Insider Sell Alert: Exec. Chairman & CEO D Bidzos Sells 15,000 Shares of VeriSign Inc (VRSN)

VeriSign Inc (NASDAQ:VRSN), a global provider of domain name registry services and internet infrastructure, has witnessed a significant insider sell by one of its top executives. D Bidzos, the Executive Chairman and CEO of VeriSign Inc, sold 15,000 shares of the company on November 24, 2023. This transaction has caught the attention of investors and market analysts, as insider activity, particularly sells by high-ranking executives, can provide valuable insights into a company's financial health and future prospects.

Who is D Bidzos?

Dennis (D) Bidzos is a prominent figure in the internet and cybersecurity industries. As the Executive Chairman and CEO of VeriSign Inc, Bidzos has been instrumental in shaping the company's strategic direction and growth. Under his leadership, VeriSign has solidified its position as a leader in domain registration and internet security services. Bidzos's tenure at VeriSign has been marked by his deep understanding of the internet infrastructure landscape and his ability to navigate the company through the evolving digital economy.

VeriSign Inc's Business Description

VeriSign Inc operates as a critical player in the internet infrastructure sector. The company is primarily known for managing the registry of domain names for the .com, .net, and other top-level domains. VeriSign's services ensure the security, stability, and resiliency of key internet infrastructure. The company's registry services allow individuals and organizations worldwide to establish their online presence, making VeriSign a backbone provider in the digital age. With the ever-increasing reliance on the internet for business and communication, VeriSign's role in maintaining the integrity of online operations is more important than ever.

Analysis of Insider Buy/Sell and the Relationship with the Stock Price

Insider transactions, particularly those involving buys and sells, can be a strong indicator of a company's internal perspective on its stock's value. Over the past year, D Bidzos has sold a total of 174,000 shares and has not made any purchases. This one-sided activity could signal that the insider believes the stock may be fully valued or that they are taking profits off the table.

When examining the broader insider transaction history for VeriSign Inc, we observe that there have been no insider buys over the past year, while there have been 60 insider sells. This trend might raise questions among investors about the confidence insiders have in the company's future growth potential or stock price appreciation.

On the day of the insider's recent sell, shares of VeriSign Inc were trading at $213.55, giving the company a market cap of $21.77 billion. The price-earnings ratio stands at 30.51, which is higher than both the industry median of 26.39 and the company's historical median price-earnings ratio. This elevated P/E ratio could suggest that the stock is priced on the higher end of its valuation spectrum.

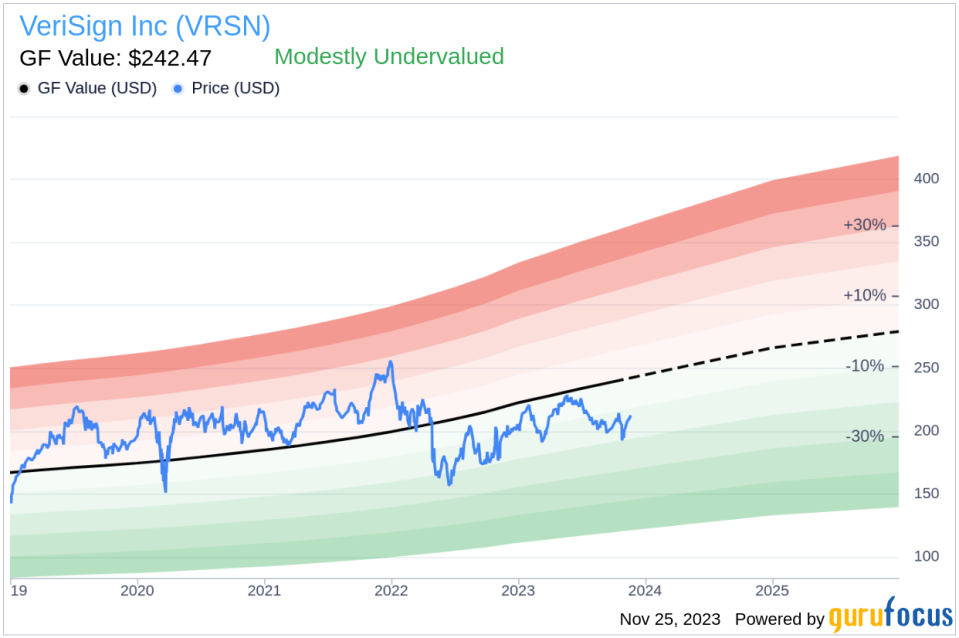

However, it's important to consider the stock's valuation in the context of the GuruFocus Value. With a price of $213.55 and a GuruFocus Value of $242.47, VeriSign Inc has a price-to-GF-Value ratio of 0.88, indicating that the stock is modestly undervalued. The GF Value is a comprehensive intrinsic value estimate that takes into account historical trading multiples, a GuruFocus adjustment factor based on past returns and growth, and future business performance estimates from analysts.

The insider trend image above provides a visual representation of the selling pattern by insiders at VeriSign Inc. This consistent selling could be interpreted in various ways, but it often suggests that insiders might perceive the stock's current price as an opportune time to realize gains.

The GF Value image further illustrates the stock's current valuation relative to its intrinsic value. Despite the insider selling activity, the modest undervaluation based on the GF Value could present an attractive entry point for investors who believe in the long-term prospects of VeriSign Inc.

Conclusion

The recent insider sell by D Bidzos, along with the overall trend of insider sells at VeriSign Inc, may lead to mixed interpretations among investors. While the insider's actions could suggest a belief that the stock is not likely to appreciate significantly in the near term, the GF Value indicates that VeriSign Inc may be undervalued at its current price. Investors should weigh these factors alongside the company's strong position in the internet infrastructure industry and its potential for growth in an increasingly digital world.

As with any investment decision, it is crucial to conduct thorough research and consider a multitude of factors, including insider transactions, valuation metrics, and the company's fundamental strengths. VeriSign Inc's role as a key player in the domain name registry space and its importance to the internet's infrastructure cannot be understated, and these attributes may well support the stock's value over the long term.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.