Insider Sell Alert: Five9 Inc's Daniel Burkland Unloads 16,000 Shares

In a notable insider transaction, Daniel Burkland, the President & Chief Revenue Officer of Five9 Inc (FIVN), sold 16,000 shares of the company on November 20, 2023. This move has caught the attention of investors and analysts who closely monitor insider behaviors as indicators of a company's financial health and future performance.

Daniel Burkland is a key executive at Five9 Inc, a leading provider of cloud contact center software. The company offers solutions that enable businesses to manage inbound and outbound customer interactions across various channels. Burkland's role as President & Chief Revenue Officer puts him at the forefront of the company's sales and revenue generation strategies, making his insider transactions particularly noteworthy.

Five9 Inc's business model revolves around providing a comprehensive suite of applications that allow clients to optimize their customer service and sales operations. The company's cloud-based platform is designed to be scalable, secure, and flexible, catering to the needs of businesses of all sizes across various industries.

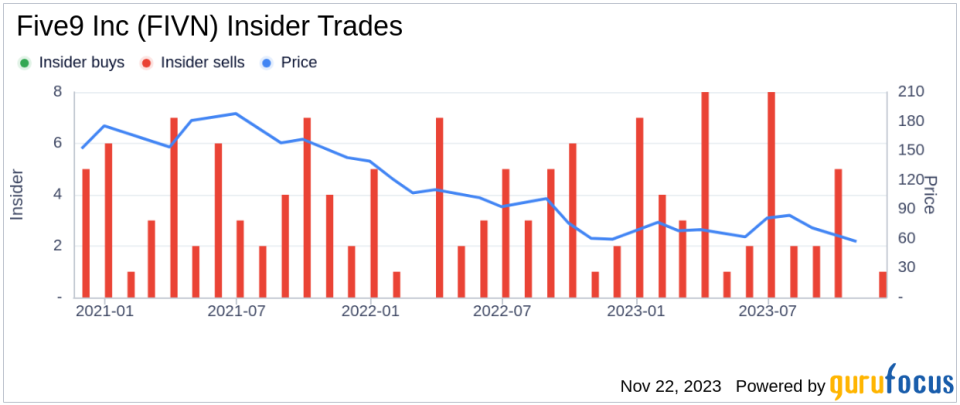

Analysis of Insider Buy/Sell and Stock Price Relationship

Insider transactions, such as the recent sale by Daniel Burkland, can provide valuable insights into a company's internal perspective on its stock's value. Over the past year, Burkland has sold a total of 195,736 shares and has not made any purchases. This pattern of selling without corresponding buys could signal that insiders might believe the stock is fully valued or potentially overvalued at current prices.

The insider transaction history for Five9 Inc shows a clear trend of insider selling, with 43 insider sells and no insider buys over the past year. This consistent selling activity may raise questions among investors about the insiders' confidence in the company's future growth prospects.

However, it's important to consider that insider sells can occur for various reasons unrelated to a company's performance, such as personal financial planning, diversification of assets, or meeting personal expenses. Therefore, while insider sells can be a red flag, they should not be the sole factor in an investment decision.

On the day of the insider's recent sale, Five9 Inc's shares were trading at $75.02, giving the company a market cap of $5.394 billion. This valuation places the stock in the mid-cap category, which can offer a balance between the growth potential of small-cap stocks and the stability of large-cap companies.

Five9 Inc's Valuation and GF Value

With the stock trading at $75.02 and a GuruFocus Value (GF Value) of $140.11, Five9 Inc is currently significantly undervalued with a price-to-GF-Value ratio of 0.54. The GF Value is a proprietary intrinsic value estimate from GuruFocus, which suggests that the stock might be a compelling buy for value investors.

The GF Value is determined by considering historical trading multiples such as the price-earnings ratio, price-sales ratio, price-book ratio, and price-to-free cash flow. Additionally, a GuruFocus adjustment factor is applied based on the company's past returns and growth, along with future business performance estimates from Morningstar analysts.

Given the current price-to-GF-Value ratio, investors might interpret the stock as being undervalued, potentially offering an attractive entry point. However, the insider selling trend could temper this optimism, suggesting that insiders might not share the same bullish outlook implied by the GF Value.

Conclusion

The recent insider sell by Daniel Burkland, along with the broader trend of insider selling at Five9 Inc, presents a mixed signal to the market. While the GF Value indicates that the stock is significantly undervalued, the lack of insider buying could suggest a less optimistic view from those with intimate knowledge of the company.

Investors should weigh these factors alongside a comprehensive analysis of Five9 Inc's financials, competitive position, and market trends. As always, insider transactions are just one piece of the puzzle when it comes to making informed investment decisions.

For those considering an investment in Five9 Inc, it may be prudent to monitor the company's upcoming earnings reports, any changes in analyst ratings, and further insider transaction activity to gain a better understanding of the stock's potential trajectory.

As the market digests the implications of insider selling at Five9 Inc, it remains to be seen how the stock will perform in the near to medium term. Investors should stay informed and consider all aspects of the company before making any investment decisions.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.