Insider Sell Alert: EVP Human Resources Christopher Jensen Sells 7,000 Shares of NXP ...

In a notable insider transaction, Christopher Jensen, the Executive Vice President of Human Resources at NXP Semiconductors NV, sold 7,000 shares of the company on December 12, 2023. This sale has caught the attention of investors and analysts alike, as insider transactions can often provide valuable insights into a company's prospects.

Who is Christopher Jensen of NXP Semiconductors NV?

Christopher Jensen is a seasoned executive with extensive experience in human resources and organizational development. At NXP Semiconductors NV, Jensen is responsible for overseeing the company's global human resources strategy, talent management, and leadership development. His role is crucial in shaping the company's culture and ensuring that it attracts, develops, and retains top talent in the competitive semiconductor industry.

NXP Semiconductors NV's Business Description

NXP Semiconductors NV is a leading global semiconductor company that provides high-performance mixed-signal and standard product solutions. These solutions are used in a wide range of automotive, industrial, IoT, mobile, and communication infrastructure applications. The company's product portfolio includes microcontrollers, processors, power management chips, sensors, and connectivity solutions, all of which are essential components in the modern electronic devices and systems that define our digital world.

Analysis of Insider Buy/Sell and the Relationship with the Stock Price

Insider transactions, particularly those involving high-level executives, can be a strong indicator of a company's internal perspective on its stock's value. In the case of Christopher Jensen's recent sale of 7,000 shares, it is important to analyze the context and potential implications for NXP Semiconductors NV's stock price.

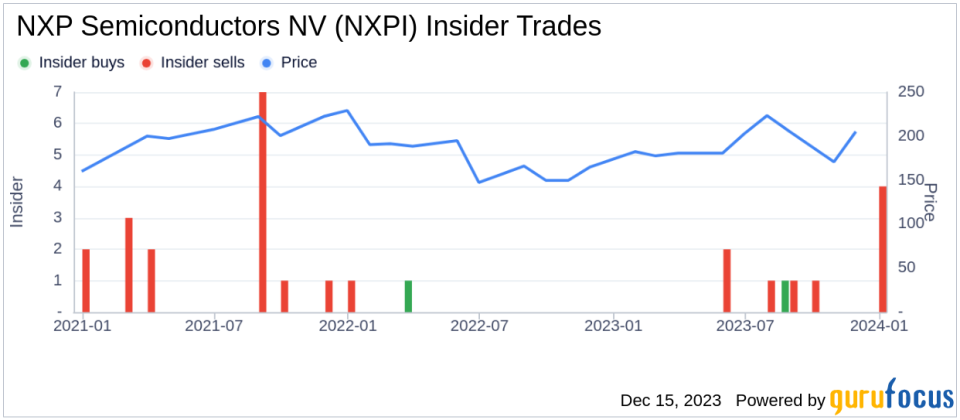

The insider trend image above shows that over the past year, there has been a predominance of insider selling at NXP Semiconductors NV, with 10 insider sells and only 1 insider buy. This could suggest that insiders, including Jensen, may believe that the stock is currently valued appropriately or may even be overvalued, prompting them to lock in profits.However, it is also essential to consider the size and frequency of these transactions. Jensen's sale of 7,000 shares is just a fraction of the total insider sales over the past year, which amounts to 16,696 shares sold by him alone. This pattern of selling could be part of a planned trading program or related to personal financial planning rather than a bearish signal on the company's prospects.

Valuation and Market Reaction

On the day of Jensen's sale, NXP Semiconductors NV's shares were trading at $221, giving the company a market cap of $60.927 billion. The price-earnings ratio of 21.91 is lower than both the industry median and the company's historical median, suggesting that the stock may be undervalued compared to its peers and its own past performance.

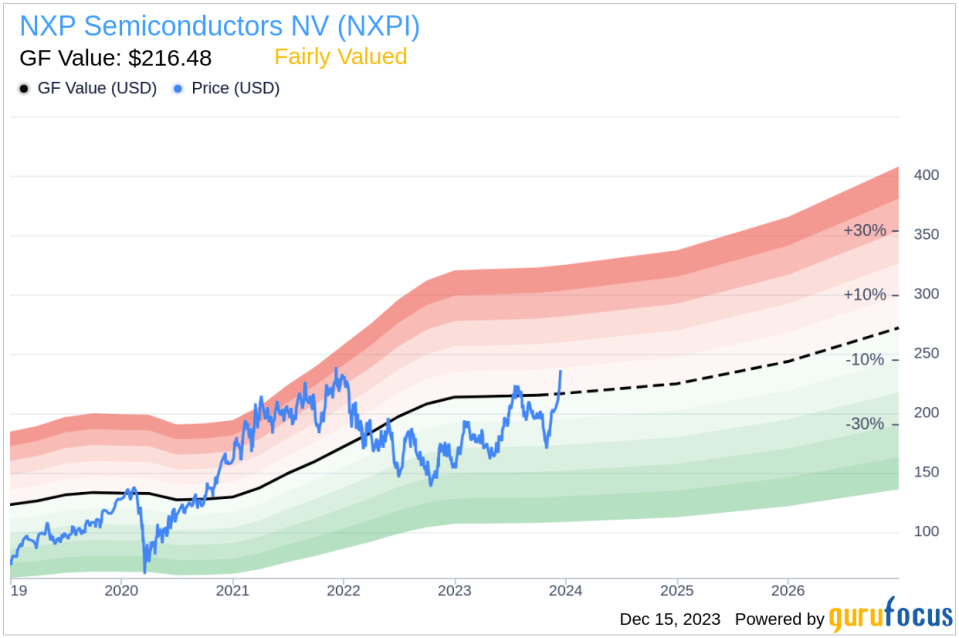

The GF Value image indicates that with a price of $221 and a GuruFocus Value of $216.48, NXP Semiconductors NV is considered Fairly Valued with a price-to-GF-Value ratio of 1.02. This assessment is based on historical trading multiples, a GuruFocus adjustment factor, and future business performance estimates.The stock's valuation near its GF Value suggests that the market has efficiently priced in the company's fundamentals and growth prospects. Jensen's decision to sell at this price point could be interpreted as a belief that the stock is not likely to see significant appreciation in the near term, aligning with the GF Value assessment.

Conclusion

Christopher Jensen's recent insider sale at NXP Semiconductors NV provides an opportunity for investors to consider the implications of such transactions. While insider selling can sometimes raise concerns about a company's future prospects, it is important to analyze the broader context, including the company's valuation, industry position, and historical trading patterns.Given the current Fairly Valued status of NXP Semiconductors NV and the ongoing insider selling trend, investors should monitor the company's performance and any further insider transactions closely. These insights can help inform investment decisions and provide a clearer picture of the company's internal sentiment towards its stock valuation.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.