Insider Sell Alert: Executive Vice President Camille Burckhart Sells Shares of Popular Inc

Executive Vice President Camille Burckhart has recently made a significant stock transaction within Popular Inc (NASDAQ:BPOP), a notable event for investors and market watchers alike. On November 21, 2023, Camille Burckhart sold 7,764 shares of the company, a move that has sparked interest in the financial community regarding insider activity and its potential implications for the stock's future performance.

Who is Camille Burckhart?

Camille Burckhart serves as the Executive Vice President of Popular Inc, a prominent financial institution. Burckhart's role within the company is critical, overseeing key operations and contributing to strategic decisions that shape the organization's direction. With a deep understanding of the company's inner workings and market position, Burckhart's trading activities are closely monitored for insights into executive sentiment and potential strategic shifts.

Popular Inc's Business Description

Popular Inc, traded under the ticker BPOP on the NASDAQ, is a diversified financial services company with a strong presence in Puerto Rico, the United States, and the Caribbean. The company offers a wide range of banking services, including retail, mortgage, and commercial banking, as well as other financial services. With a robust portfolio of products and a commitment to serving its communities, Popular Inc has established itself as a key player in the financial sector.

Analysis of Insider Buy/Sell and Relationship with Stock Price

Insider trading activities, such as those of Camille Burckhart, can provide valuable clues about a company's health and future prospects. Over the past year, Burckhart has sold a total of 21,764 shares and has not made any purchases. This pattern of selling without corresponding buys could suggest that insiders might perceive the stock as being fully valued or potentially overvalued at current levels.

However, it's important to consider these transactions in the context of the company's overall insider trading history. Over the past year, there have been no insider buys and six insider sells for Popular Inc. This trend of insider selling could be interpreted as a lack of confidence in the company's future growth or as a normal part of personal financial management for the insiders involved.

On the day of Burckhart's recent sale, shares of Popular Inc were trading at $71.58, giving the company a market cap of $5.208 billion. This price point is particularly interesting when considering the company's valuation metrics.

The price-earnings ratio of Popular Inc stands at 7.38, which is lower than both the industry median of 8.44 and the company's historical median price-earnings ratio. This suggests that the stock may be undervalued compared to its peers and its own historical standards.

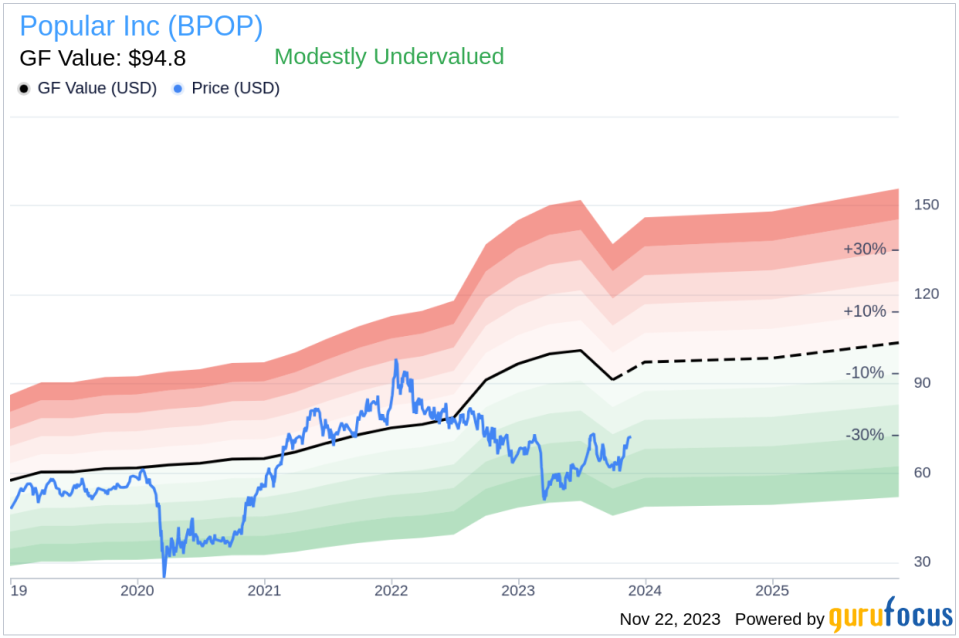

Adding to the valuation analysis, the price-to-GF-Value ratio of 0.76 indicates that Popular Inc is modestly undervalued based on its GF Value of $94.80. The GF Value is a proprietary intrinsic value estimate from GuruFocus, which factors in historical trading multiples, a GuruFocus adjustment factor based on past returns and growth, and future business performance estimates from Morningstar analysts.

The insider trend image above provides a visual representation of the insider trading activities at Popular Inc, highlighting the recent sell transactions without corresponding buys.

The GF Value image further illustrates the stock's current valuation in relation to its intrinsic value, supporting the notion that Popular Inc may be trading at a discount.

Conclusion

While the insider's recent sale of shares could raise questions about the stock's future performance, the valuation analysis suggests that Popular Inc may still be an attractive investment opportunity. The stock's modest undervaluation, as indicated by the price-to-GF-Value ratio, and its lower-than-average price-earnings ratio compared to the industry, provide compelling reasons for investors to take a closer look.

Investors should consider the insider trading trends, the company's valuation, and the broader market conditions when making investment decisions. As always, it's recommended to conduct thorough research and consider a diversified investment strategy to mitigate risk.

For those interested in following insider trading activities and gaining insights into company valuations, staying informed through reliable financial news sources and analysis platforms like GuruFocus is essential.

Keep an eye on Popular Inc and its insider trading patterns for further clues about the company's trajectory and potential investment opportunities.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.