Insider Sell Alert: EVP Julie D'Emilio Sells Shares of Carter's Inc

In the intricate dance of the stock market, insider transactions often attract the attention of investors seeking clues about a company's future performance. A recent transaction that has caught the eye of the market is the sale of shares by Julie D'Emilio, Executive Vice President of Sales at Carter's Inc (NYSE:CRI). On December 8, 2023, the insider sold 3,400 shares of the company, a move that prompts a closer examination of the context and implications.

Who is Julie D'Emilio?

Julie D'Emilio serves as the Executive Vice President of Sales at Carter's Inc, a prominent player in the children's apparel industry. With a career that spans various leadership roles, D'Emilio's expertise in sales strategy and market expansion is integral to Carter's growth and market presence. Her decisions, including stock transactions, are closely watched for insights into the company's internal perspective.

Carter's Inc: A Brief Business Description

Carter's Inc is a storied name in the children's apparel sector, known for its quality clothing, gifts, and accessories. The company boasts a rich history dating back to 1865 and has since grown into a leading brand in the American market. With a diverse portfolio that includes names like Carter's, OshKosh B'gosh, and Skip Hop, the company caters to a wide range of consumer needs, from newborns to young children.

Insider Buy/Sell Analysis and Stock Price Relationship

The recent sale by Julie D'Emilio is part of a broader pattern observed over the past year. D'Emilio has sold a total of 8,400 shares and has not made any purchases. This one-sided transaction history could signal various things, from personal financial planning to a less optimistic outlook on the company's short-term stock performance.When analyzing insider transactions, it's crucial to consider the broader insider trend. Over the past year, Carter's Inc has seen 10 insider sells and no insider buys. This trend might raise eyebrows among investors, as insider sells without corresponding buys could suggest that those with the most intimate knowledge of the company see limited upside potential in the near term.

Valuation and Market Reaction

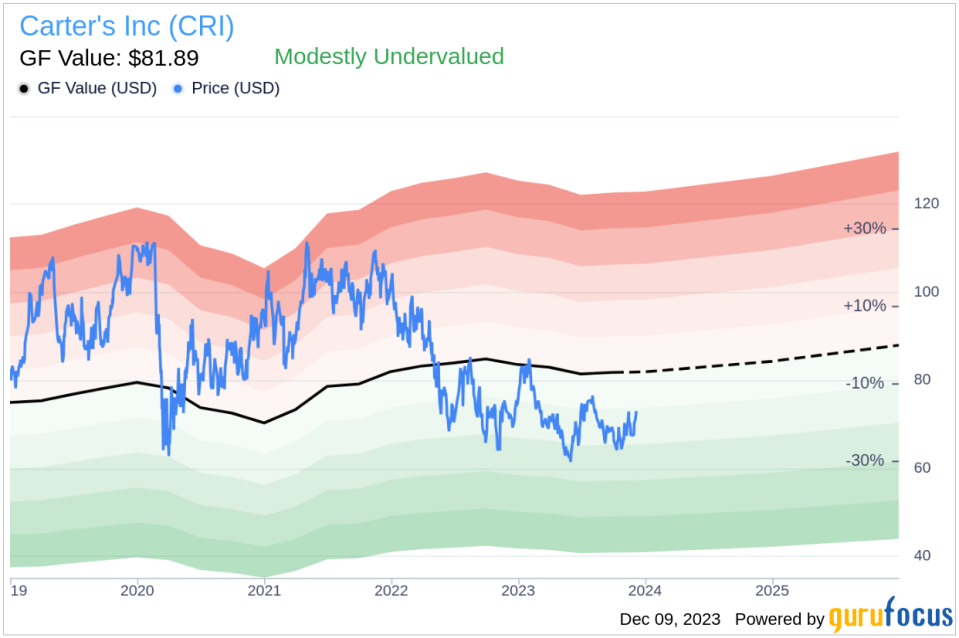

On the day of D'Emilio's sale, Carter's Inc shares were trading at $72.5, giving the company a market cap of $2.676 billion. The price-earnings ratio stood at 13.26, below both the industry median of 17.39 and the company's historical median. This lower valuation could indicate that the stock is undervalued compared to its peers and historical performance.However, the GF Value paints a more nuanced picture. With a price of $72.5 and a GuruFocus Value of $81.89, Carter's Inc has a price-to-GF-Value ratio of 0.89, suggesting that the stock is modestly undervalued. The GF Value is a composite measure that considers historical trading multiples, a GuruFocus adjustment factor based on past returns and growth, and future business performance estimates from analysts.

Interpreting the Insider's Move

The insider's decision to sell shares could be influenced by the stock's current valuation, suggesting that D'Emilio believes the shares might not appreciate significantly in the near future. Alternatively, the sale could be part of a pre-planned diversification or liquidity strategy unrelated to her outlook on the company's prospects.

Investor Considerations

Investors should weigh insider trends alongside other fundamental and technical analyses. While insider sells can be a red flag, they are not definitive indicators of a stock's trajectory. The modest undervaluation based on the GF Value suggests that Carter's Inc may still have room for growth, especially if the company can capitalize on its strong brand presence and adapt to the evolving retail landscape.In conclusion, Julie D'Emilio's recent sale of Carter's Inc shares is a development worth noting, but it should be considered as part of a broader investment analysis. With a market cap of $2.676 billion and a modest undervaluation, Carter's Inc presents an interesting case for investors looking for opportunities in the children's apparel market. As always, a balanced approach that considers multiple factors will serve investors best in making informed decisions.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.