Insider Sell Alert: EVP Wendy Carruthers Sells 11,672 Shares of Boston Scientific Corp (BSX)

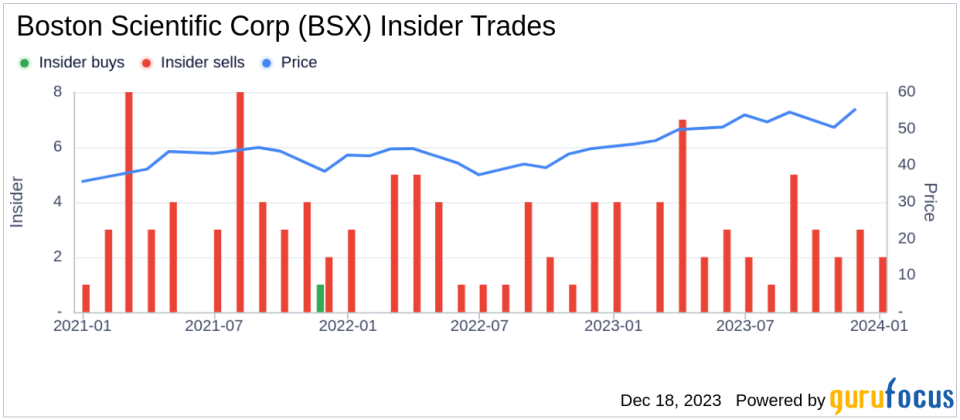

Boston Scientific Corp (NYSE:BSX), a leading innovator in medical solutions that improve the health of patients around the world, has recently witnessed a significant insider sell by one of its top executives. Wendy Carruthers, the Executive Vice President of Human Resources at Boston Scientific, sold 11,672 shares of the company's stock on December 15, 2023. This transaction has caught the attention of investors and market analysts, prompting a closer look at the implications of such insider activity.Who is Wendy Carruthers of Boston Scientific Corp?Wendy Carruthers has been serving as the Executive Vice President of Human Resources at Boston Scientific since joining the company. With a wealth of experience in managing human capital and developing strategies to foster a productive workforce, Carruthers plays a crucial role in shaping the company's culture and driving its success. Her insider position provides her with a unique perspective on the company's operations and future prospects.Boston Scientific Corp's Business DescriptionBoston Scientific is a global medical technology leader with a focus on transforming lives through innovative medical solutions that improve the health of patients around the world. The company operates in various segments, including Cardiovascular, Rhythm and Neuro, MedSurg, and more. Boston Scientific's products and technologies are used to diagnose or treat a wide range of medical conditions, including heart, digestive, pulmonary, vascular, urological, women's health, and chronic pain conditions.Analysis of Insider Buy/Sell and the Relationship with the Stock PriceThe recent sale by Wendy Carruthers is part of a broader trend of insider selling at Boston Scientific. Over the past year, Carruthers has sold a total of 116,711 shares and has not made any purchases. This pattern of selling without corresponding buys could signal that insiders, including Carruthers, may believe the stock is fully valued or potentially overvalued at current levels.

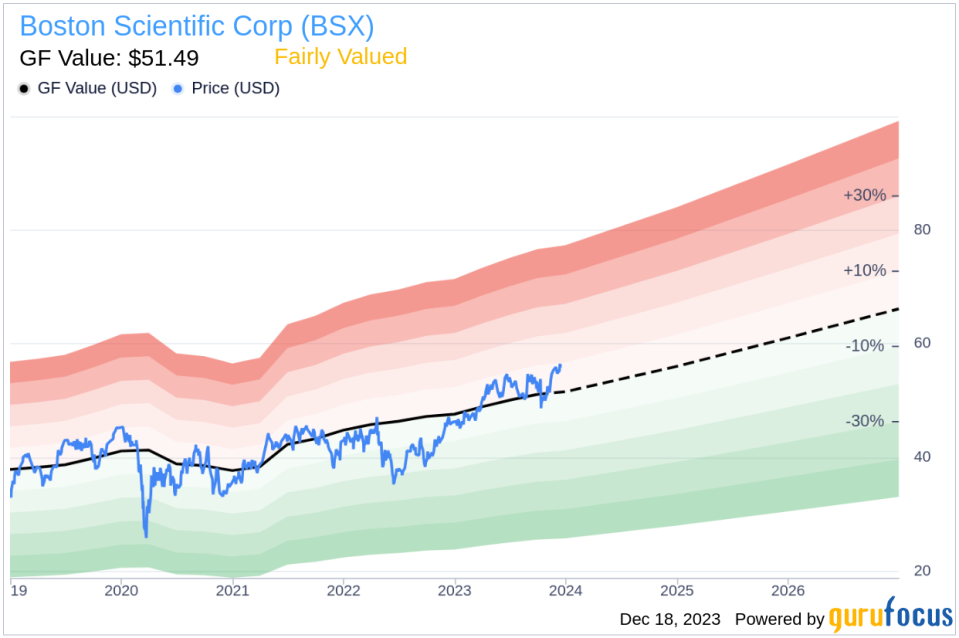

The insider transaction history for Boston Scientific shows a total of 34 insider sells over the past year, with no insider buys during the same timeframe. This trend of insider selling could be interpreted as a lack of confidence in the stock's future appreciation or simply a desire to realize gains or diversify personal portfolios.Valuation and Market ReactionOn the day of the insider's recent sell, shares of Boston Scientific were trading at $55.61, giving the company a market cap of $81.321 billion. The price-earnings ratio of 67.70 is higher than the industry median of 30.1, suggesting that the stock may be trading at a premium compared to its peers. However, it is lower than the company's historical median price-earnings ratio, indicating that the stock may be more reasonably priced relative to its own trading history.With a price of $55.61 and a GuruFocus Value of $51.49, Boston Scientific Corp has a price-to-GF-Value ratio of 1.08. This suggests that the stock is Fairly Valued based on its GF Value.

The GF Value is an intrinsic value estimate that takes into account historical trading multiples, a GuruFocus adjustment factor based on past returns and growth, and future business performance estimates from Morningstar analysts. The current price-to-GF-Value ratio indicates that the stock is trading close to its intrinsic value, which may explain why insiders like Wendy Carruthers are choosing to sell their shares.ConclusionThe insider selling activity at Boston Scientific, particularly by EVP Wendy Carruthers, raises questions about the stock's valuation and future performance. While the company remains a leader in the medical technology industry, the consistent pattern of insider selling could be a signal for investors to proceed with caution. As always, it is important for investors to conduct their own research and consider the broader market context when making investment decisions.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.