Insider Sell Alert: Executive Chairman & President Bradley Vizi Sells Shares of RCM ...

In a notable insider transaction, Executive Chairman & President, and 10% Owner Bradley Vizi sold 4,390 shares of RCM Technologies Inc (NASDAQ:RCMT) on December 12, 2023. This move has caught the attention of investors and market analysts, as insider transactions can often provide valuable insights into a company's prospects and the sentiment of its leadership.

Who is Bradley Vizi of RCM Technologies Inc?

Bradley Vizi is a significant figure at RCM Technologies Inc, holding the dual roles of Executive Chairman and President. His position as a 10% Owner further underscores his substantial investment and interest in the company's success. Vizi's actions in the stock market, particularly his insider trades, are closely watched as they may reflect his confidence in the company's future performance and strategic direction.

RCM Technologies Inc's Business Description

RCM Technologies Inc is a premier provider of business and technology solutions designed to enhance and maximize the operational performance of its customers through the adaptation and deployment of advanced engineering, specialty health care, and information technology services. Operating across North America, RCM Technologies serves a broad spectrum of sectors, including healthcare, aerospace, financial services, and energy, offering tailored solutions that address the unique challenges of each industry.

Analysis of Insider Buy/Sell and Relationship with Stock Price

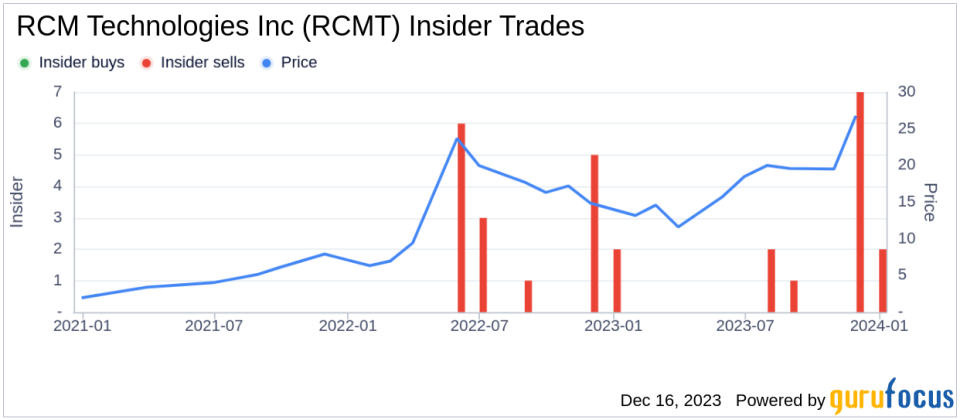

The recent sale by Bradley Vizi of 4,390 shares is part of a larger pattern observed over the past year. During this period, Vizi has sold a total of 154,390 shares and has not made any purchases. This one-sided transaction history could suggest a strategic portfolio adjustment or a response to the company's valuation and market conditions.The insider transaction history for RCM Technologies Inc shows a lack of insider buys over the past year, with 12 insider sells recorded during the same timeframe. This trend may raise questions among investors about the insiders' long-term confidence in the company's stock.

On the day of the insider's recent sale, shares of RCM Technologies Inc were trading at $27.51, giving the company a market cap of $207.95 million. The price-earnings ratio stands at 14.59, which is higher than the industry median of 11.86 but lower than the company's historical median price-earnings ratio. This suggests that while the stock may be trading at a premium compared to its industry peers, it is still below its own historical valuation norms.

Valuation and GF Value Analysis

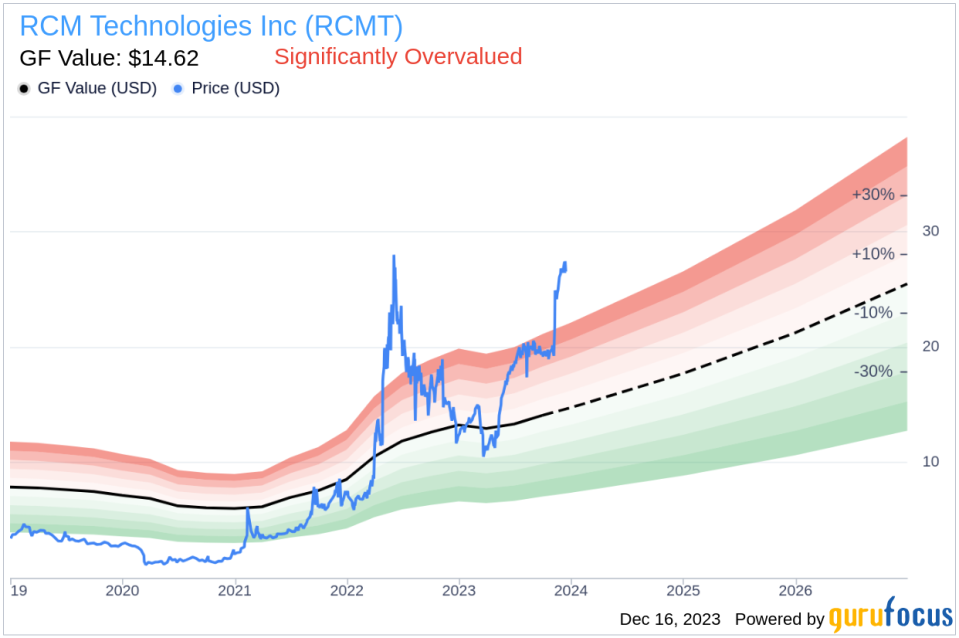

The stock's current price-to-GF-Value ratio of 1.88 indicates that RCM Technologies Inc is significantly overvalued based on its GF Value of $14.62. The GF Value is a proprietary intrinsic value estimate developed by GuruFocus, which factors in historical trading multiples, a GuruFocus adjustment factor based on past returns and growth, and future business performance estimates from Morningstar analysts.

The significant overvaluation of the stock, as suggested by the GF Value, could be a contributing factor to the insider's decision to sell shares. It is possible that the insider believes the current market price does not accurately reflect the company's intrinsic value and future growth prospects, prompting a reduction in their holdings.

Conclusion

The recent insider sell by Bradley Vizi at RCM Technologies Inc, coupled with the broader trend of insider sells and no buys over the past year, may signal caution to investors. The stock's overvaluation relative to the GF Value and the industry median price-earnings ratio could be influencing insiders to lock in gains or reallocate their investments.Investors should consider these insider transactions as part of a broader investment analysis, taking into account the company's performance, industry trends, and overall market conditions. While insider sells can provide valuable context, they are just one piece of the puzzle when evaluating a stock's potential.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.