Insider Sell Alert: EVP, President, Public Cloud Dharmendra Sinha Sells 91,066 Shares of ...

In a notable insider transaction, Dharmendra Sinha, the EVP and President of Public Cloud at Rackspace Technology Inc (NASDAQ:RXT), sold 91,066 shares of the company on November 28, 2023. This move has caught the attention of investors and market analysts, as insider trades can provide valuable insights into a company's prospects and the confidence level of its executives.

Who is Dharmendra Sinha at Rackspace Technology Inc?

Dharmendra Sinha is a seasoned executive with a deep understanding of cloud technologies and their applications in modern business. As the EVP and President of Public Cloud at Rackspace Technology Inc, Sinha is responsible for leading the company's efforts in delivering public cloud solutions to its customers. His role involves strategic planning, overseeing product development, and ensuring that Rackspace remains competitive in the rapidly evolving cloud services industry.

Rackspace Technology Inc's Business Description

Rackspace Technology Inc is a leading provider of multi-cloud solutions across applications, data, security, and infrastructure. The company offers a broad range of services, including cloud management, professional services, and managed hosting. Rackspace's expertise spans various cloud platforms, such as Amazon Web Services, Microsoft Azure, Google Cloud, and others, making it a go-to partner for businesses looking to leverage the power of the cloud. With a focus on innovation and customer service, Rackspace aims to deliver cutting-edge solutions that drive digital transformation for its clients.

Analysis of Insider Buy/Sell and the Relationship with the Stock Price

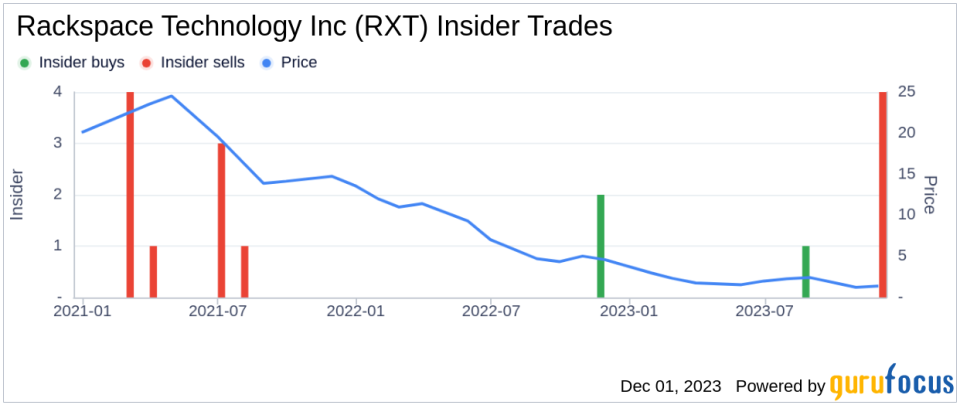

Insider transactions are closely monitored by investors as they can provide clues about a company's internal view of its stock's value. Over the past year, Dharmendra Sinha has sold a total of 91,066 shares and has not made any purchases. This could be interpreted in several ways, but without additional context, it's challenging to draw a definitive conclusion. It's important to consider the overall insider transaction history for Rackspace Technology Inc, which shows 1 insider buy and 4 insider sells over the past year.

On the day of Sinha's recent sale, shares of Rackspace Technology Inc were trading at $1.28, giving the company a market cap of $274.837 million. This relatively low share price, in conjunction with the insider selling activity, might raise concerns among investors about the company's valuation and future prospects.

When analyzing the relationship between insider trades and stock price, it's crucial to consider the broader market conditions and company performance. Insider sells do not always indicate a lack of confidence in the company; they can also reflect personal financial planning or diversification strategies. However, consistent selling by insiders, particularly without corresponding insider buying, may suggest that those with the most knowledge of the company anticipate a less favorable future for the stock.

Valuation and GF Value Analysis

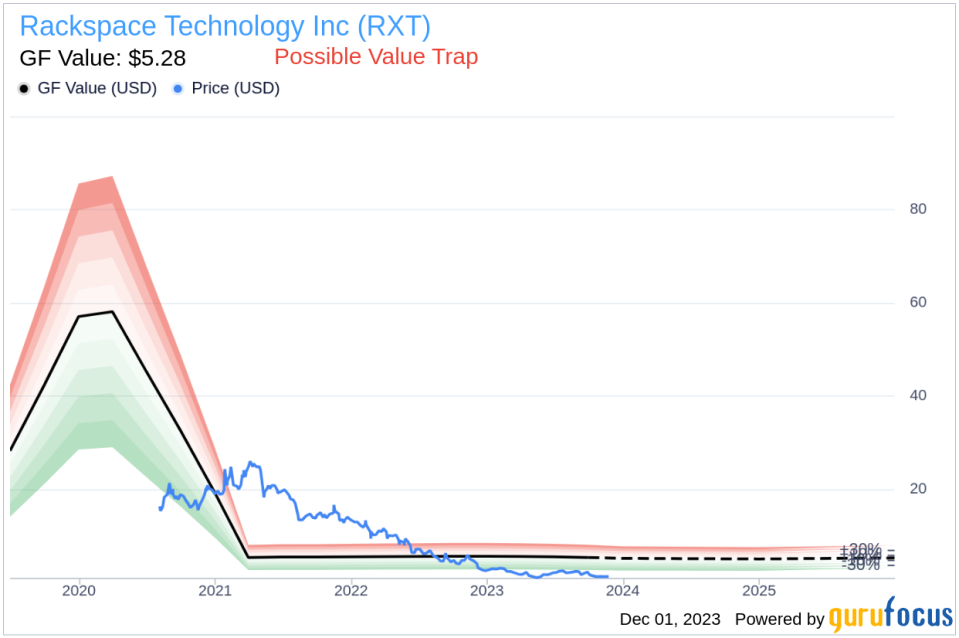

With a current trading price of $1.28 and a GuruFocus Value (GF Value) of $5.28, Rackspace Technology Inc has a price-to-GF-Value ratio of 0.24. This indicates that the stock is considered a Possible Value Trap, Think Twice, based on its GF Value. The GF Value is a proprietary intrinsic value estimate developed by GuruFocus, which takes into account historical trading multiples, a GuruFocus adjustment factor, and future business performance estimates from analysts.

The low price-to-GF-Value ratio suggests that the stock is trading well below its estimated intrinsic value, which could mean that the market is undervaluing the company's potential. However, the label of "Possible Value Trap" implies that investors should be cautious and conduct further research before making any investment decisions. It's possible that the market has priced in challenges that the company may face, which could be reflected in the insider selling activity.

Investors should consider the reasons behind the GF Value's assessment, including the historical trading multiples and the company's past returns and growth. Additionally, the future performance estimates from analysts, which are factored into the GF Value, should be scrutinized to understand the potential headwinds or tailwinds that could impact Rackspace Technology Inc's business.

Conclusion

The recent insider sell by Dharmendra Sinha at Rackspace Technology Inc raises questions about the company's valuation and future prospects. While the low price-to-GF-Value ratio suggests that the stock may be undervalued, the insider selling trend and the "Possible Value Trap" designation from GuruFocus warrant a cautious approach. Investors should carefully analyze the company's financials, market position, and growth potential, as well as monitor any further insider transactions, to make informed investment decisions.

As with any investment, it's essential to consider a wide range of factors, including industry trends, competitive landscape, and overall market sentiment. Insider transactions are just one piece of the puzzle, and while they can provide valuable insights, they should not be the sole basis for investment decisions.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.