Insider Sell Alert: Former Senior VP & CFO Sue Main Sells Shares of Teledyne Technologies ...

In a notable insider transaction, Sue Main, the former Senior Vice President and Chief Financial Officer of Teledyne Technologies Inc (NYSE:TDY), sold 9,461 shares of the company on December 12, 2023. This move has caught the attention of investors and market analysts, as insider sales can provide valuable insights into a company's financial health and future prospects.

Who is Sue Main?

Sue Main has been a key figure at Teledyne Technologies Inc, serving as the Senior Vice President and Chief Financial Officer. With a deep understanding of the company's financial operations and strategic direction, Main's actions in the stock market are closely monitored. Her tenure at Teledyne has provided her with an intimate knowledge of the company's inner workings, making her stock transactions particularly noteworthy.

Teledyne Technologies Inc's Business Description

Teledyne Technologies Inc is a leading provider of sophisticated instrumentation, digital imaging products and software, aerospace and defense electronics, and engineered systems. The company's products are used in a wide range of applications, including deepwater oil and gas exploration and production, oceanographic research, air and water quality environmental monitoring, factory automation, and medical imaging. With a diverse portfolio of products and services, Teledyne serves a global customer base across various industries.

Analysis of Insider Buy/Sell and Relationship with Stock Price

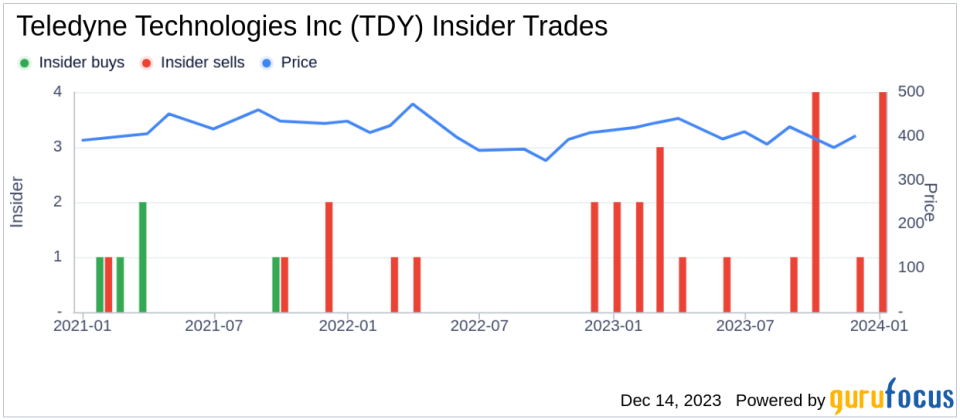

The recent sale by Sue Main is part of a broader pattern of insider transactions at Teledyne Technologies Inc. Over the past year, Main has sold a total of 19,461 shares and has not made any purchases. This could be interpreted in several ways; however, without additional context, it is challenging to draw definitive conclusions. Insider sales can occur for various reasons, including personal financial planning, diversification of assets, or other non-company related factors.The insider transaction history for Teledyne Technologies Inc shows a trend of more insider sells than buys over the past year, with 17 insider sells and no insider buys. This trend could suggest that insiders, on balance, see the current stock price as favorable for selling rather than buying. However, it is essential to consider the overall context and not rely solely on insider trading patterns when evaluating a stock's potential.

Valuation and Market Response

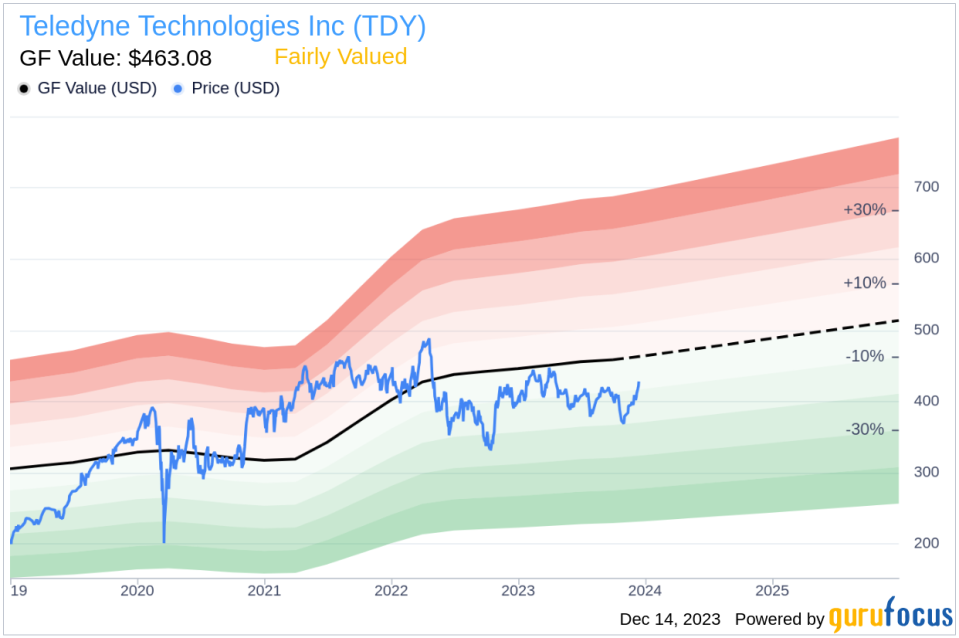

On the day of Sue Main's recent sale, shares of Teledyne Technologies Inc were trading at $421.34, giving the company a market capitalization of $20.203 billion. The price-earnings ratio of 25.97 is higher than the industry median of 22.75 and also above the company's historical median price-earnings ratio. This indicates that the stock is trading at a premium compared to its peers and its own historical valuation.Despite the higher price-earnings ratio, the stock is considered Fairly Valued with a price-to-GF-Value ratio of 0.91, based on a GF Value of $463.08. The GF Value is an intrinsic value estimate that takes into account historical trading multiples, a GuruFocus adjustment factor, and future business performance estimates from Morningstar analysts.

The relationship between insider selling and stock price can be complex. While a high volume of insider selling could be perceived negatively, suggesting that insiders believe the stock is overvalued or that future prospects are not as bright, the current valuation metrics indicate that the stock is fairly priced. It is also possible that the insider's decision to sell is based on personal financial considerations rather than a bearish view on the company.

Conclusion

The sale of shares by Sue Main, a prominent insider of Teledyne Technologies Inc, is a significant event that warrants attention. While the insider sell trend and the valuation metrics provide some context, investors should consider a range of factors when assessing the implications of insider transactions. It is crucial to analyze the company's financial health, market position, and growth prospects in conjunction with insider trading patterns to make informed investment decisions.As always, investors are encouraged to conduct their own due diligence and consider the broader market conditions and company-specific news before making any investment decisions based on insider trading activity.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.