Insider Sell Alert: FuboTV Inc's COO Alberto Horihuela Divests 36,827 Shares

In a notable insider transaction, Alberto Horihuela, the Chief Operating Officer of FuboTV Inc (NYSE:FUBO), sold 36,827 shares of the company on November 22, 2023. This move has caught the attention of investors and analysts alike, as insider selling can often provide valuable insights into a company's prospects.

Who is Alberto Horihuela?

Alberto Horihuela is a co-founder and the Chief Operating Officer of FuboTV Inc. His role in the company is pivotal, overseeing the day-to-day operations and contributing to the strategic direction of the business. Horihuela's expertise in marketing and product development has been instrumental in FuboTV's growth, helping to establish the company as a significant player in the streaming television space.

FuboTV Inc's Business Description

FuboTV Inc is a digital entertainment company primarily focused on offering consumers a live TV streaming platform for sports, news, and entertainment through fuboTV. The platform aims to replace traditional cable TV by providing subscribers with a comprehensive package of channels that can be streamed on smart TVs, mobile devices, and computers. FuboTV's unique selling proposition lies in its extensive sports coverage, which has made it a go-to service for sports enthusiasts.

Analysis of Insider Buy/Sell and Relationship with Stock Price

The recent sale by the insider, Alberto Horihuela, is part of a broader pattern of insider transactions at FuboTV Inc. Over the past year, Horihuela has sold a total of 176,628 shares and has not made any purchases. This could be interpreted in several ways, but investors often view consistent insider selling as a signal that those with the most intimate knowledge of the company may lack confidence in the stock's future appreciation.

The insider trend image above provides a visual representation of the buying and selling activities. With only 1 insider buy and 4 insider sells over the past year, the trend seems to lean towards more selling. This could potentially raise concerns among investors about the company's valuation and future prospects.

Valuation and Market Cap

On the day of the insider's recent sale, FuboTV Inc's shares were trading at $3.19, giving the company a market cap of $901.841 million. This valuation is significant as it reflects the market's current assessment of the company's worth.

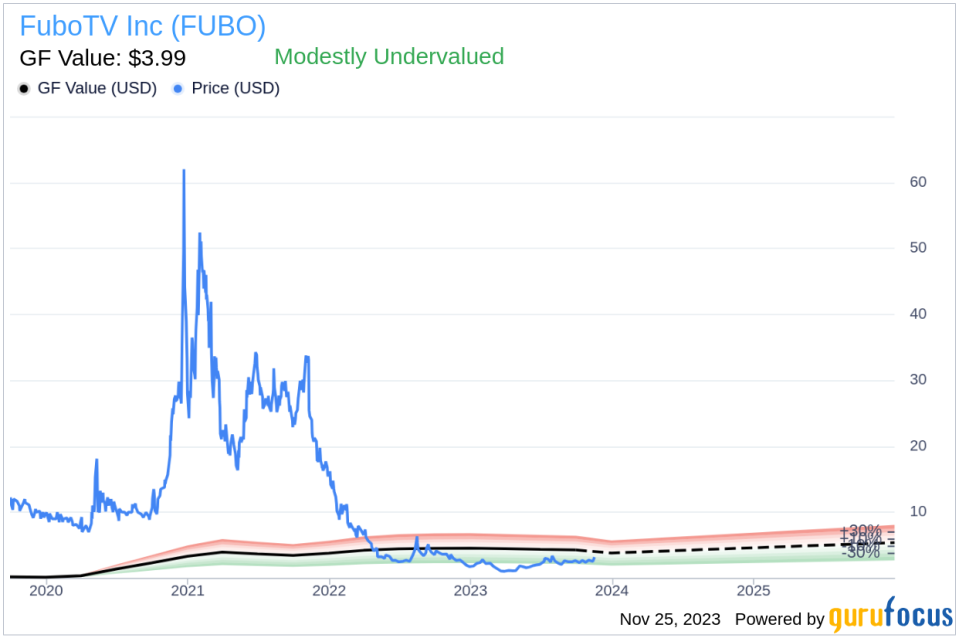

The GF Value image above indicates that FuboTV Inc has a price-to-GF-Value ratio of 0.8, suggesting that the stock is modestly undervalued based on its GF Value of $3.99. The GF Value is an intrinsic value estimate that takes into account historical trading multiples, a GuruFocus adjustment factor, and future business performance estimates. The fact that the stock is trading below its GF Value could mean that the market has not fully recognized the company's potential, or it could reflect broader market skepticism.

Conclusion

The recent insider sell by Alberto Horihuela at FuboTV Inc is a development that warrants attention. While insider selling does not always indicate a problem with the company, the pattern of sales by Horihuela over the past year could be a sign that insiders are taking a cautious stance on the stock's future. However, the company's current valuation suggests that the stock may be undervalued, presenting a potential opportunity for investors who believe in the long-term prospects of FuboTV Inc.Investors should consider the insider selling trends, the company's business model, and the GF Value when making investment decisions. It's also important to look at the broader industry trends, competitive landscape, and the company's financial health to get a comprehensive view of FuboTV Inc's potential as an investment. As always, insider transactions are just one piece of the puzzle, and thorough due diligence is essential for any investment strategy.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.