Insider Sell Alert: EVP Valentin Sribar Sells Shares of Gartner Inc

In the realm of stock market movements, insider trading activity is often a significant indicator that investors keep a close eye on. Recently, an insider sell event has caught the attention of the market. Valentin Sribar, the Executive Vice President, Research & Advisory of Gartner Inc (NYSE:IT), has sold 675 shares of the company on December 11, 2023. This transaction has prompted a closer look into the insider's actions and the potential implications for Gartner Inc's stock.

Who is Valentin Sribar?

Valentin Sribar serves as the Executive Vice President, Research & Advisory at Gartner Inc, a leading research and advisory company. In his role, Sribar is responsible for delivering actionable, objective insight to executives and their teams. His expertise and leadership are crucial in guiding clients through complex challenges and helping them make informed decisions. With a deep understanding of the technology sector and its trends, Sribar's actions within the company are closely monitored by investors seeking insights into Gartner's strategic direction.

Gartner Inc's Business Description

Gartner Inc is a renowned entity in the global research and advisory sector, providing essential insights, advice, and tools for leaders in IT, finance, HR, customer service and support, legal and compliance, marketing, sales, and supply chain functions. The company's mission is to equip business executives with indispensable insights, advice, and tools to achieve their mission-critical priorities and build the successful organizations of tomorrow. With a comprehensive suite of services, Gartner's research and analysis are pivotal for companies navigating the ever-evolving business landscape.

Analysis of Insider Buy/Sell and Relationship with Stock Price

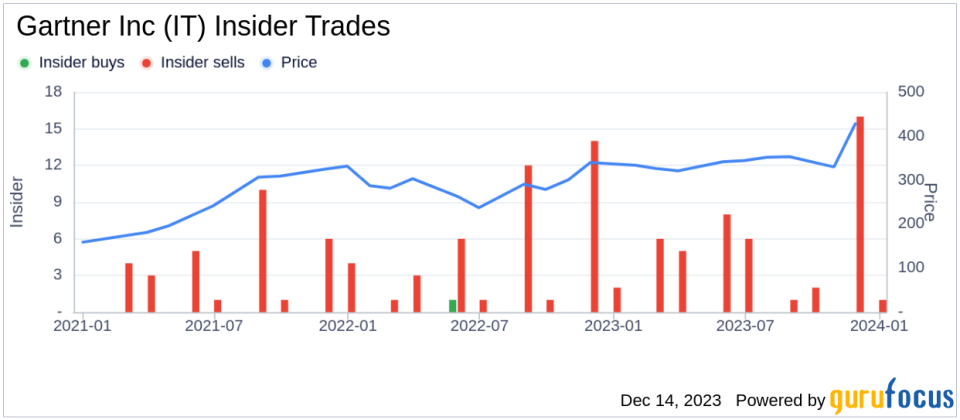

Insider trading patterns, particularly sells, can provide valuable clues about a company's future prospects. Over the past year, Valentin Sribar has sold a total of 1,443 shares and has not made any purchases. This one-sided activity might raise questions about the insider's confidence in the company's future performance. However, it's essential to consider that insider sells can occur for various reasons, including personal financial planning, diversification, and others that may not necessarily reflect a lack of confidence in the company.

When examining the broader insider transaction history for Gartner Inc, we observe that there have been no insider buys over the past year, contrasted with 45 insider sells. This trend could suggest that insiders, on the whole, are choosing to cash in on their investments rather than increase their positions. While this might seem bearish at first glance, it's important to analyze this data in the context of the company's performance and market conditions.

On the day of Sribar's recent sell, Gartner Inc's shares were trading at $459.06, valuing the company at a market cap of $35,389.449 billion. The price-earnings ratio stood at 39.04, above the industry median of 26.73 but below the company's historical median. This indicates that while the stock is trading at a premium compared to the industry, it is somewhat in line with its own historical valuation trends.

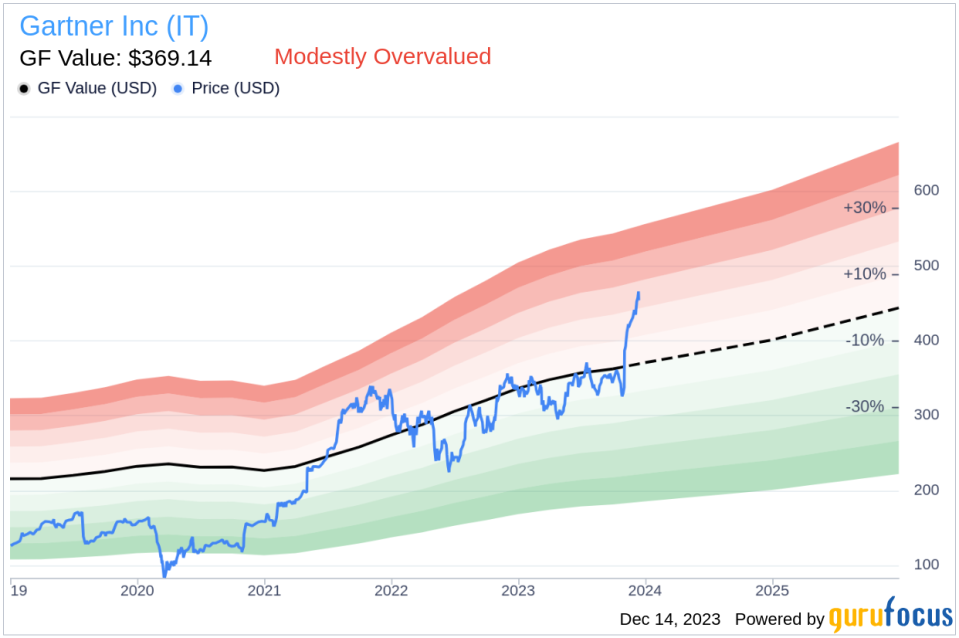

Considering the price-to-GF-Value ratio of 1.24, Gartner Inc is deemed to be Modestly Overvalued based on its GF Value of $369.14. The GF Value is a proprietary intrinsic value estimate from GuruFocus, factoring in historical trading multiples, a GuruFocus adjustment for past performance, and future business performance estimates from analysts.

The insider trend image above provides a visual representation of the insider selling pattern, which could be interpreted as a signal for investors to proceed with caution. However, it's crucial to consider the broader market context and the company's fundamentals before drawing conclusions.

The GF Value image further illustrates the stock's valuation status, suggesting that Gartner Inc's shares might not be undervalued at the current price levels. This could imply that the insider perceives the stock as fairly valued or overvalued, prompting the decision to sell.

Conclusion

Valentin Sribar's recent insider sell transaction at Gartner Inc has provided investors with an opportunity to reassess the stock's valuation and future prospects. While insider sells can be a red flag for potential issues within a company, they should not be the sole factor in investment decisions. It is essential to consider the company's overall financial health, market position, and future growth potential. As with any investment, due diligence and a comprehensive analysis of all available data are key to making informed decisions.

Investors should continue to monitor insider activity and market trends for Gartner Inc, as these can offer valuable insights into the company's internal dynamics and external perceptions. With a market cap in the tens of billions and a modest overvaluation based on the GF Value, Gartner Inc remains a significant player in the research and advisory industry, and its stock will likely continue to be a topic of interest for market watchers.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.