Insider Sell Alert: EVP Vivek Jain Sells Shares of Analog Devices Inc (ADI)

Analog Devices Inc (NASDAQ:ADI), a leader in the semiconductor industry, has recently witnessed a significant insider sell by EVP, Global Operations, Vivek Jain. On November 27, 2023, Vivek Jain sold 17,038 shares of the company, a transaction that has caught the attention of investors and market analysts alike. This article delves into the details of the sale, the insider's profile, the company's business description, and the implications of insider trading activities on the stock's performance.

Who is Vivek Jain of Analog Devices Inc?

Vivek Jain serves as the Executive Vice President of Global Operations at Analog Devices Inc. His role is crucial in overseeing the company's worldwide operations, ensuring that the production and distribution of ADI's products meet the highest standards of efficiency and quality. Jain's position places him at the heart of the company's operational strategies, making his trading activities particularly noteworthy for investors seeking insights into the company's internal dynamics.

Analog Devices Inc's Business Description

Analog Devices Inc is a global semiconductor company specializing in data conversion, signal processing, and power management technology. With a market cap of $90.915 billion, ADI plays a pivotal role in converting real-world phenomena into actionable insights through its integrated circuits (ICs). These ICs are used in a wide array of applications, from automotive systems to industrial automation, healthcare, and consumer electronics. The company's innovative solutions are designed to bridge the physical and digital worlds, making it a key player in the ever-evolving tech landscape.

Analysis of Insider Buy/Sell and the Relationship with the Stock Price

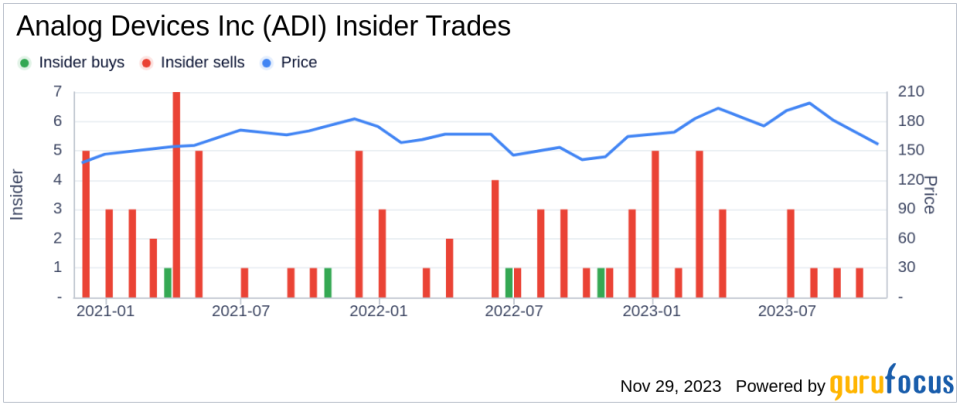

Insider trading activities, particularly sells, can provide valuable clues about a company's health and future prospects. In the case of Analog Devices Inc, the insider transaction history shows a pattern of more sells than buys over the past year. Specifically, there have been 21 insider sells and no insider buys, indicating that insiders may perceive the stock's current price as favorable for liquidation, or they might be diversifying their personal portfolios for reasons unrelated to the company's performance.

On the day of Vivek Jain's recent sell, ADI's shares were trading at $183.66, giving the company a substantial market cap. The price-earnings ratio stands at 28.01, slightly above the industry median, suggesting a higher valuation compared to peers. However, it is lower than the company's historical median, indicating that the stock might not be overvalued in the context of its own trading history.

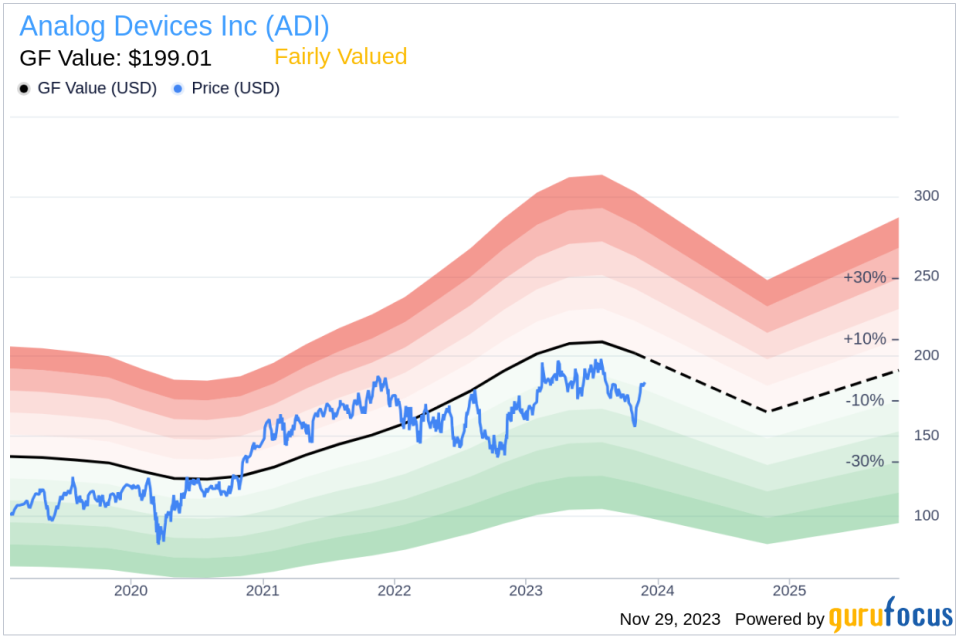

The price-to-GF-Value ratio of 0.92, with a GF Value of $199.01, classifies the stock as Fairly Valued. This assessment is based on historical trading multiples, a GuruFocus adjustment factor, and future business performance estimates. The GF Value serves as a benchmark for investors to gauge whether the stock is trading at a discount or premium relative to its intrinsic value.

The insider trend image above illustrates the recent selling pattern, which could be interpreted in various ways. While some investors might view this as a bearish signal, others could see it as a non-consequential part of insider portfolio management. It is essential to consider the broader market conditions and the company's fundamentals before drawing conclusions from insider trading patterns.

The GF Value image provides a visual representation of the stock's valuation relative to its intrinsic value. The proximity of the current price to the GF Value suggests that the stock is not significantly undervalued or overvalued, which might explain the insider's decision to sell at this point.

Conclusion

The recent insider sell by EVP Vivek Jain of Analog Devices Inc is a transaction that warrants attention. While the insider's sell-off could be perceived as a negative signal by some market participants, it is crucial to analyze the context of the sale, including the company's valuation, the insider's historical trading activities, and the overall market environment. As of now, ADI's stock appears to be fairly valued, and the insider trading trend does not necessarily indicate a lack of confidence in the company's future. Investors should continue to monitor insider activities and company performance for a more comprehensive understanding of the stock's potential trajectory.

It is always recommended for investors to conduct their own due diligence and consider a multitude of factors, including insider trading data, when making investment decisions. The sale by Vivek Jain provides an interesting data point, but it is just one piece of the larger investment puzzle.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.