Insider Sell Alert: EVP Operations & COO Kip Ellis Sells 8,000 Shares of Patrick Industries ...

In a notable insider transaction, Kip Ellis, the Executive Vice President of Operations and Chief Operating Officer of Patrick Industries Inc (NASDAQ:PATK), sold 8,000 shares of the company's stock on December 14, 2023. This move has caught the attention of investors and market analysts, prompting a closer look at the implications of such insider activity.

Who is Kip Ellis of Patrick Industries Inc?

Kip Ellis has been an integral part of Patrick Industries, serving as the EVP of Operations and COO. His role involves overseeing the operational aspects of the company, ensuring that Patrick Industries' manufacturing and service processes run smoothly and efficiently. Ellis's insights into the company's operations give him a unique perspective on its performance and prospects, making his trading activities particularly noteworthy for investors.

Patrick Industries Inc's Business Description

Patrick Industries Inc is a prominent manufacturer and distributor of building products and materials for the recreational vehicle, manufactured housing, and marine industries, among others. The company's product range includes decorative vinyl and paper laminated panels, countertops, wrapped profile mouldings, cabinet doors and components, hardwood furniture, fiberglass bath fixtures, and more. Patrick Industries prides itself on its customer-focused approach and has a reputation for providing high-quality products and services to its diverse clientele.

Analysis of Insider Buy/Sell and the Relationship with the Stock Price

The insider transaction history for Patrick Industries Inc reveals a pattern of insider selling over the past year, with 20 insider sells and no insider buys. This could be interpreted in various ways; however, consistent selling by insiders may signal that those with the most intimate knowledge of the company's workings believe the stock may not appreciate significantly in the near term.Kip Ellis's recent sale of 8,000 shares is part of a larger trend of his trading activities, having sold a total of 29,100 shares over the past year without any recorded purchases. This sustained selling could be a sign of Ellis's personal financial management or a lack of confidence in the company's future stock performance.

The relationship between insider selling and stock price is not always straightforward. While insider sales can sometimes lead to negative market reactions, they do not always result in a decline in stock prices. In the case of Patrick Industries, the stock was trading at $93.21 on the day of Ellis's recent sale, giving the company a market cap of $2.063 billion.

Valuation and Market Reaction

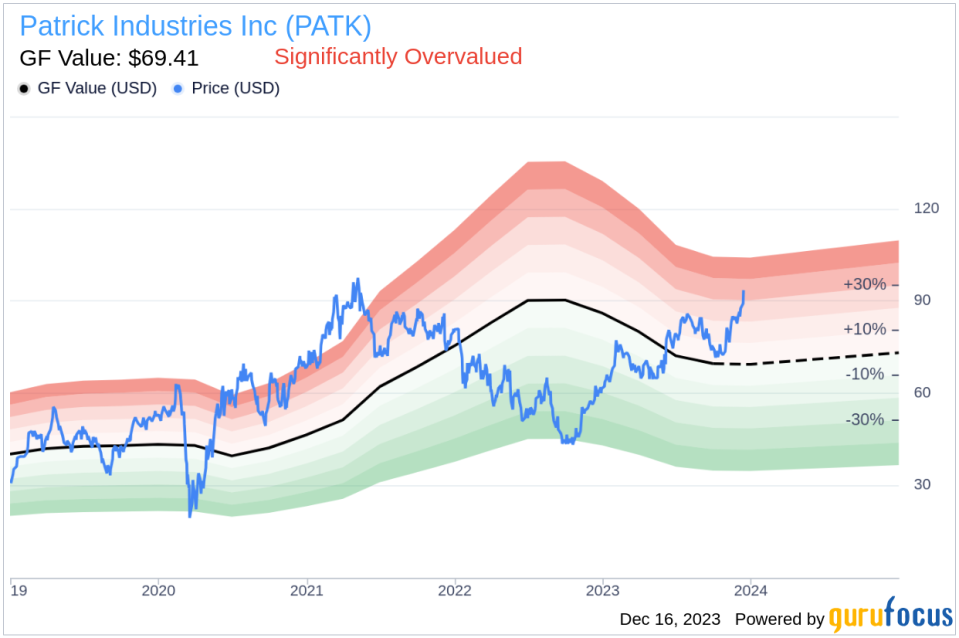

The price-earnings ratio of Patrick Industries stands at 13.75, which is lower than the industry median of 18.76 and also below the company's historical median price-earnings ratio. This suggests that the stock is trading at a discount compared to its peers and its own historical valuation, which could be seen as an attractive entry point for value investors.However, with a price of $93.21 and a GuruFocus Value of $69.41, Patrick Industries Inc has a price-to-GF-Value ratio of 1.34, indicating that the stock is Significantly Overvalued based on its GF Value. The GF Value is a proprietary intrinsic value estimate developed by GuruFocus, taking into account historical trading multiples, a GuruFocus adjustment factor, and future business performance estimates.

The discrepancy between the current stock price and the GF Value could be a cause for concern among investors, as it suggests that the stock may be overpriced relative to its intrinsic value. This overvaluation, coupled with insider selling, might lead some investors to question the stock's potential for near-term growth.

Conclusion

The recent insider sell by Kip Ellis, EVP Operations & COO of Patrick Industries Inc, is part of a broader pattern of insider selling at the company. While the stock's current valuation metrics present a mixed picture, being lower than industry medians but significantly overvalued according to the GF Value, investors should consider the implications of insider trading trends alongside other fundamental and technical analysis when making investment decisions.As always, insider trading is just one piece of the puzzle when it comes to evaluating a stock's potential. It is essential for investors to conduct thorough due diligence, considering a company's financial health, growth prospects, and broader market conditions before making any investment decisions.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.