Insider Sell Alert: EVP Scott Schatz Sells 11,729 Shares of Townsquare Media Inc (TSQ)

In a notable insider transaction, Scott Schatz, the Executive Vice President of Finance, Operations, and Technology at Townsquare Media Inc (NYSE:TSQ), sold 11,729 shares of the company on December 14, 2023. This sale has caught the attention of investors and market analysts, as insider transactions can provide valuable insights into a company's financial health and future prospects.

Who is Scott Schatz?

Scott Schatz is a key executive at Townsquare Media Inc, overseeing the company's financial operations, technological advancements, and operational strategies. His role is crucial in ensuring that the company remains competitive and financially sound. With years of experience in the media industry, Schatz's actions and decisions are closely watched by investors for indications of the company's direction.

Townsquare Media Inc's Business Description

Townsquare Media Inc is a diversified media, entertainment, and digital marketing services company that owns and operates radio, digital, and live event properties. The company is primarily focused on small and mid-sized markets and is known for its strong local presence. Townsquare Media's portfolio includes over 320 radio stations, numerous digital products, and a robust live events business. The company's strategy revolves around creating and distributing original and motivating media experiences that connect communities with the content they love, the people they trust, and the products they want.

Analysis of Insider Buy/Sell and Relationship with Stock Price

The recent sale by Scott Schatz is part of a broader pattern of insider selling at Townsquare Media Inc. Over the past year, Schatz has sold a total of 59,647 shares and has not made any purchases. This one-sided transaction history could signal that insiders may believe the stock is fully valued or potentially overvalued at current levels, or it could be part of personal financial planning or diversification strategies.The relationship between insider selling and stock price is not always straightforward. While extensive insider selling can sometimes precede a decline in stock price, it is not a definitive indicator. In the case of Townsquare Media Inc, the stock is currently trading at $10.37, which is below the GuruFocus Value (GF Value) of $12.07. This suggests that the stock is modestly undervalued, and the insider selling may not necessarily reflect a negative outlook on the company's valuation.

The insider trend image above shows the pattern of insider transactions over time, providing a visual representation of the selling and buying activities of company insiders.

GF Value and Market Cap

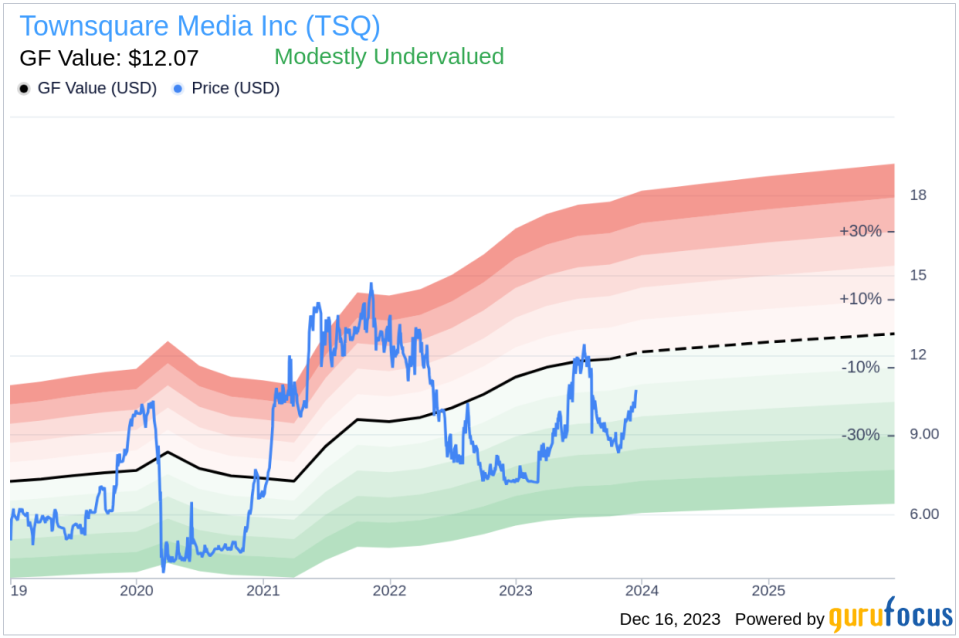

The GF Value is a proprietary metric developed by GuruFocus to estimate the intrinsic value of a stock. For Townsquare Media Inc, the GF Value is calculated at $12.07, which is higher than the current trading price. This discrepancy indicates that the stock may be modestly undervalued, offering a potential opportunity for investors.The market cap of Townsquare Media Inc is $176.094 million, which places it in the small-cap category. Small-cap stocks often offer higher growth potential but can also come with greater volatility and risk.

The GF Value image above provides a visual comparison between the stock's current price and its estimated intrinsic value, further illustrating the potential undervaluation.

Conclusion

The recent insider sell by EVP Scott Schatz is a significant event for investors of Townsquare Media Inc. While the company appears to be modestly undervalued based on the GF Value, the consistent pattern of insider selling raises questions about the stock's future performance. Investors should consider the insider transaction trends, the company's business fundamentals, and the overall market conditions when making investment decisions. As always, insider transactions are just one piece of the puzzle, and a comprehensive analysis should include a variety of financial and strategic factors.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.