Insider Sell Alert: EVP Johanna Roberts Sells Shares of Penumbra Inc

In the intricate dance of the stock market, insider transactions often attract the attention of investors seeking clues about a company's future performance. A recent transaction by Johanna Roberts, the Executive Vice President, General Counsel, and Secretary of Penumbra Inc, has become the focal point for such analysis. On November 14, 2023, the insider sold 600 shares of Penumbra Inc (NYSE:PEN), a move that prompts a closer examination of the insider's trading patterns and the company's valuation.

Who is Johanna Roberts of Penumbra Inc?

Johanna Roberts serves as the Executive Vice President, General Counsel, and Secretary of Penumbra Inc. In her role, Roberts is responsible for overseeing the legal aspects of the company's operations, ensuring compliance with regulatory requirements, and providing legal guidance to the executive team. Her position places her in the inner circle of decision-makers, giving her a unique perspective on the company's strategic direction and operational health.

Penumbra Inc's Business Description

Penumbra Inc is a global healthcare company that designs, develops, manufactures, and markets innovative medical devices. The company is known for its cutting-edge technology in the fields of neuro and peripheral vascular diseases. Penumbra's product portfolio includes devices for stroke and aneurysm treatment, thrombectomy procedures, and embolization therapies for peripheral conditions. With a commitment to improving patient outcomes, Penumbra continues to push the boundaries of medical device technology.

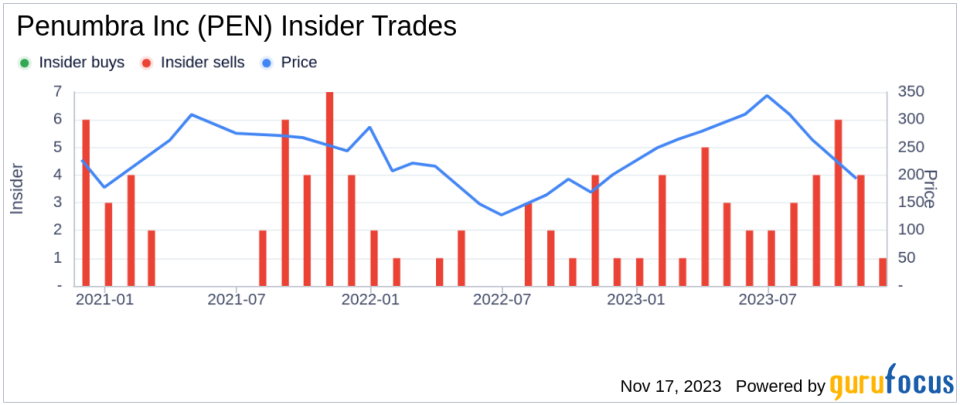

Analysis of Insider Buy/Sell and the Relationship with the Stock Price

The insider's recent sale of 600 shares is part of a broader pattern observed over the past year. Johanna Roberts has sold a total of 6,900 shares and has not made any purchases. This one-sided transaction history could signal a lack of confidence in the company's short-term growth prospects or simply a personal financial decision by the insider.The insider transaction history for Penumbra Inc shows a notable absence of insider buys over the past year, with 36 insider sells recorded during the same period. This trend may raise questions among investors about the insiders' collective outlook on the company's valuation and future performance.

On the day of the insider's recent sale, shares of Penumbra Inc were trading at $214.14, giving the company a market cap of $8.812 billion. The price-earnings ratio stands at 221.68, significantly higher than the industry median of 28.86. This elevated ratio suggests that the market has high expectations for the company's earnings growth, despite it being lower than the company's historical median price-earnings ratio.

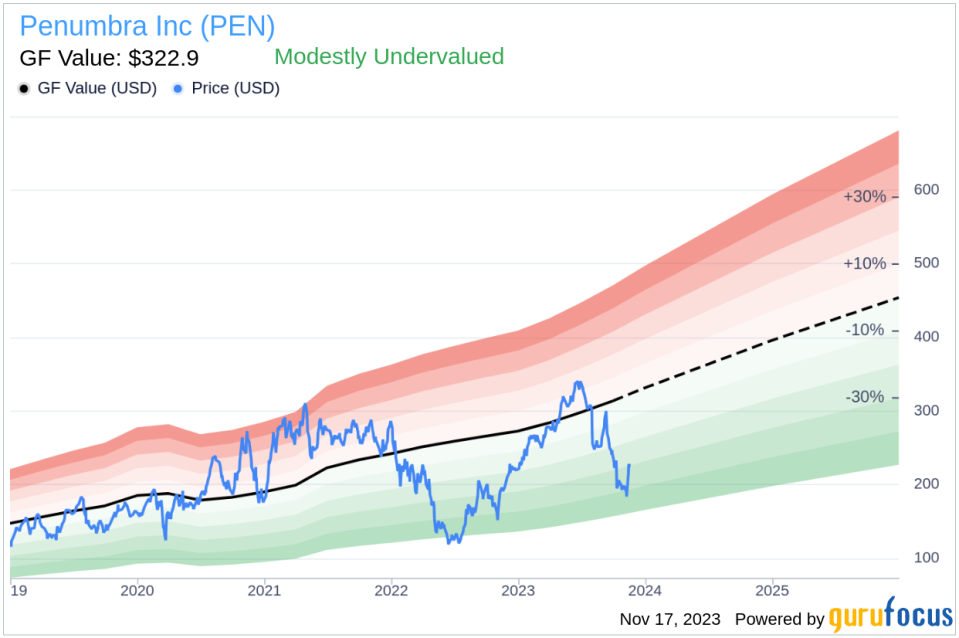

Valuation and GF Value Analysis

The GF Value, an intrinsic value estimate developed by GuruFocus, places Penumbra Inc's value at $322.90 per share. With the stock trading at $214.14, the price-to-GF-Value ratio is 0.66, indicating that the stock is modestly undervalued. This discrepancy between the market price and the GF Value could imply that the stock has room to grow, making it an attractive buy for value investors.

The GF Value is calculated considering historical trading multiples, a GuruFocus adjustment factor based on past returns and growth, and future business performance estimates from Morningstar analysts. The current valuation suggests that the market may not be fully recognizing Penumbra Inc's growth potential or the strength of its business model.

Conclusion

The insider sell activity by Johanna Roberts, coupled with the broader trend of insider sells at Penumbra Inc, may initially appear bearish. However, when juxtaposed with the company's modestly undervalued GF Value, the narrative becomes more nuanced. Investors must weigh the insider's actions against the company's strong valuation metrics and the potential for future growth.As with any insider transaction, it is crucial to consider the broader context, including the company's financial health, market position, and industry trends. While insider sells can provide valuable insights, they are just one piece of the puzzle in the complex decision-making process of investing.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.