Insider Sell Alert: Fiserv Inc's Kenneth Best Unloads Shares

In the realm of stock market movements, insider trading activity is often a significant indicator that investors keep a close eye on. Recently, Kenneth Best, the Chief Accounting Officer of Fiserv Inc, made a notable move by selling a substantial number of shares in the company. This article delves into the details of the transaction, provides an overview of Kenneth Best and Fiserv Inc, and analyzes the implications of insider trading on the stock's performance.

Who is Kenneth Best of Fiserv Inc?

Kenneth Best serves as the Chief Accounting Officer at Fiserv Inc, a prominent financial services technology company. In his role, Best is responsible for overseeing the company's accounting operations, ensuring compliance with regulatory requirements, and maintaining the integrity of financial reports. His position places him in a critical spot to understand the company's financial health and strategic direction.

Fiserv Inc's Business Description

Fiserv Inc is a global leader in financial services technology solutions. The company offers a wide range of services, including electronic payment processing, risk and compliance management, customer and channel management, and insights and optimization. Fiserv's solutions help banks, credit unions, and other financial institutions to manage their operations efficiently and deliver superior experiences to their customers. With a strong focus on innovation and integration, Fiserv is at the forefront of the digital transformation in the financial services industry.

Analysis of Insider Buy/Sell and the Relationship with the Stock Price

Insider trading activity, particularly selling, can be a double-edged sword when it comes to stock price implications. On one hand, insiders may sell shares for personal financial planning reasons that have no direct correlation with the company's performance. On the other hand, investors often perceive insider selling as a lack of confidence in the company's future prospects, which can lead to negative sentiment and downward pressure on the stock price.

According to the data provided, Kenneth Best has sold a total of 9,138 shares of Fiserv Inc over the past year, without any recorded purchases. This one-sided activity could raise questions among investors about Best's outlook on the company's valuation and future growth.

On November 28, 2023, the insider executed a sale of 9,138 shares at a price point of $127.5 per share, resulting in a transaction value that investors should not overlook. This sale occurred when the stock was trading close to its GF Value, suggesting that the insider might perceive the stock as fairly valued at this price.

The insider trend image above illustrates the pattern of insider transactions over the past year. With zero insider buys and 15 insider sells, the trend indicates that insiders at Fiserv Inc have been consistent sellers of the stock. This could be interpreted as a signal that insiders believe the stock might not offer substantial upside potential in the near term.

When examining the valuation metrics, Fiserv Inc's price-earnings ratio stands at 27.27, slightly above the industry median of 26.48. This indicates that the stock is trading at a premium compared to its peers. However, it is also trading below the company's historical median price-earnings ratio, which could suggest some level of undervaluation.

The market capitalization of Fiserv Inc is a substantial $78.228 billion, reflecting the company's significant presence in the financial technology sector. The stock's market cap, combined with its valuation ratios, plays a crucial role in how investors perceive the company's size and worth.

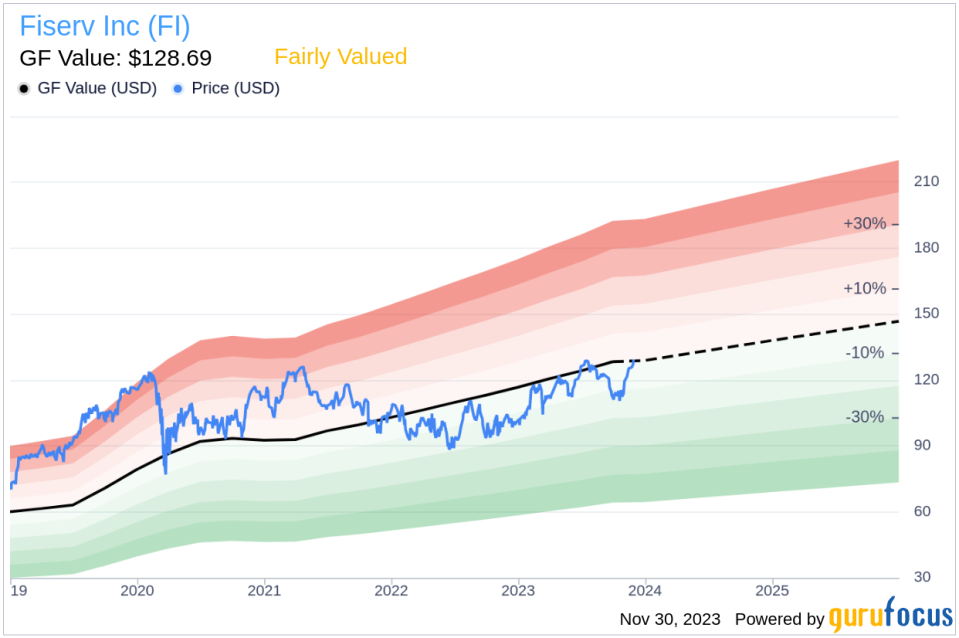

The GF Value image above provides an intrinsic value estimate for Fiserv Inc, considering historical trading multiples, a GuruFocus adjustment factor, and future business performance estimates. With a price-to-GF-Value ratio of 0.99, the stock is deemed to be Fairly Valued. This suggests that the current stock price is in line with the intrinsic value estimated by GuruFocus, which may have influenced the insider's decision to sell at this level.

It is important to note that while insider trading activity can provide valuable insights, it should not be the sole factor in making investment decisions. Investors should consider a comprehensive analysis of the company's financials, industry trends, and broader market conditions before drawing conclusions from insider transactions.

Conclusion

The recent insider sell by Kenneth Best at Fiserv Inc has certainly caught the attention of market participants. While the insider's actions may suggest a belief that the stock is fairly valued, investors should weigh this against other factors such as the company's strong market position and growth prospects. As always, a balanced approach that considers multiple data points will serve investors best in making informed decisions about their investment portfolios.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.