Insider Sell Alert: EVP Jonathan Gottsegen Trades Shares of BrightView Holdings Inc

BrightView Holdings Inc (NYSE:BV), a leading name in commercial landscaping services, has recently witnessed a significant insider transaction. Jonathan Gottsegen, the company's Executive Vice President, Chief Legal Officer, and Corporate Secretary, sold a substantial number of shares, raising questions about the insider's sentiment towards the company's future performance. This article delves into the details of the transaction, provides an overview of Jonathan Gottsegen's role at BrightView Holdings Inc, and analyzes the potential implications of this insider activity on the stock's valuation and market perception.

Who is Jonathan Gottsegen?

Jonathan Gottsegen serves as the Executive Vice President, Chief Legal Officer, and Corporate Secretary of BrightView Holdings Inc. In his role, Gottsegen oversees the company's legal affairs, ensuring compliance with regulatory requirements and guiding corporate governance. His position places him in the inner circle of decision-makers, with a clear view of the company's strategic direction and operational performance. Gottsegen's actions in the stock market, therefore, are closely monitored by investors as they may reflect his confidence in the company's future prospects.

BrightView Holdings Inc's Business Description

BrightView Holdings Inc is a premier provider of commercial landscaping services across the United States. The company offers a comprehensive suite of services, including landscape maintenance, design, development, snow and ice management, and tree care. With a focus on sustainability and innovation, BrightView caters to a diverse clientele ranging from corporate campuses to homeowner associations. The company's commitment to excellence and customer satisfaction has positioned it as a leader in the landscaping industry.

Analysis of Insider Buy/Sell and Relationship with Stock Price

On November 20, 2023, Jonathan Gottsegen sold 59,403 shares of BrightView Holdings Inc. This transaction is particularly noteworthy as it represents a significant reduction in Gottsegen's stake in the company. Over the past year, the insider has sold a total of 59,403 shares and has not made any purchases. This one-sided activity may suggest a bearish outlook from the insider, potentially due to personal financial planning or a belief that the stock may be overvalued at current levels.

The relationship between insider transactions and stock prices is often complex. While insider selling can sometimes be interpreted as a lack of confidence in the company's future, it is essential to consider the context. Insiders may sell shares for various reasons unrelated to their outlook on the company, such as diversifying their investment portfolio, tax planning, or personal financial needs. Therefore, while insider sales can serve as a piece of the puzzle, they should not be the sole basis for investment decisions.

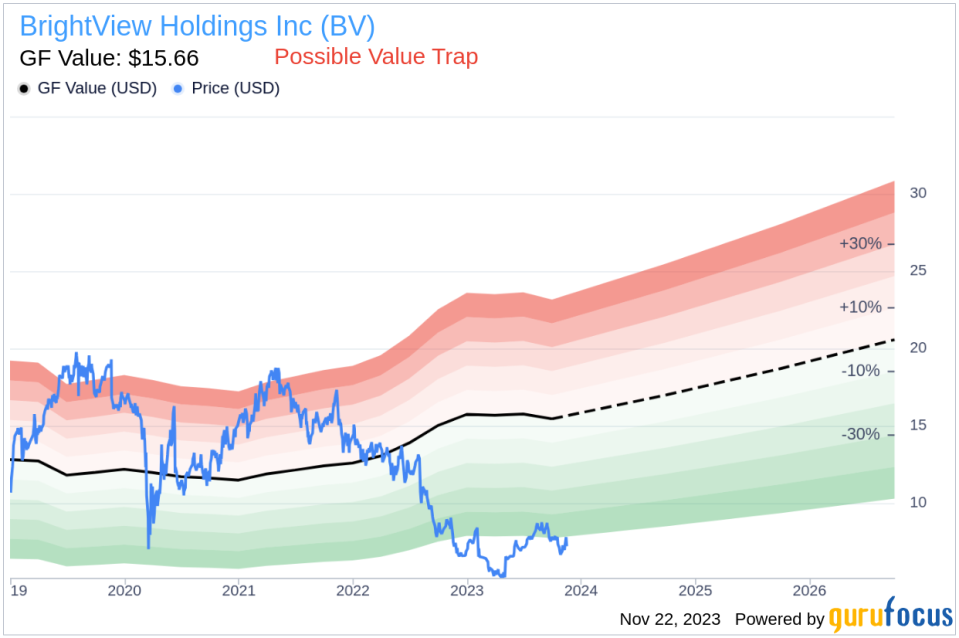

At the time of the insider's recent sale, shares of BrightView Holdings Inc were trading at $7.34, giving the company a market cap of $685.62 million. This valuation places the stock below the GuruFocus Value (GF Value) of $15.66, indicating that the stock may be undervalued. The price-to-GF-Value ratio stands at 0.47, suggesting that the stock could be a possible value trap and warrants caution before investing.

The GF Value is a proprietary metric developed by GuruFocus, which factors in historical trading multiples, a GuruFocus adjustment factor based on past returns and growth, and future business performance estimates from analysts. While the current price-to-GF-Value ratio points to a potential undervaluation, investors should conduct thorough due diligence, considering the insider's recent sell-off and other fundamental aspects of the company.

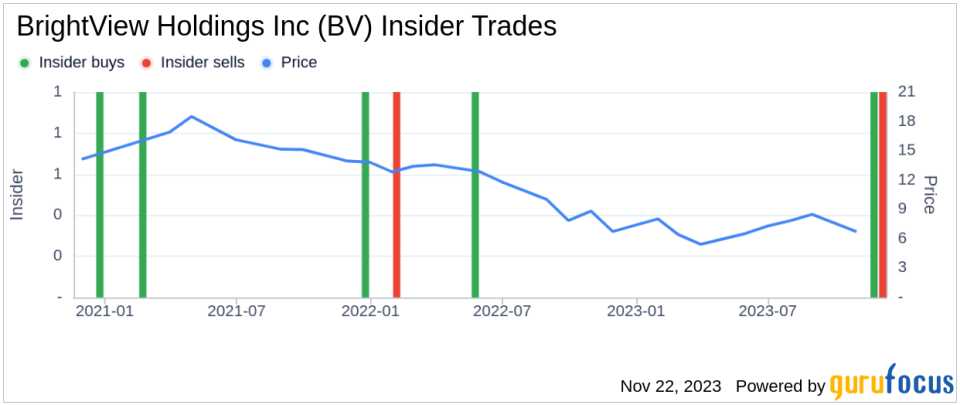

The insider trend image above illustrates the recent insider transactions at BrightView Holdings Inc. With only one insider buy and one insider sell over the past year, the activity does not present a clear trend. However, the size of the recent sell by Jonathan Gottsegen may raise eyebrows among investors and analysts, prompting a closer examination of the company's financial health and growth prospects.

The GF Value image provides a visual representation of the stock's valuation relative to its intrinsic value estimate. The current market price's significant discount to the GF Value could attract value investors looking for potential bargains. However, the insider's decision to sell a large number of shares may temper enthusiasm, as it could be seen as a signal that the stock's upside potential is limited, or that there are unaddressed risks that the market has not fully priced in.

Conclusion

In conclusion, the recent insider sell transaction by Jonathan Gottsegen at BrightView Holdings Inc is a development that warrants attention. While the stock appears undervalued based on the GF Value, the insider's decision to sell a considerable number of shares introduces an element of caution. Investors should weigh the potential value opportunity against the insider's sentiment and other fundamental factors before making investment decisions. As always, a balanced approach that considers multiple data points will likely yield the most informed and strategic investment choices.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.