Insider Sell Alert: EVP Michael Halstead Sells 50,000 Shares of Intra-Cellular Therapies Inc (ITCI)

In a notable insider transaction, Executive Vice President and General Counsel Michael Halstead has parted with 50,000 shares of Intra-Cellular Therapies Inc (NASDAQ:ITCI), a significant move that has caught the attention of investors and market analysts. This sale, executed on November 13, 2023, has raised questions about the insider's confidence in the company's future prospects and the potential implications for the stock's performance.

Who is Michael Halstead?

Michael Halstead serves as the Executive Vice President and General Counsel of Intra-Cellular Therapies Inc, a biopharmaceutical company engaged in the development of novel drugs aimed at treating neuropsychiatric and neurological disorders. Halstead, with his extensive experience in the legal and regulatory aspects of the pharmaceutical industry, plays a crucial role in guiding the company through the complex landscape of drug development and commercialization.

About Intra-Cellular Therapies Inc

Intra-Cellular Therapies Inc is a biopharmaceutical company that specializes in creating and commercializing innovative treatments for patients with complex psychiatric and neurologic diseases. The company is known for its commitment to addressing unmet medical needs by developing a pipeline of novel drugs. Their focus on leveraging science to enhance the lives of patients has positioned them as a notable player in the biopharmaceutical sector.

Analysis of Insider Buy/Sell and Relationship with Stock Price

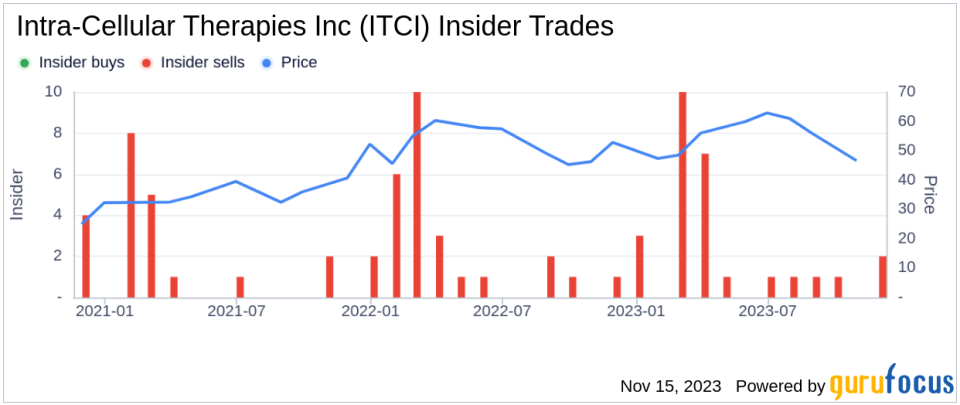

Insider transactions, particularly sales, can provide valuable insights into a company's internal perspective on its stock's value and future performance. In the case of Intra-Cellular Therapies Inc, the insider transaction history over the past year shows a lack of insider purchases, with zero buys recorded. On the other hand, there have been 27 insider sells during the same period, suggesting that insiders may perceive the stock's current price as being on the higher end of its value spectrum or may have other reasons for liquidating their holdings.

Michael Halstead's recent sale of 50,000 shares is part of a larger pattern of insider selling. Over the past year, the insider has sold a total of 143,097 shares and has not made any purchases. This consistent selling activity could be interpreted as a lack of confidence in the company's short-term growth potential or simply a personal financial decision by the insider.

On the day of the insider's recent sale, shares of Intra-Cellular Therapies Inc were trading at $53.9, giving the company a market cap of $5.456 billion. This valuation places the company among the mid-cap biopharmaceutical firms, a segment known for its volatility and high growth potential.

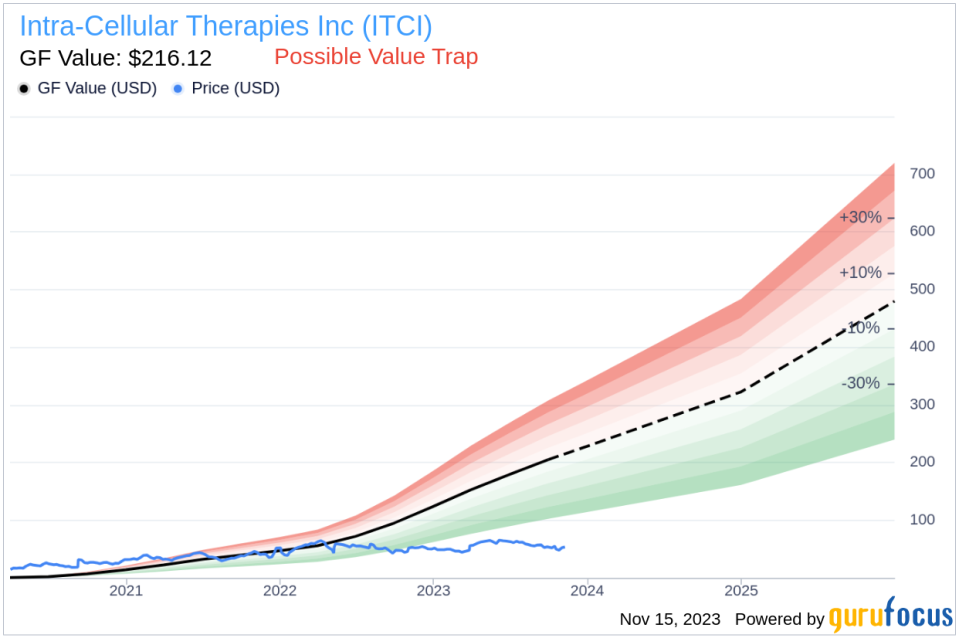

However, when considering the price-to-GF-Value ratio, which stands at 0.25, the stock appears to be a Possible Value Trap, Think Twice, according to GuruFocus's valuation metrics. This suggests that despite the stock's current price, investors should exercise caution as the low ratio may indicate that the stock is undervalued for a reason, such as fundamental issues within the company or industry challenges.

The GF Value, an intrinsic value estimate, takes into account historical trading multiples, a GuruFocus adjustment factor based on past performance, and future business performance estimates from analysts. With a GF Value of $216.12 and a current trading price of $53.9, the discrepancy is significant, warranting a closer examination of the company's fundamentals and growth prospects.

The insider trend image above illustrates the recent selling activity by insiders, which could be a red flag for potential investors. A consistent pattern of insider selling may indicate that those with the most intimate knowledge of the company's operations and outlook are choosing to reduce their stake, which could be perceived as a lack of confidence in the stock's future appreciation.

The GF Value image provides a visual representation of the stock's valuation relative to its intrinsic value as calculated by GuruFocus. The significant gap between the current stock price and the GF Value suggests that the market may be undervaluing the company, or there may be underlying factors that justify the lower price.

Conclusion

Michael Halstead's recent sale of 50,000 shares of Intra-Cellular Therapies Inc is a transaction that warrants attention from investors. While insider selling is not uncommon, the pattern of sales without corresponding buys over the past year could suggest a cautious or bearish outlook from those within the company. Coupled with the stock's low price-to-GF-Value ratio, investors should carefully consider the potential risks and rewards associated with investing in Intra-Cellular Therapies Inc. As always, a thorough analysis of the company's financials, market position, and growth prospects is essential before making any investment decisions.

It is important to note that insider transactions are just one piece of the puzzle when evaluating a stock's potential. Other factors, such as market trends, competitive landscape, and overall economic conditions, also play a critical role in determining a stock's future performance. Therefore, investors should use insider trading information as a supplement to a comprehensive investment strategy.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.