Insider Sell Alert: Executive Vice President Eli Sepulveda Sells 10,000 Shares of Popular Inc (BPOP)

Executive Vice President Eli Sepulveda of Popular Inc (NASDAQ:BPOP) has recently made a significant change to his stake in the company. On November 28, 2023, the insider sold 10,000 shares of Popular Inc, a notable transaction that has caught the attention of investors and market analysts alike. This article delves into the details of the sale, the insider's history, and what this could mean for the stock's future.

Who is Eli Sepulveda?

Eli Sepulveda is an experienced executive serving as the Executive Vice President at Popular Inc. His role within the company is crucial, overseeing various strategic initiatives and operations. Sepulveda's decisions and actions are often seen as indicative of the company's internal perspective, making his recent sale of shares particularly noteworthy.

About Popular Inc

Popular Inc, traded under the ticker BPOP, is a diversified financial services company offering a range of banking, investment, and insurance services. With its headquarters in Puerto Rico, Popular Inc has a significant presence in the Caribbean and Latin America, as well as operations in the mainland United States. The company's commitment to providing comprehensive financial solutions to its customers has established it as a key player in the regions it serves.

Analysis of Insider Buy/Sell and Relationship with Stock Price

Insider transactions can provide valuable insights into a company's health and future prospects. Over the past year, Eli Sepulveda has sold a total of 10,000 shares and has not made any purchases. This one-sided activity could suggest that the insider sees the current stock price as an opportune moment to realize gains or reallocate assets.

Looking at the broader insider transaction history for Popular Inc, there have been no insider buys over the past year, contrasted with 8 insider sells. This trend might raise questions about the confidence insiders have in the company's near-term growth potential or valuation.

On the day of Sepulveda's recent sale, shares of Popular Inc were trading at $71.7, giving the company a market cap of $5.301 billion. The price-earnings ratio stood at 7.51, lower than both the industry median of 8.53 and the company's historical median price-earnings ratio. This could indicate that the stock is undervalued compared to its peers and its own historical performance.

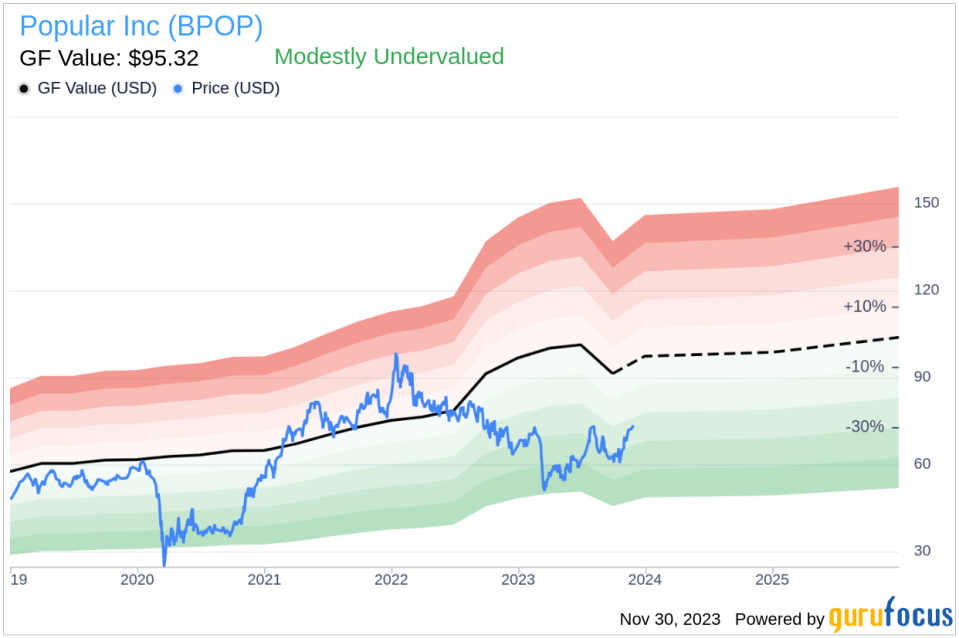

However, with a price of $71.7 and a GuruFocus Value of $95.32, Popular Inc has a price-to-GF-Value ratio of 0.75, suggesting that the stock is modestly undervalued based on its GF Value. The GF Value is a proprietary intrinsic value estimate from GuruFocus, factoring in historical trading multiples, a GuruFocus adjustment factor, and future business performance estimates from Morningstar analysts.

The insider trend image above provides a visual representation of the selling pattern, which could be interpreted as a signal to investors. While insider selling does not always imply negative prospects for a company, it can sometimes precede a downturn in the stock price or reflect a belief that the stock is fully valued.

The GF Value image further illustrates the stock's valuation status. When the price-to-GF-Value ratio is below 1, as it is in this case, it suggests that the stock may be undervalued. This could mean that despite the insider selling, the market has not fully recognized the company's intrinsic value, potentially presenting an opportunity for investors.

Conclusion

The recent insider sale by Executive Vice President Eli Sepulveda is a significant event for Popular Inc. While the insider's actions might suggest a lack of confidence in the stock's short-term appreciation, the company's current valuation metrics indicate that it may be undervalued. Investors should consider both the insider's transaction and the company's fundamentals when making investment decisions.

It is also important to note that insider transactions are just one piece of the puzzle. Market conditions, company performance, and broader economic factors also play critical roles in determining a stock's future direction. As such, while insider trends can provide valuable clues, they should be weighed alongside comprehensive analysis and due diligence.

For those interested in Popular Inc, keeping an eye on insider transactions, as well as the company's financial health and market position, will be key to understanding the potential risks and rewards associated with investing in BPOP.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.