Insider Sell Alert: EVP Scott Schatz Sells 14,138 Shares of Townsquare Media Inc (TSQ)

In a notable insider transaction, EVP, Finance Op and Tech Scott Schatz sold 14,138 shares of Townsquare Media Inc (NYSE:TSQ) on December 7, 2023. This sale has caught the attention of investors and analysts who closely monitor insider activities as an indicator of a company's financial health and future performance. Understanding who Scott Schatz is and the context of his sale is crucial for investors considering their position in TSQ.

Scott Schatz is a key executive at Townsquare Media Inc, a company that operates as a community-focused digital media, digital marketing solutions, and radio broadcasting business primarily in small and mid-sized markets. With his role overseeing finance operations and technology, Schatz has an in-depth understanding of the company's financial and operational strategies, making his trading activities particularly noteworthy.

Townsquare Media Inc's business model revolves around creating and distributing original and motivating media experiences that connect communities with the content they love, the people they trust, and the products they want. The company's assets include radio stations, digital and social media platforms, live events, and digital marketing services, which together create a comprehensive media and marketing solutions ecosystem.

Analysis of insider buy/sell activities and their relationship with stock price is a critical aspect of investment research. In the case of Townsquare Media Inc, the insider transaction history shows a pattern of more sales than purchases over the past year. Specifically, there have been 0 insider buys and 8 insider sells, with the insider in question, Scott Schatz, selling a total of 47,918 shares and making no purchases. This could signal a lack of confidence from insiders or simply a decision to realize gains or diversify their personal portfolios.

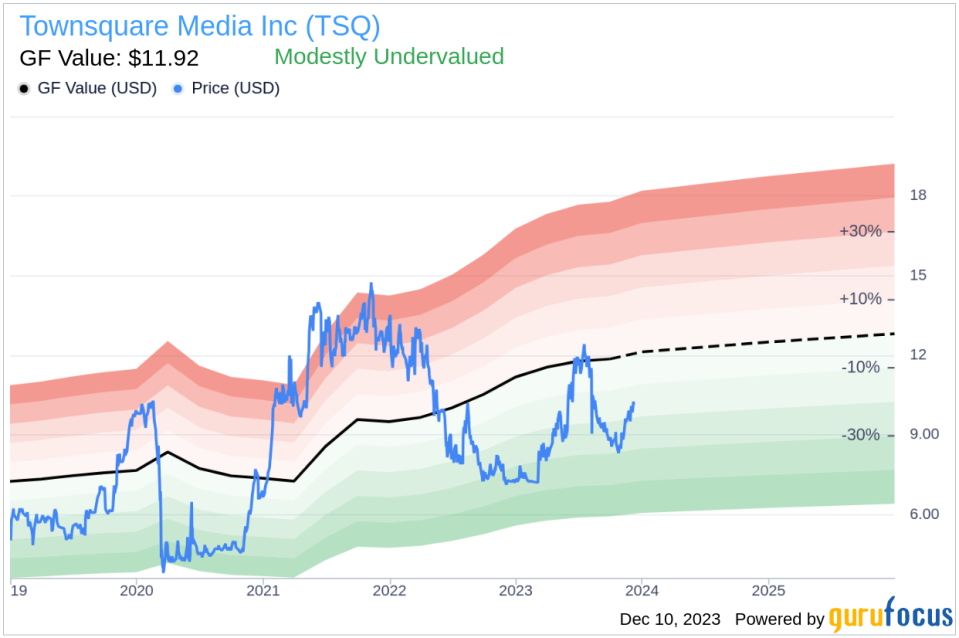

On the day of the insider's recent sale, shares of Townsquare Media Inc were trading at $10.22, giving the company a market cap of $166.713 million. This valuation is particularly interesting when considering the GF Value of the stock.

With a price of $10.22 and a GuruFocus Value of $11.92, Townsquare Media Inc has a price-to-GF-Value ratio of 0.86, indicating that the stock is modestly undervalued. The GF Value is a proprietary intrinsic value estimate developed by GuruFocus, which takes into account historical trading multiples, a GuruFocus adjustment factor based on past returns and growth, and future business performance estimates from analysts.

The recent insider sell by Scott Schatz could be interpreted in several ways. On one hand, the sale might suggest that the insider believes the stock is currently overvalued, despite the GF Value indicating otherwise. On the other hand, it could also be a personal financial decision unrelated to the company's valuation. Investors should consider the broader context of the market, the company's performance, and other insider transactions when evaluating the significance of this sale.

It is also important to look at the insider trend image to get a visual representation of the buying and selling patterns over time.

As seen in the insider trend image, the selling pattern is consistent, with no insider buys recorded over the past year. This trend could be a point of concern for potential investors, as consistent insider selling might suggest that those with the most intimate knowledge of the company's prospects are choosing to reduce their holdings.

Additionally, the GF Value image provides a visual guide to the stock's valuation relative to its intrinsic value.

The GF Value image indicates that Townsquare Media Inc is currently trading below its intrinsic value, which could mean that the stock is an attractive buy for value investors. However, the insider selling activity may temper this assessment, as it could imply that insiders do not share this optimistic valuation.

In conclusion, while the insider sell by Scott Schatz is a single data point in the broader analysis of Townsquare Media Inc, it is an important one. Investors should weigh this insider activity alongside other financial metrics, market trends, and company-specific news to make informed investment decisions. The modest undervaluation suggested by the GF Value may be an opportunity, but the insider selling trend could be a red flag that warrants further investigation.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.