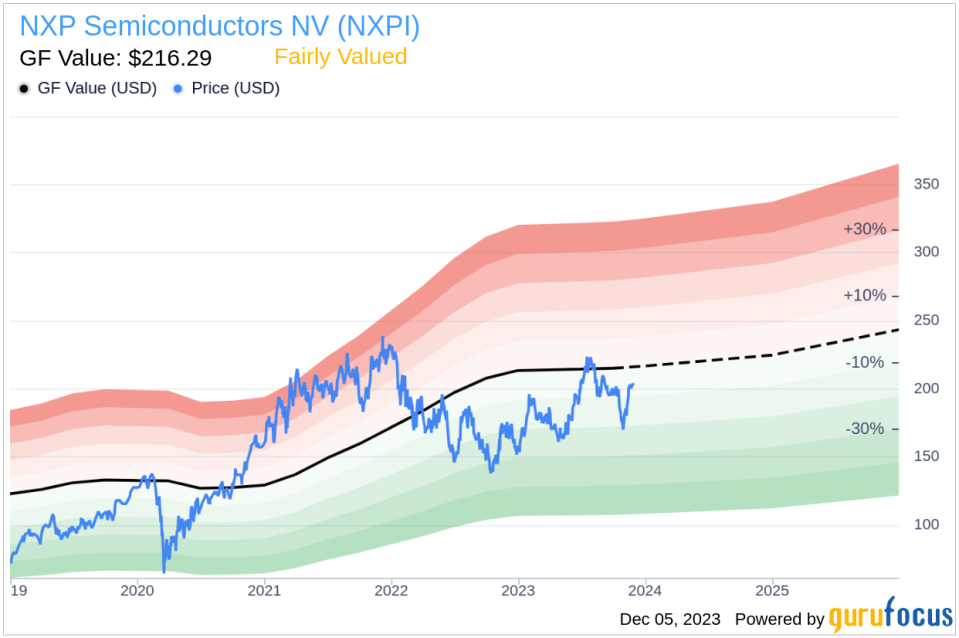

With the current price of $204 and a GuruFocus Value of $216.29, NXP Semiconductors NV has a price-to-GF-Value ratio of 0.94, indicating that the stock is Fairly Valued based on its GF Value.

The GF Value is an intrinsic value estimate that takes into account historical trading multiples, a GuruFocus adjustment factor based on past returns and growth, and future business performance estimates from Morningstar analysts. This comprehensive approach to valuation provides a benchmark for investors to assess whether a stock is trading at a fair price.

The relationship between insider trading activities and stock price can be complex. While insider selling does not always indicate a lack of confidence in the company, it can sometimes precede a downturn in the stock price. Conversely, insiders might sell shares for reasons unrelated to their outlook on the company, such as personal financial planning or diversifying their investments.

In the case of Jennifer Wuamett's recent sale, it is important to consider the broader context of the company's performance and market conditions. NXP Semiconductors NV has been performing well, with a solid position in the semiconductor industry and a fair valuation according to the GF Value. The insider's decision to sell a portion of their holdings may not necessarily reflect a negative outlook but could be a part of regular portfolio management.

Investors should also consider the overall market sentiment and economic factors that could influence the stock's performance. The semiconductor industry is known for its cyclical nature, and any shifts in demand or supply chain dynamics can impact stock prices. Additionally, macroeconomic factors such as interest rates, inflation, and global trade tensions can affect investor sentiment and the valuation of technology stocks.

In conclusion, while insider sells like the one executed by Jennifer Wuamett can provide valuable information, they should be analyzed in conjunction with other financial data and market indicators. Investors should conduct their due diligence and consider a range of factors before making investment decisions based on insider trading activities.

It is always recommended to look at the full picture of a company's financial health, future growth prospects, and industry trends when evaluating the implications of insider transactions. For NXP Semiconductors NV, the current valuation and market position suggest a stable outlook, and the insider sell activity may not necessarily detract from the company's investment appeal.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.