Insider Sell Alert: EVP Hemant Porwal Sells 13,000 Shares of WESCO International Inc

WESCO International Inc (NYSE:WCC), a leading provider of business-to-business distribution, logistics services, and supply chain solutions, has recently witnessed a significant insider sell that has caught the attention of investors and market analysts. Hemant Porwal, the Executive Vice President of Supply Chain & Operations at WESCO International Inc, sold 13,000 shares of the company on November 29, 2023. This transaction has prompted a closer look into the insider's trading behavior, the company's business operations, and the potential implications for the stock's valuation and performance.Who is Hemant Porwal of WESCO International Inc?Hemant Porwal is a seasoned executive with extensive experience in supply chain management and operations. As the EVP of Supply Chain & Operations at WESCO International Inc, Porwal plays a critical role in overseeing the company's logistics, procurement, and operational strategies. His decisions and leadership directly impact the efficiency and effectiveness of WESCO's supply chain, which is central to the company's success in serving its customers across various industries.WESCO International Inc's Business DescriptionWESCO International Inc is a global leader in the distribution of electrical, industrial, and communications maintenance, repair, and operating (MRO) products, construction materials, and advanced supply chain management and logistics services. The company serves a diverse customer base, including commercial and industrial businesses, contractors, government agencies, institutions, telecommunications providers, and utilities. WESCO operates through a network of branches and distribution centers, offering a broad range of products and services that enable it to be a one-stop-shop for its customers' needs.Analysis of Insider Buy/Sell and the Relationship with the Stock PriceThe recent sale of 13,000 shares by EVP Hemant Porwal is part of a broader pattern of insider selling at WESCO International Inc. Over the past year, Porwal has sold a total of 13,000 shares and has not made any purchases. This could be interpreted in several ways by investors. On one hand, insider selling can sometimes signal a lack of confidence in the company's future prospects or a belief that the stock is overvalued. On the other hand, insiders may sell shares for personal reasons that have nothing to do with their outlook on the company, such as diversifying their investments or financing personal expenditures.

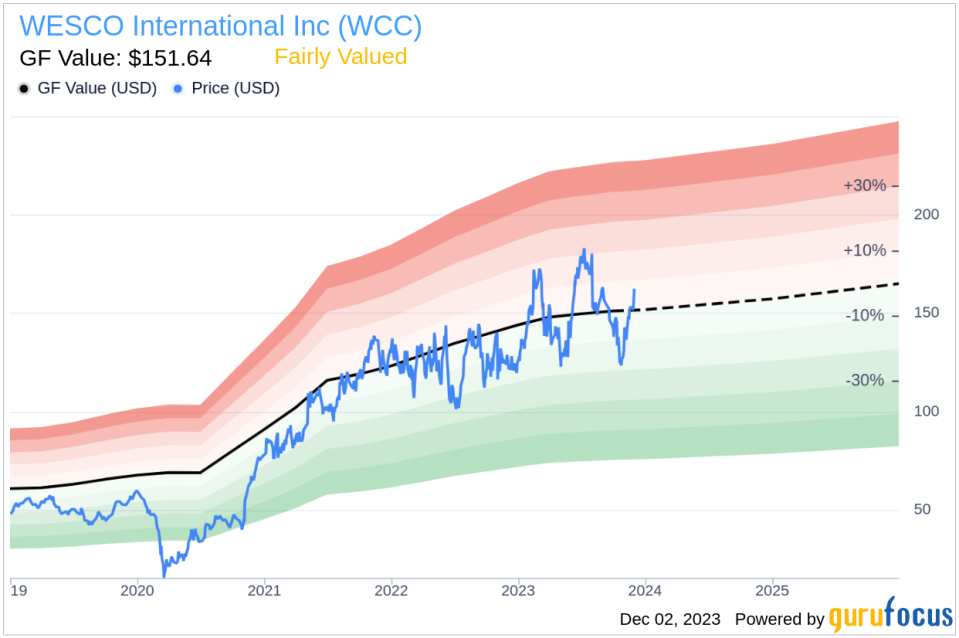

The insider transaction history for WESCO International Inc shows a trend of more insider selling than buying over the past year, with 8 insider sells and 0 insider buys. This trend could suggest that insiders, on the whole, are choosing to realize gains or redistribute their personal portfolios rather than increase their stakes in the company.Valuation and Market ReactionOn the day of Porwal's recent sale, shares of WESCO International Inc were trading at $154.12, giving the company a market cap of $8.299 billion. The price-earnings ratio of 10.84 is lower than both the industry median of 12.33 and the company's historical median, indicating that the stock may be undervalued compared to its peers and its own historical standards.With a price of $154.12 and a GuruFocus Value of $151.64, WESCO International Inc has a price-to-GF-Value ratio of 1.02, suggesting that the stock is Fairly Valued based on its GF Value. The GF Value is a proprietary intrinsic value estimate developed by GuruFocus, which takes into account historical trading multiples, a GuruFocus adjustment factor, and future business performance estimates from analysts.

The stock's current valuation and the insider selling trend may raise questions among investors about whether the current stock price fully reflects the company's future growth prospects and whether the insider's sell decision is based on an expectation of a price correction or plateau.ConclusionThe sale of 13,000 shares by EVP Hemant Porwal is a notable event for WESCO International Inc and its investors. While the insider's actions may not necessarily predict the future movement of the stock, they do provide valuable information for investors considering the company's valuation and stock performance. As with any insider transaction, it is important for investors to consider the broader context, including the company's financial health, market position, and growth potential, when making investment decisions.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.